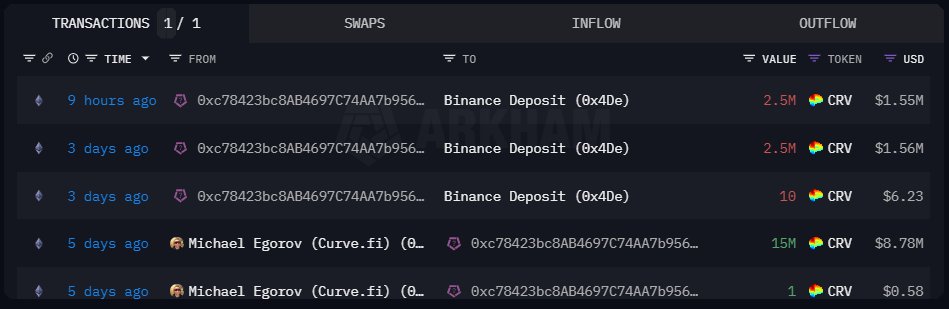

Curve Finance founder Michael Erogov has moved over 23 million CRV, the native governance token of the Curve DAO, to Binance, the world’s main cryptocurrency change, over the past 5 days, The Knowledge Nerd, on December 27, reveals. The founder moved 2.5 million CRV on December 27. This switch could ruffle traders, elevating considerations as a result of it may point out that Erogov is probably going liquidating.

CRV Is Agency, Up 60% In The Final 3 Months

Whereas the founder’s sale of CRV may put downward strain, the token stays agency and is up roughly 60% from September 2023 lows. The token trades above $0.60 at spot charges, rejecting promoting strain because the each day chart reveals.

If bulls press on, it may break above $0.72 to report new 2023 highs. The token is trending increased, rejecting bear makes an attempt amid enhancing sentiment throughout the crypto scene. Though Erogov is promoting CRV, the market appears to interpret the transfer as bullish.

The spectacular revival of CRV is web bullish for the protocol, suggesting that traders are nonetheless assured regardless of headwinds in early H2 2023 when a number of Curve swimming pools had been exploited on account of a Vyper compiler situation.

Curve Founder Offered CRV To Stop Liquidation Of DeFi Loans

Following the hack in late July 2023, Erogov was pressured to liquidate a big chunk to forestall liquidation. On its half, the hack led to over $52 million in crypto belongings, together with 7.19 million value of CRV, misplaced. Within the aftermath of the hack, costs crashed.

On the time of this hack, Erogov had over $100 million in DeFi loans backed by 427.5 million CRV as collateral. As CRV costs fell, the well being of Egorov’s loans fell in tandem.

If the worth of Egorov’s CRV collateral had been to fall additional, it may face liquidation. This meant that each one protocols from the place the founder had borrowed utilizing CRV as collateral would have been pressured to promote the token at spot charges to repay the mortgage. As an automatic intervention, the occasion would have possible brought about a cascade, even impacting abnormal holders utilizing CRV as collateral.

To keep away from this and as a type of intervention, Tron founder Justin Solar and a number of different events, together with Jeffrey Huang, made offers to purchase CRV from the Curve founder, stopping this liquidation from occurring.

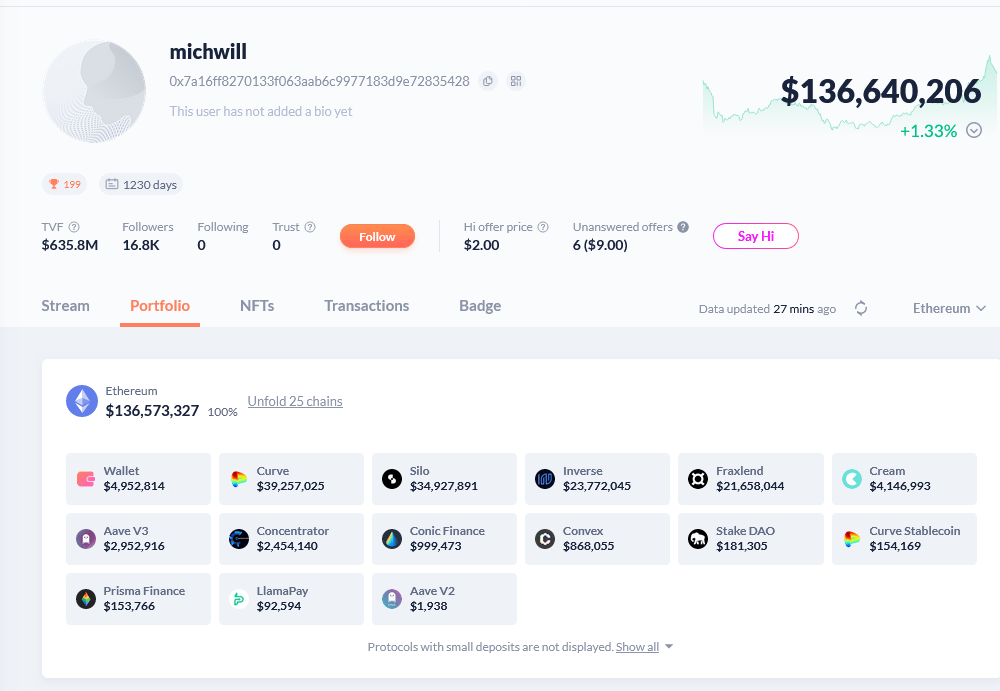

In keeping with DeBank on December 27, Erogov’s crypto portfolio was north of $136 million. Out of this, the founder owns over $38.9 million of CRV.

Function picture from Canva, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site totally at your personal danger.