Fast Take

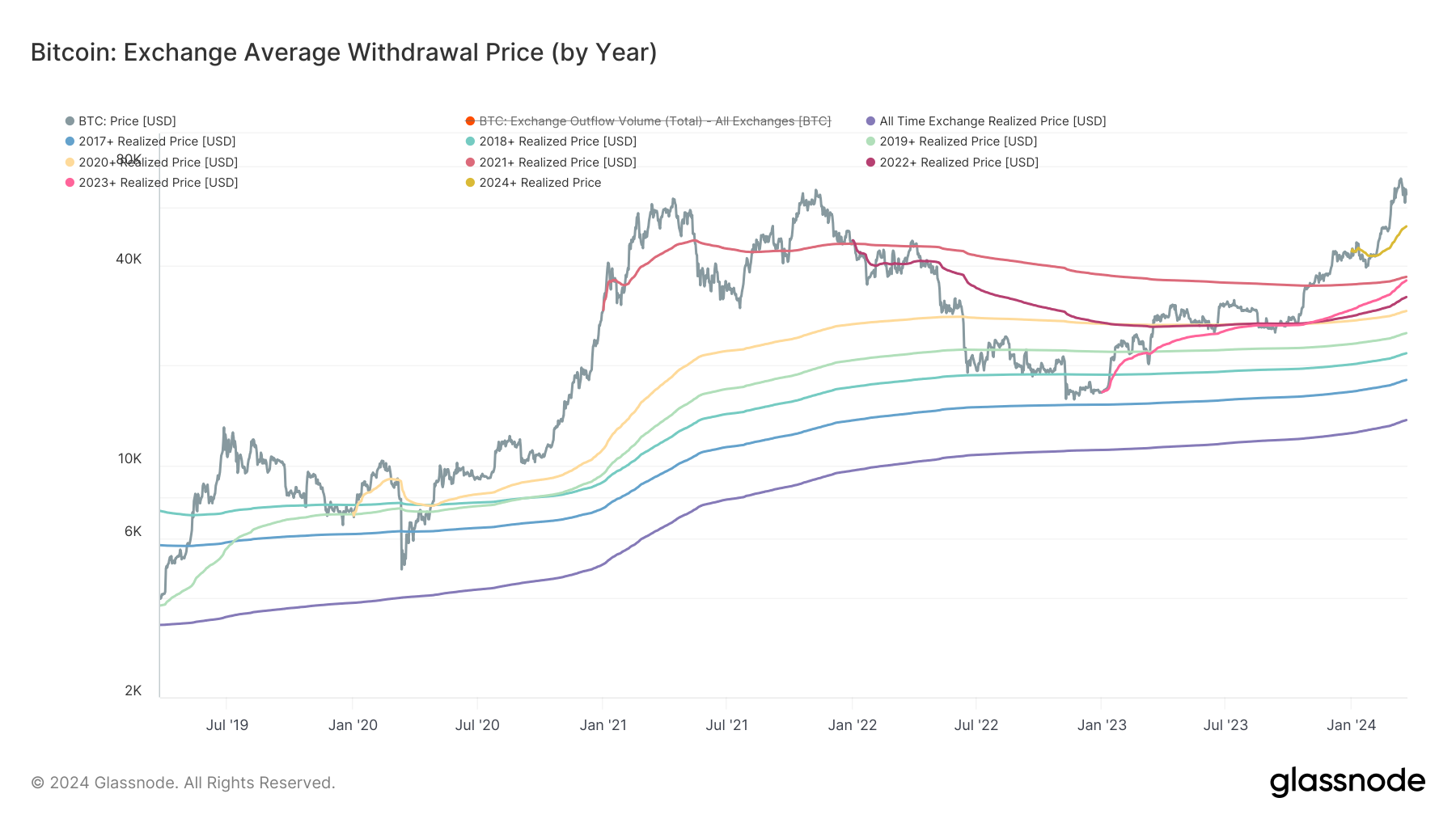

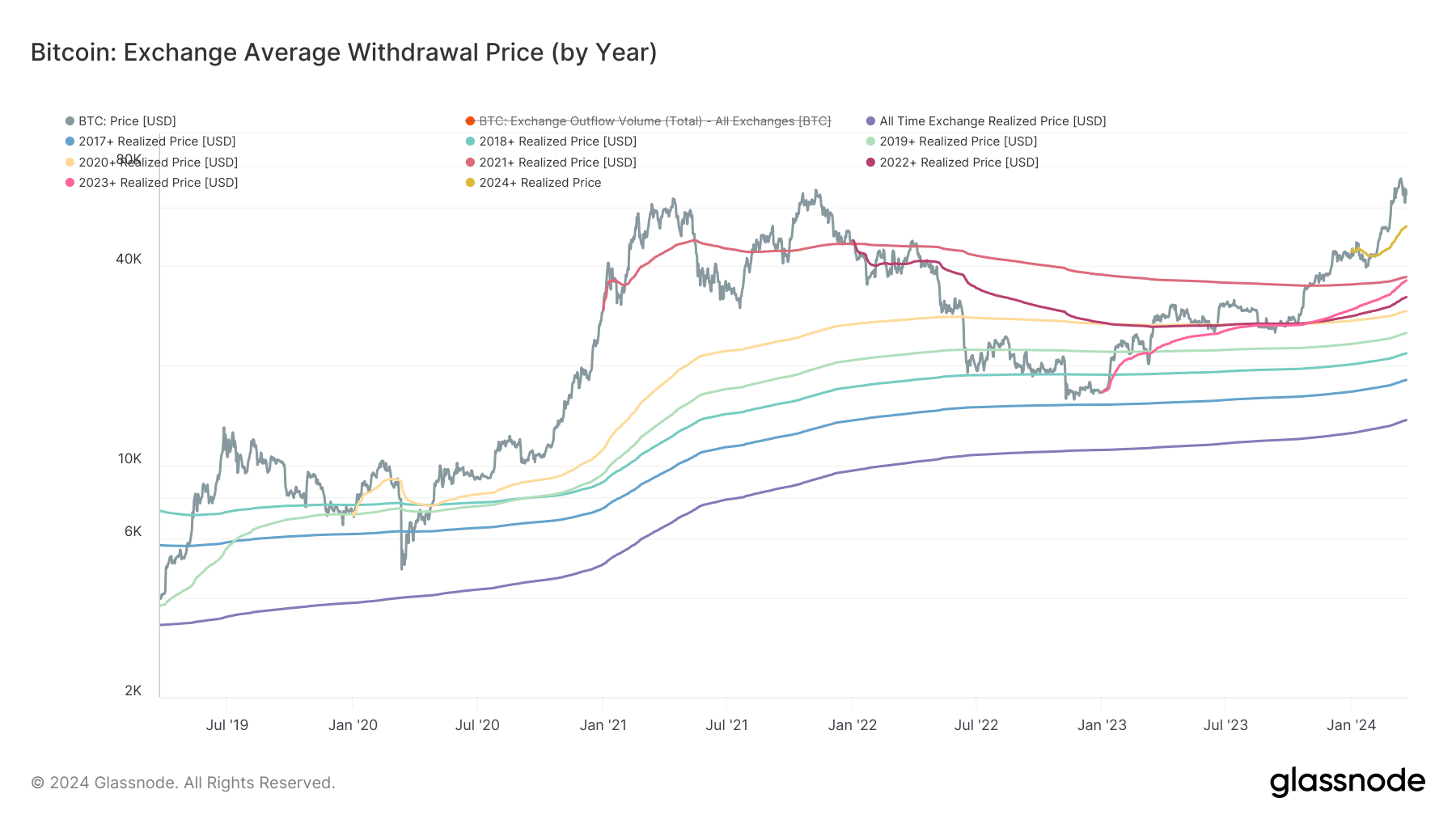

Using knowledge from Glassnode to estimate a market-wide price foundation reveals intriguing developments within the common worth at which cash are withdrawn from exchanges. The data, segregated into cohorts, uncovers an upward trajectory on a price foundation, indicating a pattern of buying Bitcoin at incrementally increased costs.

Most notably, the 2024 cohorts skilled a big upswing, seeing a median revenue margin of about $10,500, which interprets to an roughly 20% achieve from their preliminary price foundation ($52,478), in line with knowledge from Glassnode.

Apparently, the 2021 cohort managed to considerably cut back their price foundation from $47,000 to a extra conservative $36,971, as highlighted by latest CryptoSlate knowledge evaluation. Regardless of the discount, the associated fee foundation for all cohorts has risen in latest months, exhibiting an unwavering dedication to purchasing Bitcoin no matter rising costs.

| 12 months | Value |

|---|---|

| All-time | $13,689 |

| 2017+ | $18,082 |

| 2018+ | $21,758 |

| 2019+ | $25,018 |

| 2020+ | $29,173 |

| 2021+ | $36,971 |

| 2022+ | $32,139 |

| 2023+ | $36,058 |

| 2024+ | $52,478 |

Supply: Glassnode

The 2023 cohort, exhibiting essentially the most bullish conduct, showcased a dramatic rise in price foundation from roughly $26,500 in October 2023 to a gift determine of $36,058, suggesting a possible to surpass the 2021 cohort.

The put up Current Bitcoin patrons present unyielding optimism, pushing price foundation upward regardless of worth surges appeared first on CryptoSlate.