Negentropic, the official X (previously Twitter) account of Glassnode’s cofounders, has provided its personal bullish sentiment for the crypto market.

Glassnode Cofounders: There Would Be A Huge Progress Past Latest Corrections

In keeping with their evaluation, the market, excluding the highest 10 cryptocurrencies, referred to as “OTHERS,” is exhibiting indicators of a powerful uptrend with the potential for “extra upside” development.

This remark amidst elevated volatility and uncertainty following the latest Bitcoin Halving occasion on April 20 decreased miners’ block subsidy rewards from 6.25 BTC to three.125 BTC.

The cofounders identified an intriguing sample available in the market’s conduct, evaluating the present circumstances to the “sturdy correction” seen in early 2021, which they recognized as “wave 4” available in the market cycle.

The #Crypto Bull Market Continues.

“OTHERS” follows Crypto excl. the most important 10 Cryptos.

Observe that we in early 2021 had a powerful correction. We consider that was a wave 4.

We now have the same sturdy decline.Extra upside is coming. This index and our Fibonacci ranges… pic.twitter.com/qKtIOSXneP

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 22, 2024

Utilizing their index and Fibonacci ranges, Glassnode’s cofounders anticipate roughly a 350% improve from the present market ranges, noting:

Extra upside is coming. This index and our Fibonacci ranges offers us, that we might even see ~350% upside from present ranges.

Notably, this bullish projection underscores their confidence within the potential for additional market enlargement regardless of latest downturns.

Crypto Market Restoration Amid Bitcoin Criticism And Put up-Halving Predictions

Whereas the Glassnode Co-founders have predicted important development for the crypto market, it’s essential to notice that the general market sentiment stays bullish. After a notable decline final week, the worldwide crypto market is exhibiting indicators of restoration, with almost a 3% improve up to now 24 hours.

This upward motion might be attributed to main cryptocurrencies like Bitcoin and Ethereum, which have seen features of two.7% and 1.7% over the identical interval.

Bitcoin, the flagship cryptocurrency, has not too long ago confronted criticism from distinguished figures like Peter Schiff, who criticized its excessive transaction charges and longer processing instances.

The price to finish a #Bitcoin transaction is now $128 and it takes a half hour to course of. That is another excuse why Bitcoin can’t perform as a digital foreign money. The price to really use Bitcoin as a foreign money is prohibitively excessive for nearly all transactions. It’s a failure.

— Peter Schiff (@PeterSchiff) April 22, 2024

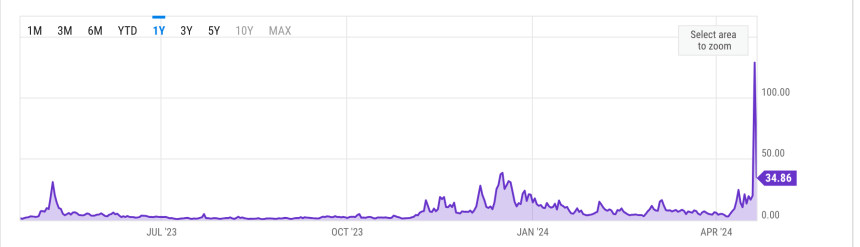

On account of these challenges, Schiff labeled Bitcoin as a “failure” when it comes to digital foreign money. Nonetheless, it’s value noting that Bitcoin’s common transaction charge has considerably decreased to $34.86 on April 21, following a file excessive of $128.45 the day earlier than.

In the meantime, analyst and founding father of the Capriole Funding fund Charles Edwards has shared three attainable eventualities for Bitcoin after the Halving.

Edwards highlighted the rise in Bitcoin’s electrical price to $77,400 per new BTC coin produced, whereas the general miner worth, together with block rewards and costs, surged to $244,000.

He predicts that Bitcoin’s worth could skyrocket, roughly 15% of miners could shut down their operations, or transaction charges will stay elevated. Edwards expects a mixture of those eventualities to unfold, finally resulting in Bitcoin’s worth surpassing $100,000.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal threat.