In a current commentary on X, Daniel Yan, co-founder of Matrixport and CIO at Kryptanium Capital, supplied an in depth comparability between the present crypto market dynamics and people noticed in early June. His insights are particularly related because the market approaches a number of key financial releases that might considerably affect the trajectory of main cryptocurrencies like Bitcoin (BTC) and Solana (SOL).

Historical past Repeating For The Crypto Market?

Yan’s evaluation started with an outline of the present market restoration, noting that each BTC and SOL are “grinding at key technical ranges properly now,” suggesting a possible setup for a breakout much like the scenario in early June. Throughout that interval, Bitcoin was difficult a significant resistance stage at $71,500, influenced by optimistic Private Consumption Expenditures (PCE) knowledge and weaker-than-expected ADP employment change numbers, which fueled optimism a couple of doubtlessly dovish stance from the Federal Reserve.

Associated Studying

Nonetheless, Yan drew consideration to the volatility that adopted, when a stronger than anticipated Non-Farm Payroll (NFP) report reversed the bullish sentiment, inflicting Bitcoin to plummet from highs of $72,000 to round $58,000 inside two weeks. He highlighted this sample to warning traders concerning the potential for related market reactions within the present context.

Trying ahead, Yan expressed a typically bullish outlook for Q3 2023, citing enhancing liquidity situations and the decision of the Mt. Gox case, which has loomed over the marketplace for years. But, he stays cautious of the short-term impacts of the upcoming NFP launch, scheduled for this Friday. “I’m getting cautious going into the NFP Friday – an identical first half of the sample could occur,” he warned.

Yan additionally pointed to the CPI launch as the following essential knowledge level, with the Cleveland Fed offering modest estimates for June however much less favorable projections for July. He emphasised the impression of summer season vitality costs on inflation metrics, noting that rising crude oil and fuel costs since early June are prone to affect each headline CPI and PCE instantly, and core inflation numbers not directly.

“A 0.3% MoM Core CPI expectation is already unhealthy, think about it realizes worse,” he remarked, underscoring the potential for these figures to exceed expectations to the upside, additional complicating the Fed’s inflation administration efforts.

Associated Studying

The rapid focus for Yan and plenty of within the crypto group is Federal Reserve Chairman Jerome Powell’s speech tonight on the European Central Financial institution. His feedback are extremely anticipated for hints on how the Fed views the present macroeconomic situations and its potential coverage actions within the close to time period. “Let’s see what he thinks of the present macro conditions,” Yan said, indicating the numerous market-moving potential of Powell’s tackle.

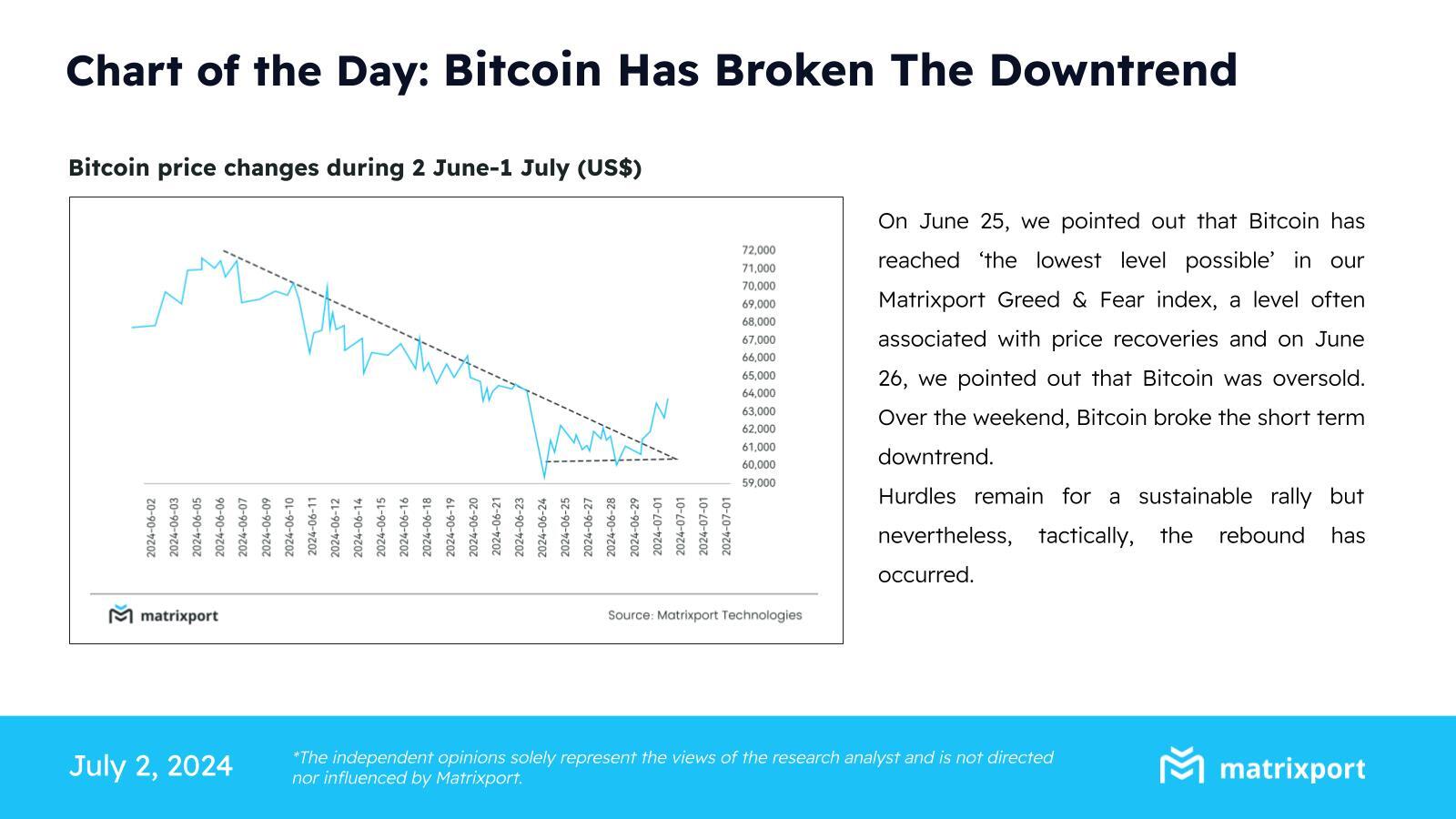

Bitcoin Breakout Wants Affirmation

Matrixport launched a “Chart of the Day” that includes Bitcoin’s value actions from June 2 to July 1, highlighting the cryptocurrency’s current break from a short-term downtrend. After signaling a backside on June 25 on their Matrixport Greed & Concern index—a device typically used to foretell potential reversals—Bitcoin confirmed indicators of an oversold situation, which generally precedes a value restoration. Certainly, Bitcoin’s value started to rebound tactically over the weekend, overcoming a number of the rapid technical hurdles.

Whereas the market seems to be organising for a possible rally, Yan’s evaluation and the approaching financial updates counsel that traders ought to brace for attainable fluctuations. As these occasions unfold, the crypto market’s response to financial indicators and central financial institution communications will likely be pivotal in shaping its short-term route.

At press time, BTC traded at $62,802.

Featured picture created with DALL·E, chart from TradingView.com