Knowledge exhibits the cryptocurrency derivatives market has suffered liquidations of greater than $1 billion prior to now day as Bitcoin has crashed to $52,000.

Bitcoin Has Plunged By Extra Than 15% Throughout The Final 24 Hours

Bitcoin traders have been dealt a shock to open Monday, with the cryptocurrency having crashed by greater than 15%, which has taken its value to the $51,500 mark.

Associated Studying

The under chart exhibits how the current trajectory has seemed like for the asset:

From the graph, it’s seen that the most recent sharp plunge within the BTC value is simply an acceleration of the development that the asset had already been witnessing for the reason that final couple of days of July.

On the twenty ninth, the cryptocurrency was floating across the $70,000 mark, which means that it had come down by greater than 26% in solely per week. Following this drawdown, Bitcoin is now again to the identical stage as that simply earlier than the late February rally, which went on to culminate in a brand new value all-time excessive (ATH).

Whereas BTC has had it dangerous through the previous day, altcoins have typically had it even worse. Ethereum (ETH), BNB (BNB), and Solana (SOL), the three largest cash subsequent to the unique (excluding the stablecoin Tether), have all seen larger losses of 23%, 19%, and 21%, respectively.

With costs throughout the sector crashing down, it’s not stunning to see that lengthy traders have taken a heavy blow over on the derivatives aspect of the market.

Crypto Liquidations Have Crossed $1 Billion, Majority Are Lengthy Contracts

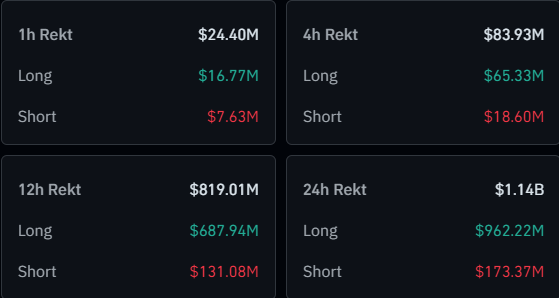

The most recent volatility within the varied property has meant the derivatives market has gone by means of chaos over the previous 24 hours, as the info from CoinGlass under exhibits.

As is seen within the desk, a whopping $1.1 billion in cryptocurrency derivatives contracts have discovered liquidation on this interval. “Liquidation” right here naturally refers back to the course of any contract undergoes after amassing losses of a sure diploma, the place its platform forcibly closes it up.

An excessive majority of those liquidations, round 85% to be extra exact, concerned the lengthy holders. It is a pure consequence of the market as an entire going by means of a crash.

Apparently, although, regardless of the sharp plummet, $173 million in shorts nonetheless managed to get liquidated, which isn’t actually a small quantity. Thus, it could seem that a considerable amount of traders solely put their bearish bets in when the crash was already completed.

Associated Studying

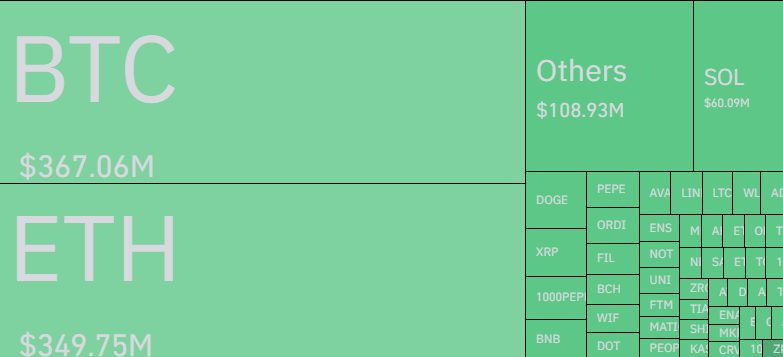

When it comes to the person symbols, Bitcoin and Ethereum have contributed to the mass liquidation occasion by practically the identical levels, witnessing liquidations of $367 million and $350 million, respectively.

Clearly, BTC continues to be forward, however by solely a small quantity, which isn’t normally the case. The rationale behind ETH’s excessive liquidations could also be the truth that the current launch of the spot exchange-traded funds (ETFs) had put extra consideration on the second largest coin by market cap.

Featured picture from Dall-E, CoinGlass.com, chart from TradingView.com