Onchain Highlights

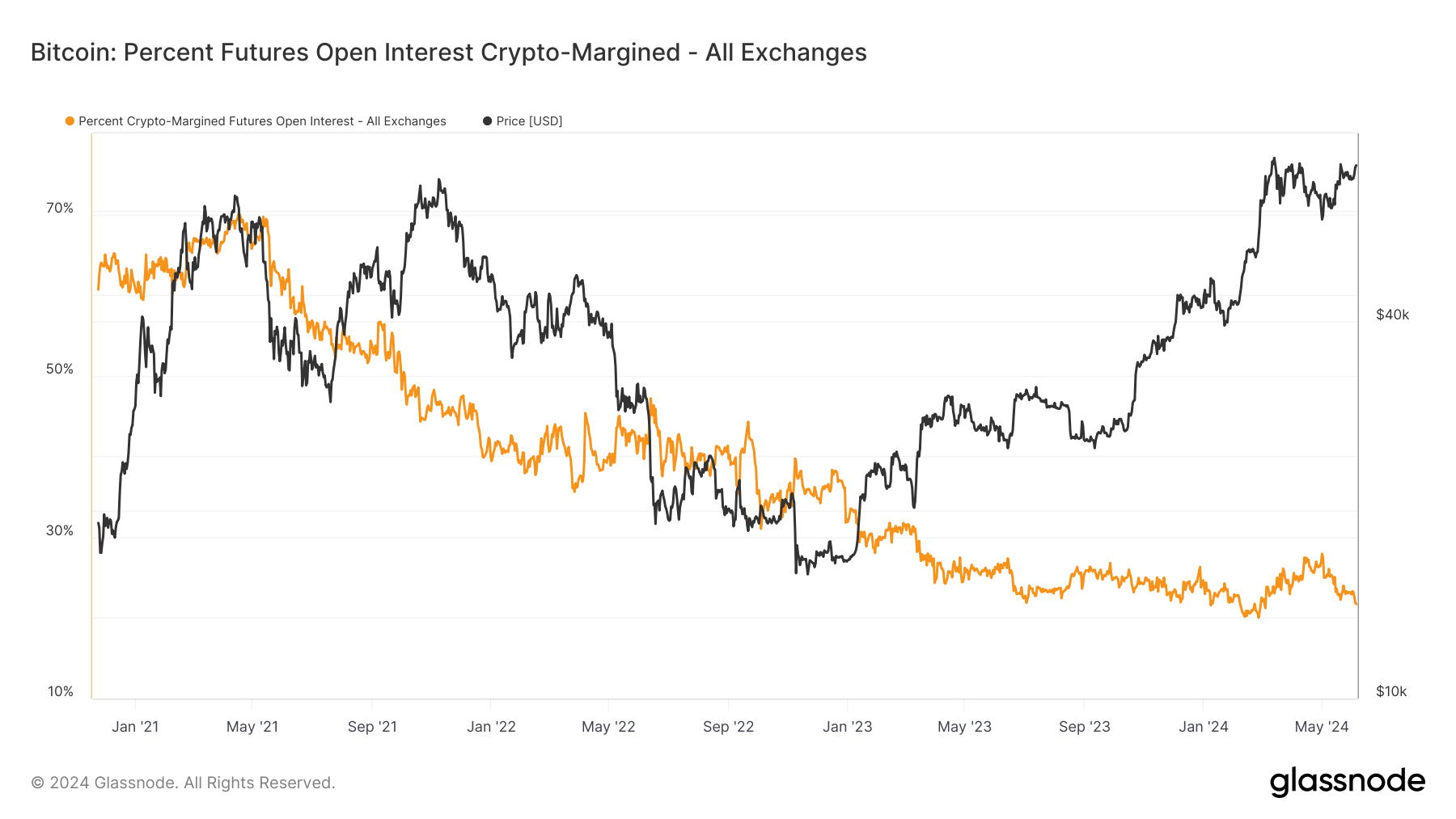

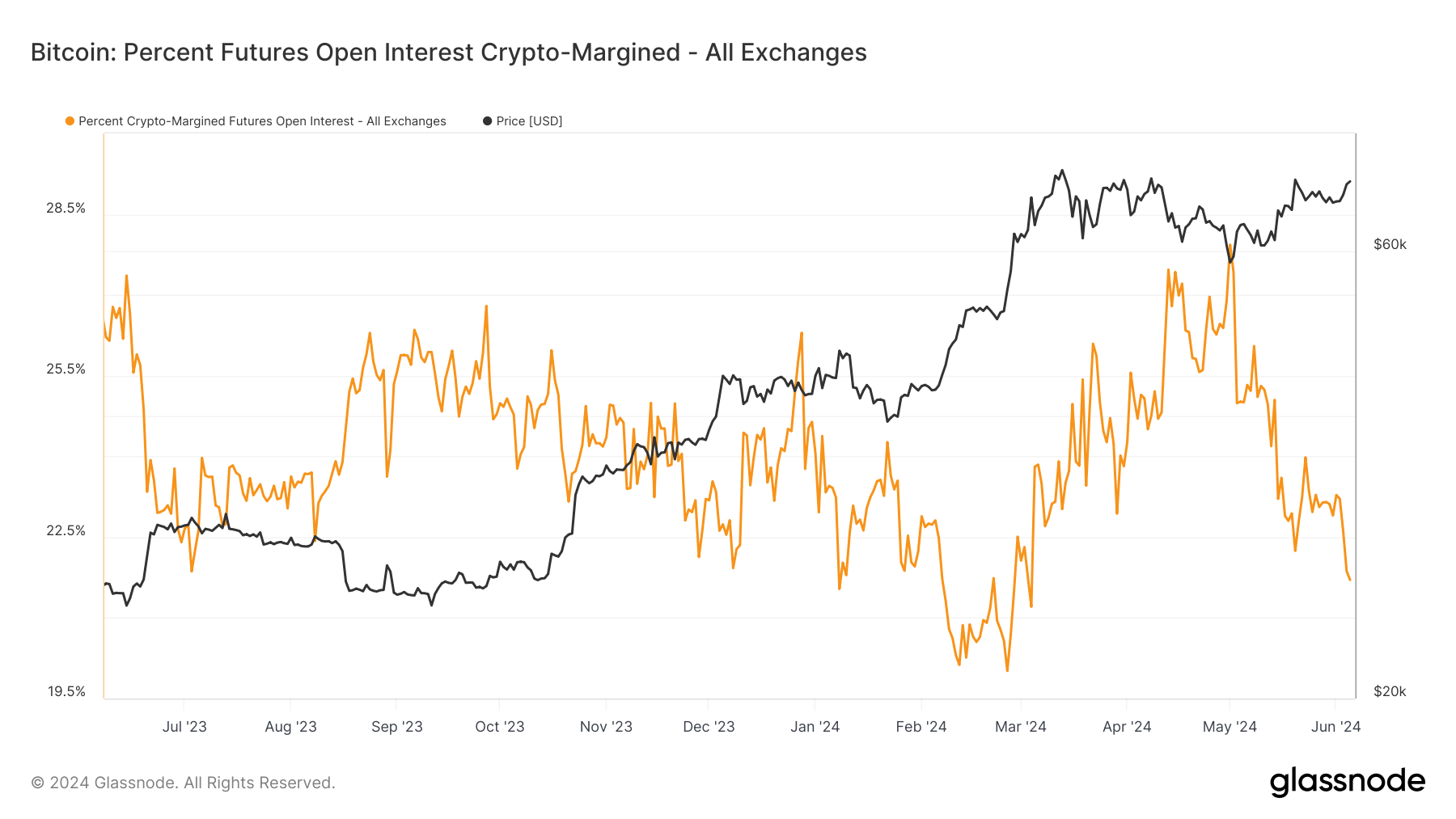

DEFINITION: The proportion of futures contracts open curiosity that’s margined within the native coin (e.g., BTC) and never in USD or a USD-pegged stablecoin.

Bitcoin’s futures market is present process a notable shift, as mirrored within the declining proportion of crypto-margined futures open curiosity throughout all exchanges. Knowledge from Glassnode highlights a big drop in the usage of Bitcoin as collateral for futures contracts, falling from 70% in early 2021 to lower than 20% by mid-2024.

This development suggests a rising choice for extra secure types of collateral, resembling USD or stablecoins, over Bitcoin itself. The rationale behind this shift is to mitigate the compounded dangers related to the volatility of Bitcoin costs, which might result in elevated liquidations throughout market swings. This transfer in direction of stability and threat mitigation alerts a maturation of the market, the place merchants are adopting methods to handle volatility extra successfully.

Moreover, the futures market’s response to Bitcoin’s value stabilization round $70,000 signifies an evolving panorama the place open curiosity is starting to recuperate. This restoration in open curiosity, coupled with the continuing shift in direction of secure collateral, highlights altering dealer behaviors and market forces.