The previous week was largely outlined by the Bitcoin value climbing above $45,800 for the primary time in over 20 months, marking an awesome begin to the yr. Nonetheless, the premier cryptocurrency quickly skilled a sharp value pullback attributable to destructive information in regards to the BTC spot (ETF).

Apparently, the most recent on-chain knowledge has revealed that buyers appear to not have utterly misplaced religion in Bitcoin, the most important cryptocurrency by market capitalization.

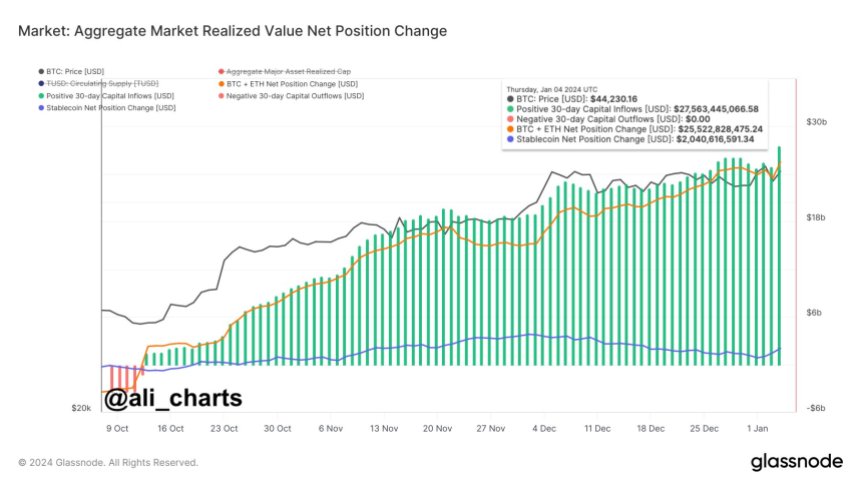

$2.5 Billion Flows Into Crypto Market Following Bitcoin Crash

In a publish on the X platform, crypto analyst Ali Martinez has provided on-chain perception into the aftermath of the crash that affected Bitcoin and all the crypto market. The pundit famous in his publish {that a} substantial quantity of funds flooded again into the sector a day after the market downturn.

This revelation was based mostly on on-chain knowledge from blockchain analytics platform Glassnode. The related indicator right here is the “constructive 30-day capital inflows”, which tracks the online inflow of capital into the crypto market over a 30-day interval.

Chart displaying mixture market realized worth web place change | Supply: Ali_charts/X

The chart above reveals {that a} vital quantity of funds have been getting into the cryptocurrency market over the previous few months. In response to Glassnode’s knowledge, greater than $2.5 billion flowed again into the cryptocurrency market on Thursday, January 4, bringing the constructive 30-day capital inflows to about $27.5 billion.

This newest influx of capital into the market presents perception into the constructive shift in sentiment and market situation. It principally indicators renewed investor confidence in crypto belongings following a brief interval of uncertainty and value correction.

As of this writing, the Bitcoin value stands at $43,661, reflecting a 0.2% decline prior to now 24 hours. Nonetheless, the market chief appears to be recovering effectively, with $44,000 not too far out of attain.

How BTC Holders Reacted To The Market Downturn

A latest evaluation reveals how varied lessons of Bitcoin buyers reacted to the destructive ETF information and the next decline. This analysis was based mostly on the Spent Output Age Bands USD (SOAB) indicator on the CryptoQuant analytics platform.

The buyers have been divided into 5 lessons based mostly on the age of their holdings. In response to the evaluation, short-term holders who fell throughout the 1-week-to-1-month and 1-month-to-3-month lessons exited the market at break-even and income, respectively.

In the meantime, long-term holders who bought Bitcoin within the first half of 2023, falling between the 6-month-to-12-month class, dumped about $7.6 billion price of BTC. The 1-year-to-5-year holder class, alternatively, barely made a transfer after the market downturn.

Bitcoin value at $43,690 on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual threat.