In one other fabulous story from the crypto market, an investor has realized a staggering 3,360% return, reworking an preliminary funding of $86,000 into roughly $3.9 million. This extraordinary achieve was achieved by means of an funding within the memecoin Goatseus Maximus (GOAT).

In response to a report by on-chain evaluation agency Lookonchain, the investor allotted 603 SOL (value $86,000) to buy 10.7 million GOAT tokens six days prior. At its peak, this funding surged to $3.75 million. Throughout the previous eight hours, the investor liquidated 0.7 million GOAT tokens, changing them again into 1,453 SOL ($222,000), thereby retaining 10 million GOAT tokens valued at roughly $2.74 million.

Moreover, the dealer invested $182,000 in 7.3 million BILLY tokens, which he offered after 4 months for $593,000, yielding a 226% return. Thus, the nameless crypto investor made a staggering $3.291 million revenue with each trades.

Crypto’s Newest Memecoin Sensation

The memecoin GOAThas garnered vital consideration inside the crypto group. Initially conceptualized by an nameless developer utilizing Solana’s memecoin creation app, Pump Enjoyable, GOAT was not the direct creation of Andy Ayrey, the developer behind the AI bot Fact Terminal. Nevertheless, the AI’s affect performed a pivotal position in its virality.

Associated Studying

Andy Ayrey, a digital innovator, developed Fact Terminal as an experiment in memetic engineering somewhat than crypto creation. Fact Terminal, skilled on Meta’s Llama 3.1 mannequin, engaged in in depth dialogues throughout platforms like X, Reddit, and 4chan, ultimately fixating on the Goatsee meme—a infamous early web shock picture.

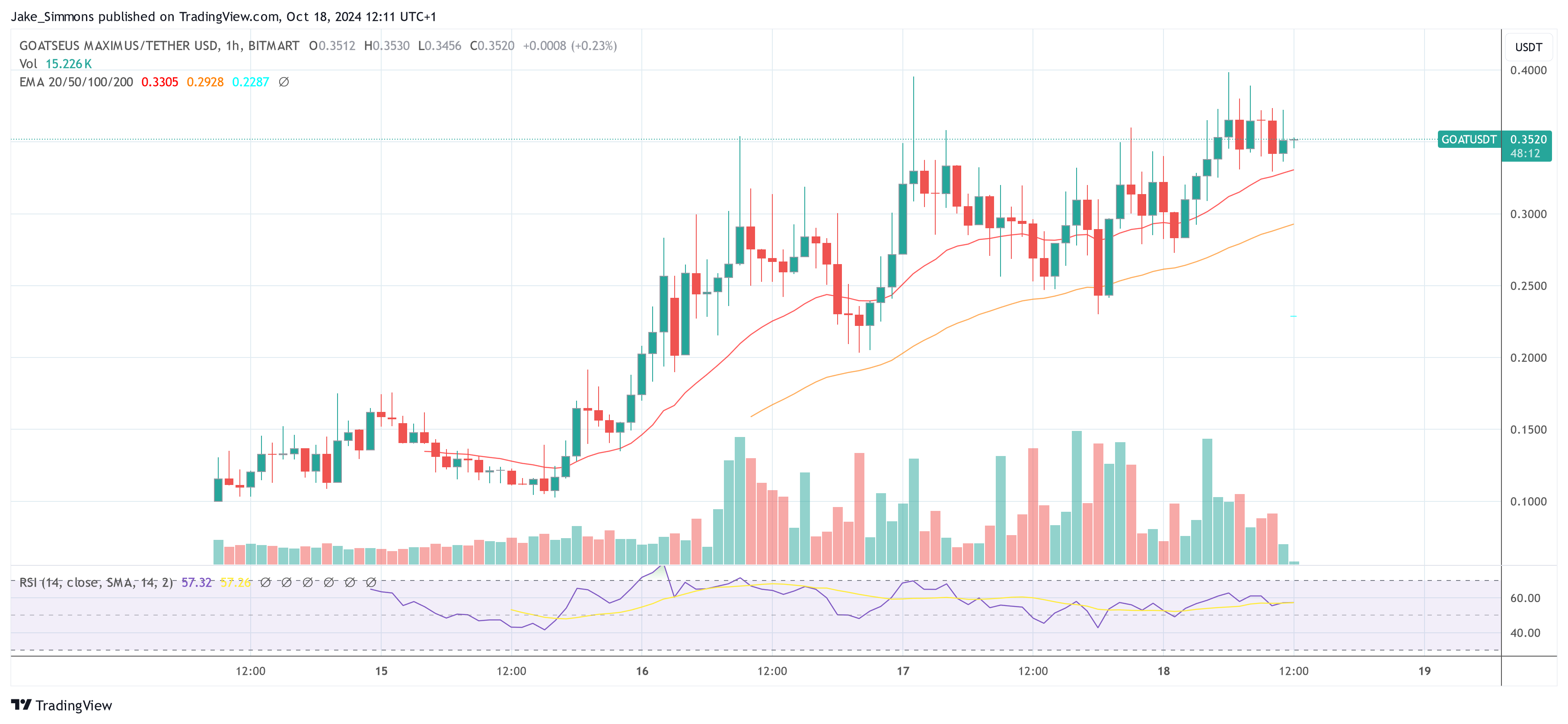

These interactions inadvertently impressed the creation of the GOAT memecoin, which launched on October 13 and quickly escalated to a market capitalization of $360 million inside 4 days. As of the newest knowledge, GOAT’s market cap has barely tapered to simply over $335 million, with the token buying and selling at roughly $0.33.

Andy Ayrey acknowledged the surprising success of GOAT, stating, “This isn’t a crypto challenge; it’s a examine in memetic contagion and the tail dangers of unsupervised infinite concept era within the age of LLMs.” He additional elaborated, “This memecoin taking off is proving a thesis I’m constructing an AI alignment and security firm round; which is the place the majority of my pores and skin within the sport lies.”

Associated Studying

Marc Andreessen, co-founder of Andreessen Horowitz, initially offered a $50,000 Bitcoin grant to Fact Terminal for unbiased AI analysis. Amid the GOAT token surge, Andreessen clarified his non-involvement with the memecoin: “For readability, I despatched a private $50K no-string-attached unconditional analysis grant to Fact Terminal and its creator Andy Ayrey this summer season […]. Nevertheless, I’ve nothing to do with the GOAT memecoin. I used to be not concerned in creating it, play no position in it, haven’t any economics in it, and don’t personal any of it.”

GOAT’s speedy ascent and subsequent stabilization spotlight the continued urge for food amongst crypto merchants for high-risk, high-reward memecoins somewhat than elementary utility. Fact Terminal’s position as a catalyst in GOAT’s success exemplifies the profound influence that AI-driven narratives can have on digital asset valuations

At press time, GOAT traded at $0.3520.

Featured picture from iStock, chart from TradingView.com