The founding father of on-chain analytics agency CryptoQuant has mentioned Bitcoin might attain a goal of $112,000 this yr pushed by the ETF inflows.

Bitcoin Could Hit $112,000 Based mostly On Inflows Into The ETFs

In a brand new put up on X, CryptoQuant CEO and founder Ki Younger Ju talked in regards to the outlook of the cryptocurrency primarily based on the inflows going in direction of the spot exchange-traded funds (ETFs).

The analyst has used the “Realized Cap” indicator to search out worth targets for the coin. The Realized Cap refers to a capitalization mannequin for Bitcoin that calculates the entire valuation of the asset by assuming that the true worth of any coin in circulation is the value at which it was final transacted on the blockchain.

If the earlier transaction of any token is assumed to have concerned a change of fingers for it (that’s, shopping for and promoting passed off), then the final switch worth would correspond to the associated fee foundation of the coin.

Because the Realized Cap primarily provides up the associated fee foundation of all of the buyers, a technique to have a look at the metric is as a measure of the entire quantity of funding the holders have put into the coin.

Naturally, the Realized Cap pushes up as trades happen at a better spot worth. One thing that might be notably influential for the Realized Cap this cycle will be the spot ETF inflows.

The spot ETFs, which lastly obtained approval from the US Securities and Alternate Fee (SEC) final month, have been shopping for up Bitcoin at comparatively excessive costs so as to add to their holdings, thus elevating the Realized Cap.

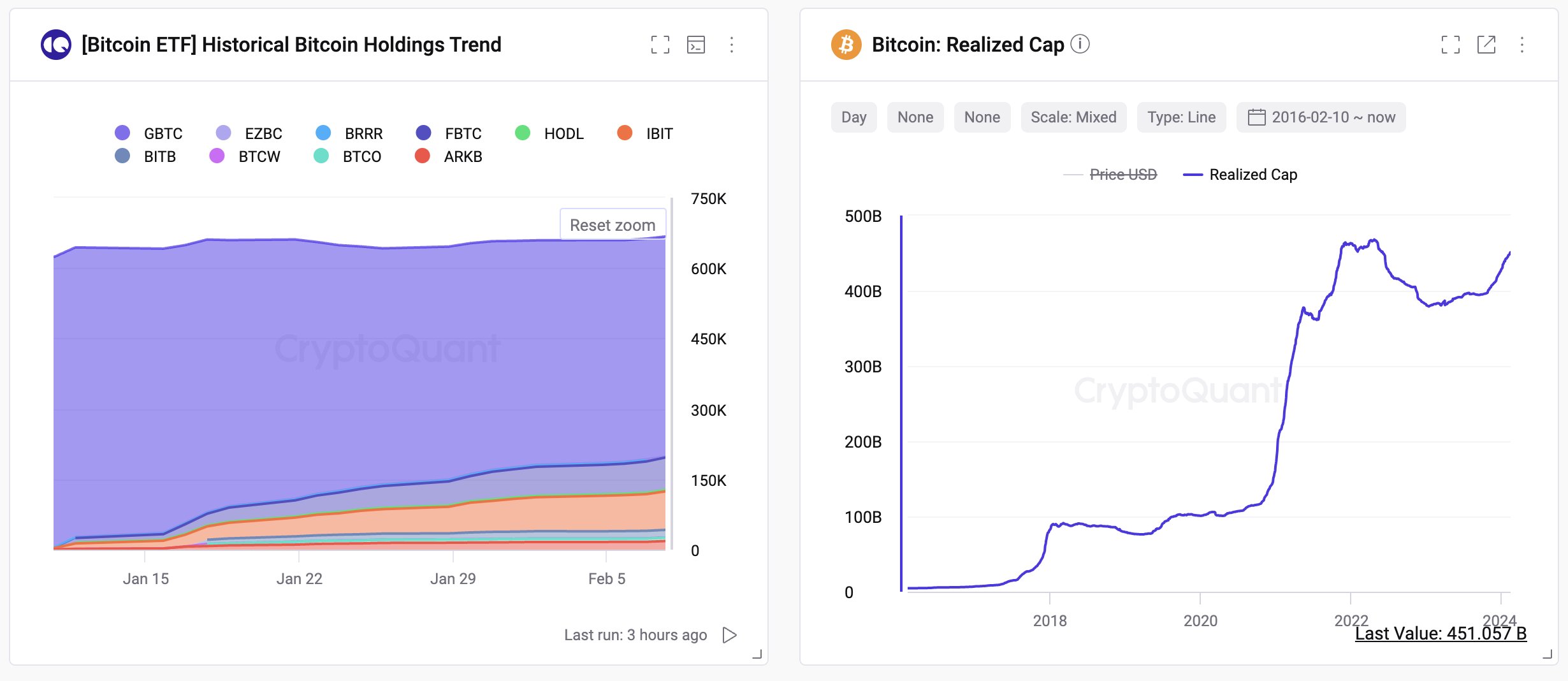

The chart under exhibits the information for the holdings of the spot ETFs and the Bitcoin Realized Cap.

The development within the spot ETF holdings and BTC Realized Cap | Supply: @ki_young_ju on X

“Bitcoin market has seen $9.5B in spot ETF inflows per thirty days, probably boosting the realized cap by $114B yearly,” explains Ju. “Even with $GBTC outflows, a $76B rise might elevate the realized cap from $451B to $527-565B.”

The Market Worth to Realized Worth (MVRV) ratio could present some hints relating to how the Realized Cap might be related for the spot worth. This indicator tracks the BTC Market Cap and the Realized Cap ratio.

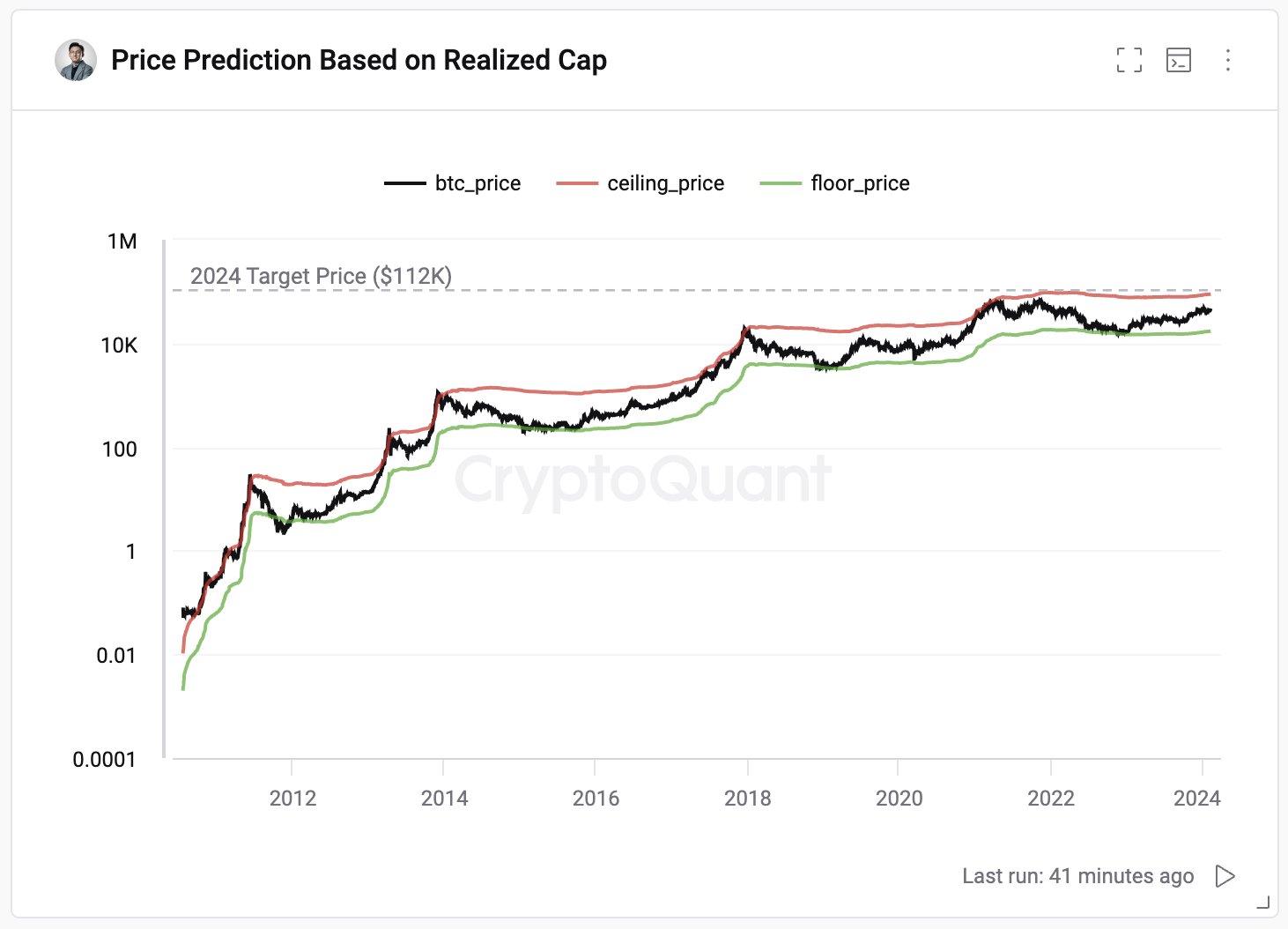

“Traditionally, BTC market bottoms happen at an MVRV of 0.75 and tops at 3.9,” notes the CryptoQuant founder. Based mostly on this reality, the desk under exhibits that ceiling and ground costs might be outlined for the asset.

The development within the ceiling and ground costs for BTC primarily based on the Realized Cap | Supply: @ki_young_ju on X

Because the spot ETF inflows proceed to return in, the Realized Cap will solely push additional up, and the potential ceiling of the cryptocurrency can even thus enhance.

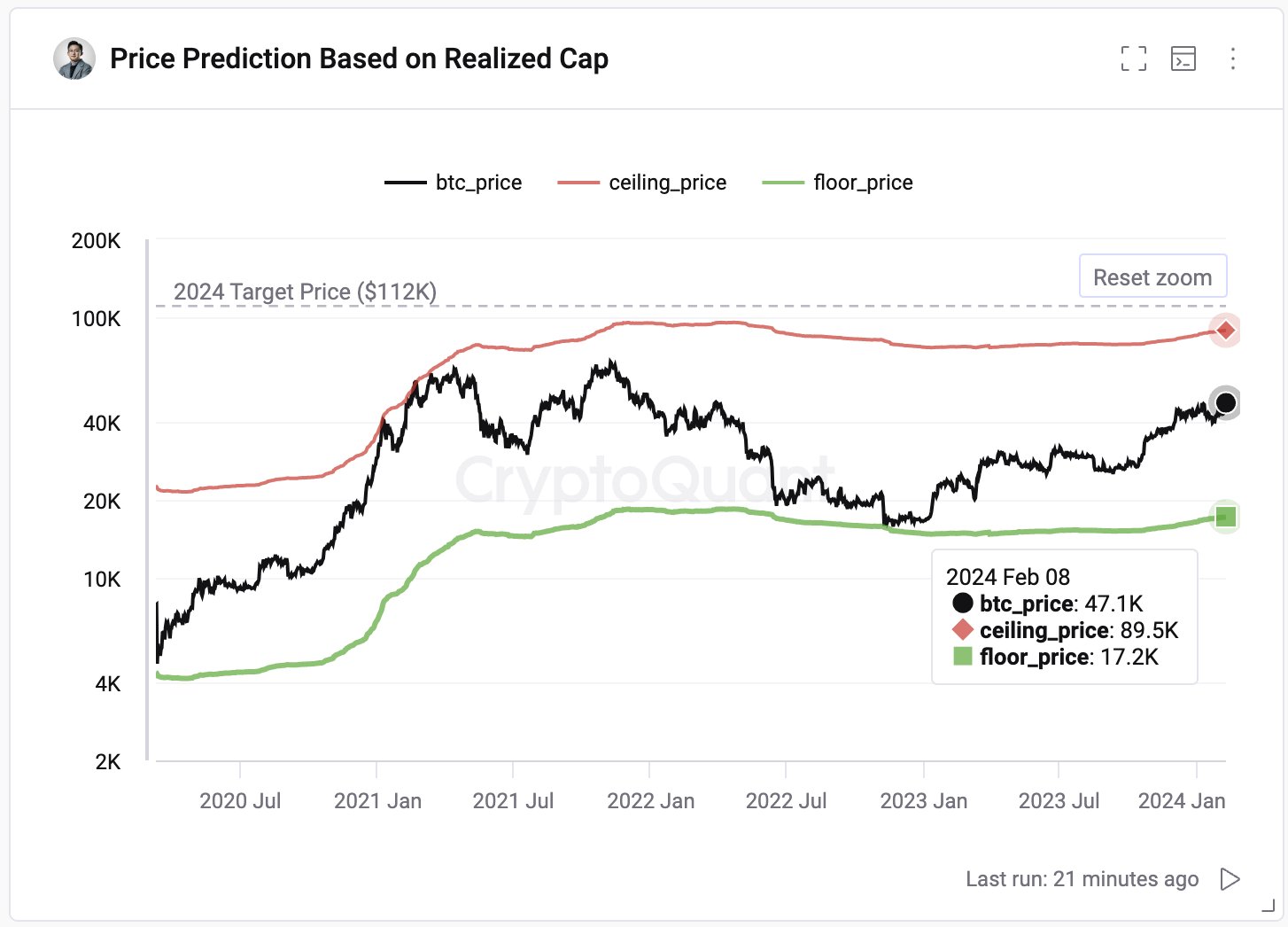

Zoomed in view of the value ceiling and ground | Supply: @ki_young_ju on X

“With present spot ETF influx traits, the highest worth might attain $104k-$112k,” says the CryptoQuant CEO. “With out hype, sustaining the present stage of two.07, the value could be $55-59k.”

Within the best-case situation, if Bitcoin had reached the $112,000 goal, the cryptocurrency would have jumped greater than 126% from the present spot worth.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $49,400, up over 15% prior to now week.

Seems to be like the value of the coin has shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual danger.