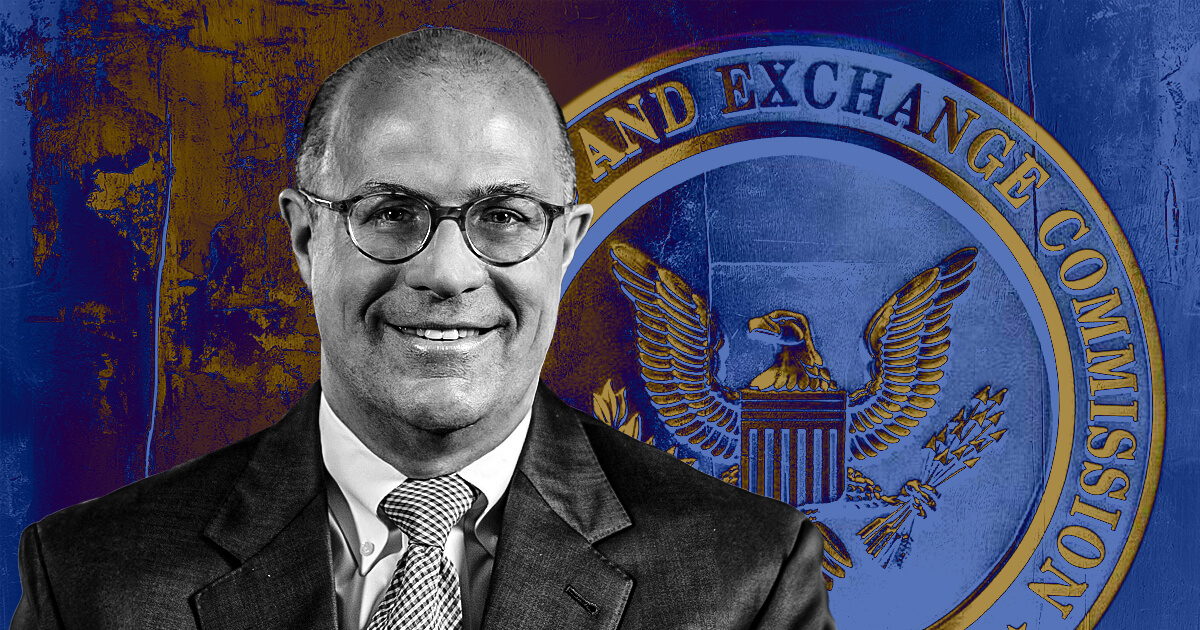

Former Commodity Futures Buying and selling Fee (CFTC) Chair Christopher Giancarlo denied rumors about being thought of as the subsequent Chair of the US Securities and Change Fee (SEC).

He additionally denied the rumors about being desirous about a crypto-related position inside the US Treasury Division, including:

“I’ve made clear that I’ve already cleaned up earlier Gary Gensler mess [at] CFTC and don’t wish to have do it once more.”

Though he didn’t specify, the ‘mess’ might be associated to the SEC’s “regulation by enforcement method” towards the crypto business, which certainly one of its Commissioners deemed a “catastrophe.”

Giancarlo took over as CFTC chair in August 2017, over three years and two phrases after present SEC Chair Gary Gensler left the position.

Giancarlo is also called ‘Crypto Dad’ as a result of his pleasant stance in the direction of this business within the US since 2018 when he mentioned that “cryptocurrencies are right here to remain.” In 2021, the previous CFTC chair revealed an autobiography that features his assist for crypto.

He’s at the moment serving as an advisor for the US Digital Chamber of Commerce.

Justified and important

Gensler just lately defended the SEC’s method throughout a speech on the Practising Regulation Institute’s 56th annual convention on securities regulation, in line with a CNBC report.

Gensler highlighted that whereas Bitcoin isn’t a safety, a considerable variety of the ten,000 different digital property in circulation doubtless qualify as securities underneath US regulation.

He additional argued that this classification locations them squarely underneath SEC regulation, reinforcing the necessity for sellers and intermediaries to register to guard traders and uphold market integrity.

Moreover, the SEC Chair described the regulator’s vigilance as vital to forestall “vital investor hurt,” citing cases the place poorly policed digital property had didn’t show lasting utility or stability.

He warned that the sector’s lax regulatory oversight uncovered traders to dangers, suggesting that the SEC’s powerful stance was justified and important to guard the general public.

Since Gensler took the helm in 2021, the SEC has pursued quite a few lawsuits towards crypto companies, together with main exchanges like Kraken, Binance, Ripple, and Coinbase. Many inside and with out the business have criticized the regulator’s actions and declare that it has failed to supply regulatory readability for the business.