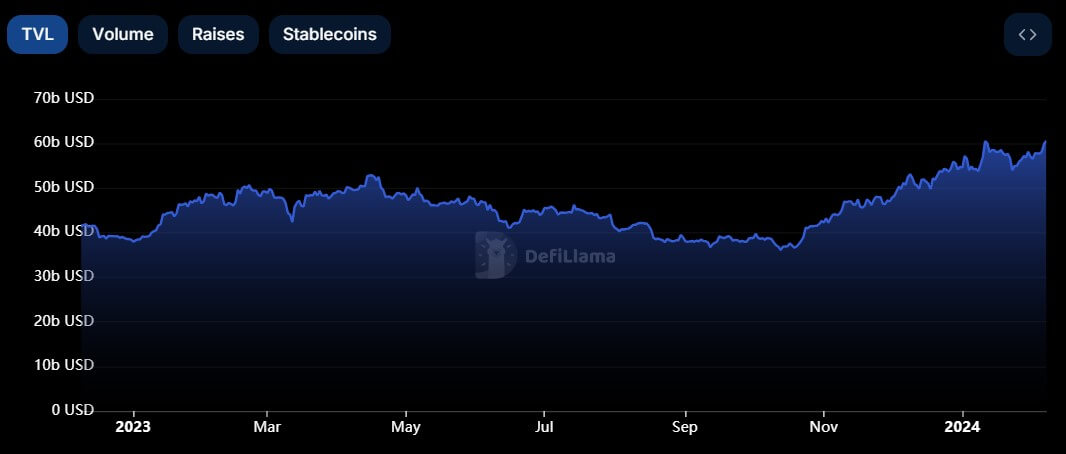

The decentralized finance (DeFi) ecosystem has hit a big milestone as the overall worth of property locked (TVL) surpassed $60 billion, marking a return to ranges final seen in August 2022.

In accordance with information from DeFiLlama, the sector surged by a formidable 68% to $60.72 billion from November 2023, when the TVL stood at round $36 billion.

The upward trajectory of a TVL alerts sturdy investor confidence, with extra customers entrusting their property to partake in decentralized monetary actions.

Market analysts attribute this progress to the latest surge in crypto asset costs, fueled by buzz surrounding Bitcoin exchange-traded funds (ETFs). This rally, capturing the curiosity of each retail and institutional buyers, propelled Bitcoin to almost $50,000 and Ethereum, the main DeFi blockchain community, above $2,000.

Ethereum leads

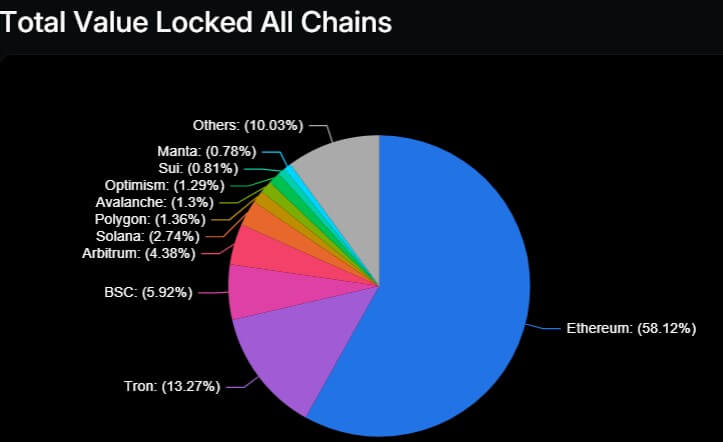

Ethereum stays the dominant drive in DeFi, claiming over 58% of the market share throughout blockchains, boasting a TVL of $35.3 billion. Tron blockchain is second, commanding a 13% market share with a TVL of $8 billion.

Past Ethereum and Tron, different blockchain networks resembling Solana, Binance Good Chain, Polygon, and Arbitrum additionally wield appreciable affect, internet hosting many initiatives and boasting substantial TVL figures.

In the meantime, the emergence of the Sui blockchain is noteworthy because it has quickly ascended the ranks within the DeFi house, securing a spot among the many prime 10 in TVL and surpassing well-established rivals like Cardano and Bitcoin.

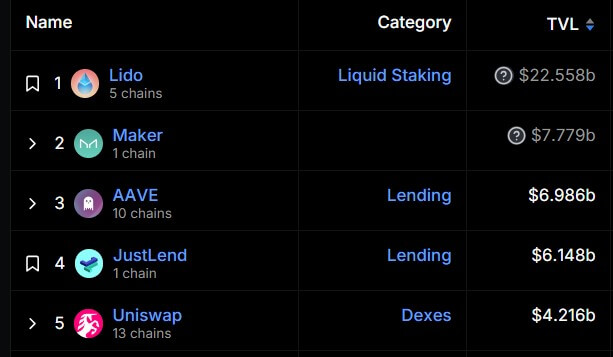

Lido dominate protocols

Lido Finance, a number one liquid staking protocol, instructions a big 37% market share, boasting a TVL of $22.58 billion.

Lido is poised to exceed 10 million ETH staked via its platform, working throughout outstanding blockchain networks resembling Ethereum, Solana, Moonbeam, and Moonriver.

The opposite prime 5 protocols embrace notable entities just like the DAI stablecoin issuer Maker, lending platforms Aave and Justlend, and the decentralized change Uniswap. These protocols collectively maintain TVLs of $7.7 billion, $6.98 billion, $6.14 billion, and $4.21 billion, respectively.

Buying and selling resurgence

Concurrently, decentralized exchanges (DEXs) have skilled a surge in day by day buying and selling volumes, witnessing a 3.29% enhance over the previous week alone, facilitating trades value roughly $22 billion, in accordance with DeFillama information.

Moreover, a Dune Analytics dashboard curated by rchen8 exhibits a resurgence within the sector’s person base, with greater than 3 million customers returning to earlier highs. Over the previous two months, the ecosystem has welcomed 3.6 million new addresses, pushing its whole person depend near 50 million.