The chief government of the digital asset analytics agency CryptoQuant thinks a nationwide strategic Bitcoin (BTC) reserve might offset US debt.

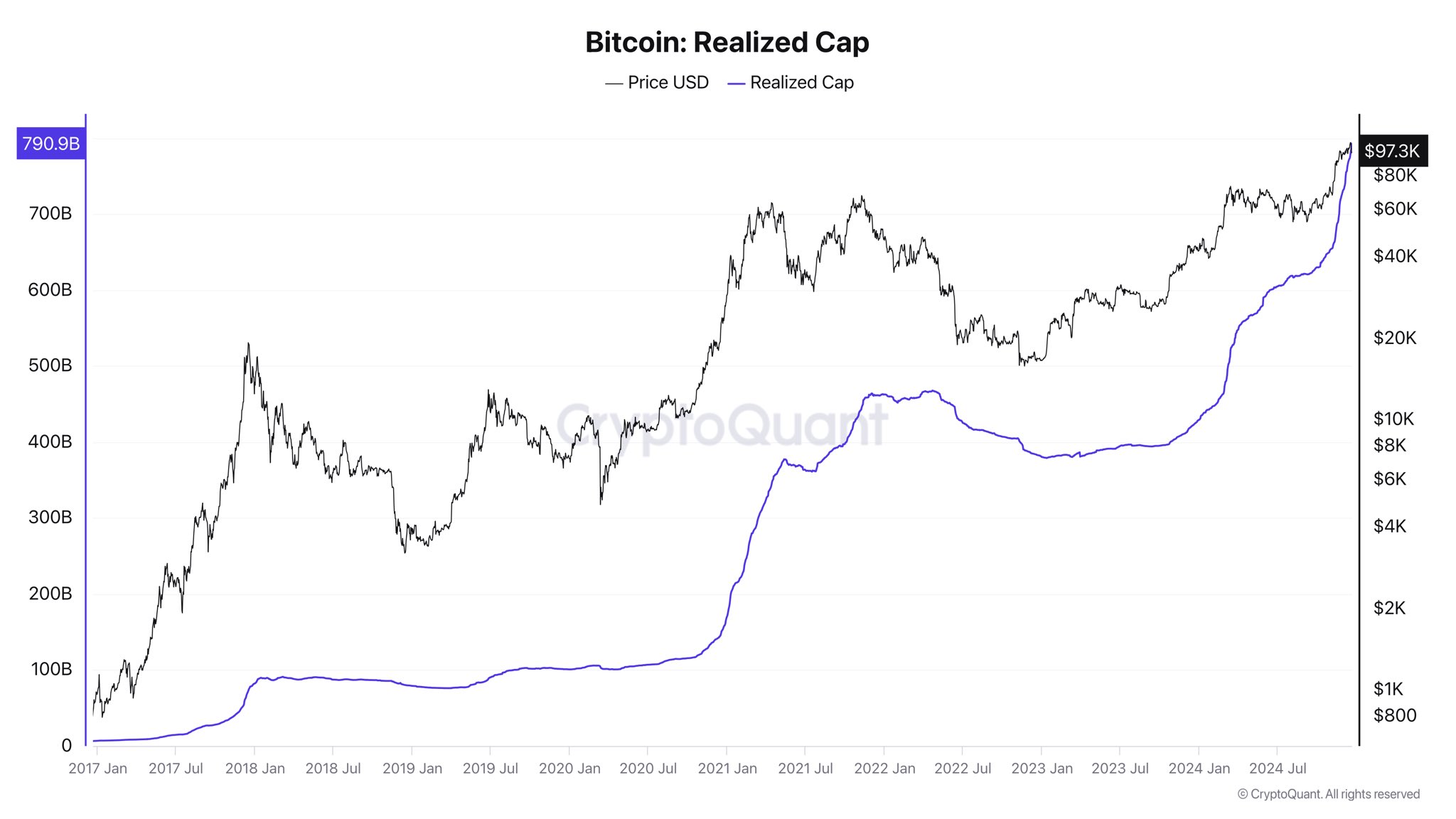

Ki Younger Ju tells his 389,600 followers on the social media platform X that $790 billion in realized capital inflows have ballooned Bitcoin’s market cap to $2 trillion over the previous 15 years.

“This yr alone, $352 billion in inflows have added $1 trillion to its market cap.

Nonetheless, utilizing a pumpable asset like Bitcoin to offset dollar-denominated debt—slightly than gold or {dollars}—might make gaining collectors’ consensus difficult. For Bitcoin to attain broader market acceptance, Bitcoin should attain world, nationwide authority on par with gold. Establishing a Strategic Bitcoin Reserve (SBR) might function a symbolic first step.

With 70% of U.S. debt held domestically, offsetting 36% of it by buying 1 million Bitcoin by 2050 turns into possible if the U.S. authorities designates Bitcoin as a strategic asset.”

The CryptoQuant CEO provides that the 30% of debt held by overseas entities would possibly resist that strategy, however he argues that the technique stays sensible nonetheless.

“If a consensus is reached on Bitcoin’s standing, attaining that is fully attainable.

The one threat could be previous whales dumping BTC to assault the US. Nonetheless, if governments proceed accumulating Bitcoin till 2050 and its value retains rising, I doubt they’d really dump it.”

Matthew Sigel, the pinnacle of digital property analysis at exchange-traded fund (ETF) supplier VanEck, initially outlined how a strategic Bitcoin reserve might offset US debt.

“Assume the US Treasury begins shopping for a million Bitcoin over 5 years at a beginning value of $200,000.

Assume US debt grows at 5% (vs. final 10 years 8% compound annual progress fee) and BTC value compounds at 25%.

In such a situation, the US Strategic BTC Reserve would maintain property equal to 36% of debt by 2050.

In that situation, BTC could be $42 million/coin (identical as Michael Saylor’s goal, coincidentally) and the market cap could be 18% of world monetary property.

However even at a 15% compound annual progress fee, the BTC stash would nonetheless be fairly useful.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney