New information reveals that distinguished centralized trade (CEX) platforms, together with Crypto.com and Bybit, noticed their buying and selling volumes surge in December.

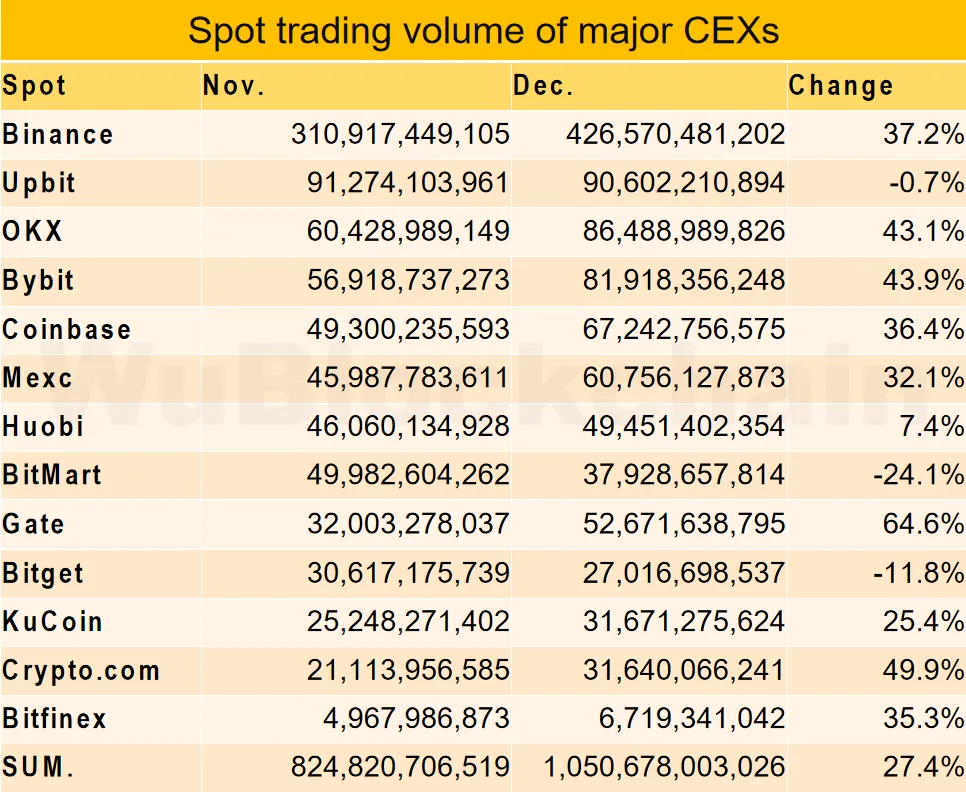

In accordance with blockchain reporter Colin Wu, in December, the general spot buying and selling quantity of centralized crypto exchanges rose 27.4% month-on-month regardless of a few of them seeing notable dips.

“In December, the spot buying and selling quantity of main exchanges rose by 27.4% month-on-month. The highest three when it comes to proportion change had been Gate at 65%, Crypto.com at 50%, and Bybit at 44%. The underside three had been BitMart at -24%, Bitget at -12%, and Upbit at -1%.”

In accordance with Wu’s information, derivatives buying and selling on main crypto exchanges rose 22.3% month-on-month whereas total site visitors to their web sites noticed a 21% month-on-month improve.

“For by-product buying and selling quantity in December, there was a 22.3% month-on-month improve amongst main exchanges. The highest three in proportion change had been Crypto.com at 46%, Bitget at 42%, and Binance at 26%. The underside three had been Mexc at -13%, Huobi at -5%, and Kucoin at 14%.

Relating to web site site visitors for main exchanges in December, there was a 21% month-on-month improve. The highest three in proportion change had been Mexc at 45%, Bybit at 38%, and Gate at 34%. The underside three had been Huobi at -80%, BitMart at -17%, and Bitget at 8%.”

In December, market intelligence platform Glassnode recommended that a rise in flows into crypto exchanges meant that institutional traders had been readying themselves for the potential approval of a spot market Bitcoin (BTC) exchange-traded fund.

On the time, an evaluation by the agency discovered that the 30-day easy transferring common (SMA) of Bitcoin flows out and in of exchanges grew 220% from the beginning of the 12 months, capturing as much as $3 billion from $930 million.

The U.S. Securities and Change Fee (SEC) is slated to approve or reject spot market BTC ETFs someday at present.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney