Fast Take

DeFi Applied sciences Inc., a public firm traded on CBOE Canada (DEFI), has made a strategic determination to undertake Bitcoin as its major treasury reserve asset, buying 110 Bitcoin, in keeping with Newswire.ca,

This transfer highlights the corporate’s confidence in Bitcoin’s potential as a hedge towards inflation and a safeguard towards financial debasement.

Olivier Roussy Newton, CEO of DeFi Applied sciences, acknowledged,

“We have now adopted Bitcoin as our major treasury reserve asset, reflecting our confidence in its position as a hedge towards inflation and a protected haven from financial debasement.”

Along with this important adoption, Valour, a subsidiary of DeFi Applied sciences, reported a powerful AUM of C$837 million ($607 million) as of Could 31, marking a year-on-year enhance of 64.9%.

Valour has additionally efficiently repaid an extra $5 million in excellent loans secured by BTC and ETH collateral, following a previous reimbursement of $19.5 million.

Valour Inc. has launched a number of progressive exchange-traded merchandise (ETPs), together with the Valour Web Laptop (ICP) ETP, Valour Toncoin (TON) ETP, Valour Chainlink (LINK) ETP, and the world’s first yield-bearing Bitcoin (BTC) ETP.

These ETPs spotlight the corporate’s continued innovation and monetary acumen within the decentralized finance sector.

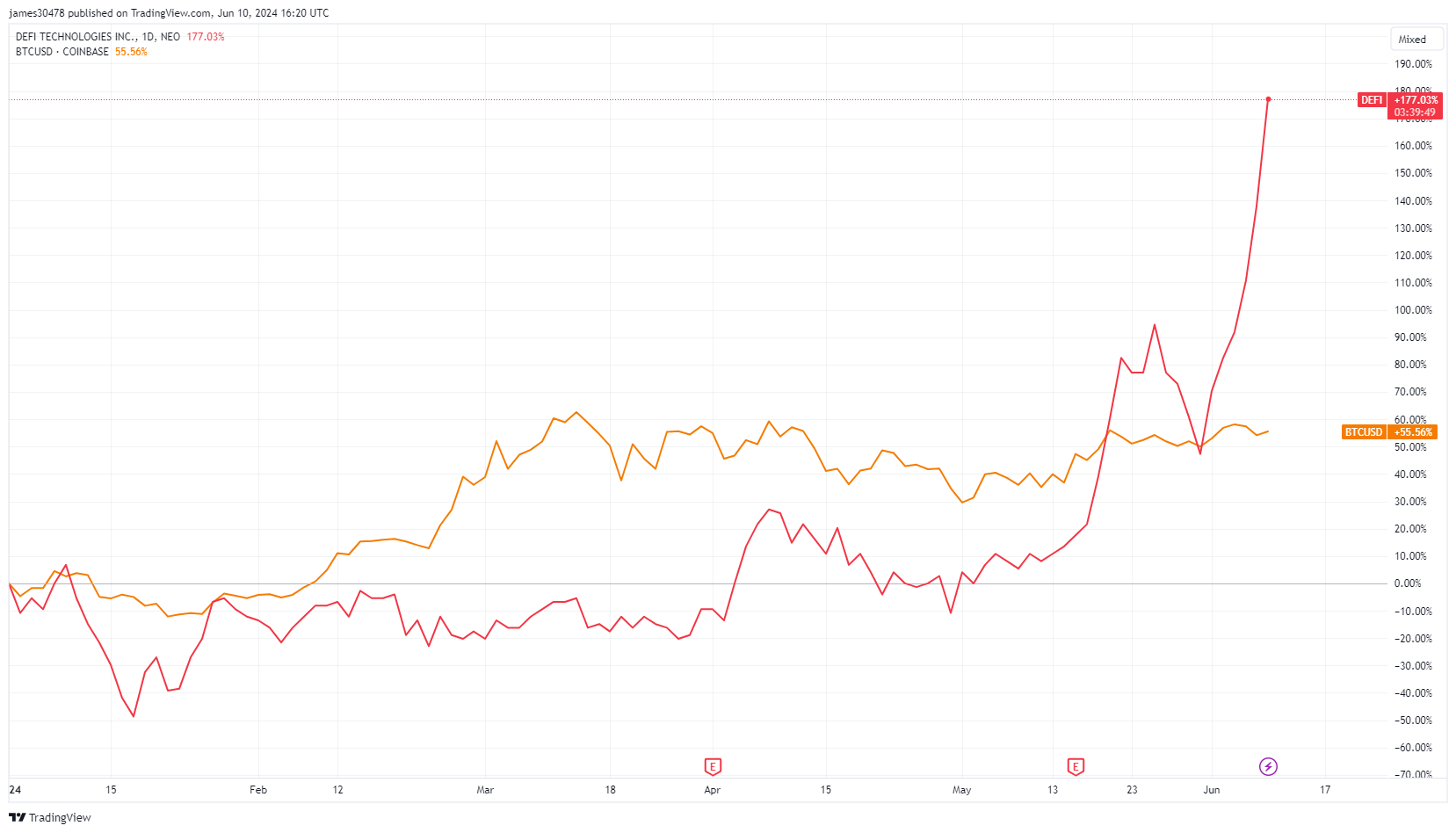

DeFi Applied sciences Inc.’s share worth has elevated by 15% following the announcement, bringing its year-to-date (YTD) progress to 176%.