In accordance with a Messari report, the Polkadot (DOT) blockchain protocol made vital progress within the first quarter (Q1) of the 12 months by way of market capitalization, income, and Cross-Consensus Message Format (XCM) exercise, in addition to a document improve in every day lively addresses.

DOT’s Market Cap Surges 16% QoQ

Throughout This autumn 2023, Polkadot’s market capitalization skilled a notable 111% quarter-on-quarter (QoQ) improve, reaching $8.4 billion. Constructing on this momentum, Q1 2024 witnessed an additional 16% QoQ rise, elevating the circulating market cap to $12.7 billion.

Regardless of these features, DOT’s market capitalization stays 80% under its all-time excessive of $55.5 billion, set on November 8, 2021.

In This autumn 2023, Polkadot’s income additionally skyrocketed by 2,880% QoQ, amounting to $2.8 million. Per the report, this surge was primarily attributed to an exponential improve in extrinsics, pushed by the Polkadot Inscriptions.

Nonetheless, income metrics for Q1 2024 declined considerably on a QoQ foundation, with income in USD dropping by 91% to $241,000 and income in DOT lowering by 92% to twenty-eight,800. It’s value noting that Polkadot’s income tends to be comparatively decrease in comparison with its opponents as a result of community’s structural design.

Polkadot’s XCM exercise continued to point out development in Q1 2024. Day by day XCM transfers surged by 89% QoQ to achieve 2,700, whereas non-asset switch use circumstances, referred to as “XCM different,” witnessed a 214% QoQ improve, averaging 185 every day transfers.

The entire variety of every day XCM messages grew 94% QoQ to 2,800, demonstrating the community’s dynamic ecosystem. As well as, the variety of lively XCM channels grew 13% QoQ to a complete of 230.

Polkadot’s Parachain Community Soars To New Heights

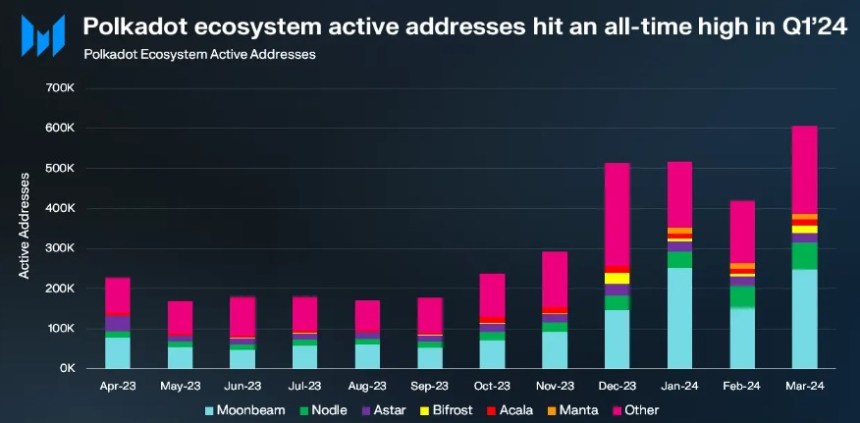

Q1 2024 marked a major kick-off to the 12 months for Polkadot’s parachains, with lively addresses reaching an all-time excessive of 514,000, representing a considerable 48% QoQ development.

Moonbeam emerged because the main parachain with 217,000 month-to-month lively addresses, a strong 110% QoQ improve. Nodle adopted intently with 54,000 month-to-month lively addresses, doubling from the earlier quarter.

Astar then again, skilled a modest 8% QoQ development to achieve 26,000 lively addresses, whereas Bifrost Finance grew barely by 2% QoQ to 10,000 addresses. Nonetheless, Acala skilled a decline, with month-to-month lively addresses falling to 13,000, down 16% QoQ.

Notably, the Manta Community stood out amongst parachains in Q1 2024, with a major surge in every day lively addresses, reaching 15,000. In accordance with Messari, this improve was fueled by the profitable launch of the MANTA token TGE and subsequent itemizing on Binance, propelling Manta’s Complete Worth Locked (TVL) to over $440 million.

Polkadot Worth Sees Upside Potential Forward

When it comes to worth motion, Polkadot’s native token DOT has regained bullish momentum following a pointy drop to the $5.8 worth mark after reaching a yearly excessive of $11 on March 14.

At the moment, DOT has regained the $7.25 stage, up 7% over the previous week. Nonetheless, DOT’s buying and selling quantity decreased barely by 4.7% in comparison with the earlier buying and selling session, amounting to $320 million over the previous 24 hours, in response to CoinGecko information.

If the bullish momentum persists, Polkadot faces its first resistance on the $7.4 zone, which serves because the final threshold earlier than a possible retest of the $8 resistance wall.

Alternatively, the $6.4 assist flooring has confirmed to achieve success after being examined for 2 consecutive days this week, highlighting its significance as a key stage to observe for the token’s upward motion prospects.

Featured picture from Shuttestock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site fully at your personal danger.