Each bull run begins with a wave of capital inflows, one thing that excites these watching sufficient to trigger FOMO. Because of that FOMO, merchants & paper holders get emotional about holding “this rattling coin that simply does nothing,”. All whereas watching others straight line up, then dump their positions at magically the fallacious time.

It’s not about capturing the primary wave of face melting income. It’s about utilizing that as an indicator to see how these items have really labored out. There’s one catch, nevertheless. It is best to solely try this should you perceive to ensure that this course of to achieve success, it should be noticed and executed with little to no emotion. Additionally don’t take heed to social media both or you’ll nearly actually fail.

The wave of capital inflows run down, similar to water. That being the case, let me let you know what we do know. Each bull run that preceded us started with Bitcoin grinding as much as the Fibonacci 0.50 mark. It was solely when BTC crossed that mark that issues obtained thrilling. The 15-17 bull run would be the essential focus of this text, as a consequence of a phrase rely cap.

Step One – The place Do I Begin?

Because the bear market lows, Bitcoin has been the most secure wager till the .50 fib. After that we’ve got to watch our radar for what has technically damaged out throughout medium cap shares which can be doubling (+/-) BTC’s features in the identical timeframe. Rotate your allotted buying and selling quantity into it with out excuses, no “hodling” based mostly on emotions, or “the workforce”, and many others. This isn’t a lot about that, as it’s in regards to the present eyes on them. Additionally similar to Solana this cycle, and Ethereum in the course of the 15-17 run, there ought to be loads of time to scale out.

Step Two – Rotation Time

After that, I scale income into the basically strongest massive and medium caps. Currently the ETH/BTC reversal (since writing worth has damaged out up) signifies that, and the strongest inside its ERC-20 household (eg. LINK, MATIC, and many others.) are those to observe in the intervening time IMO (as seen within the chart beneath).

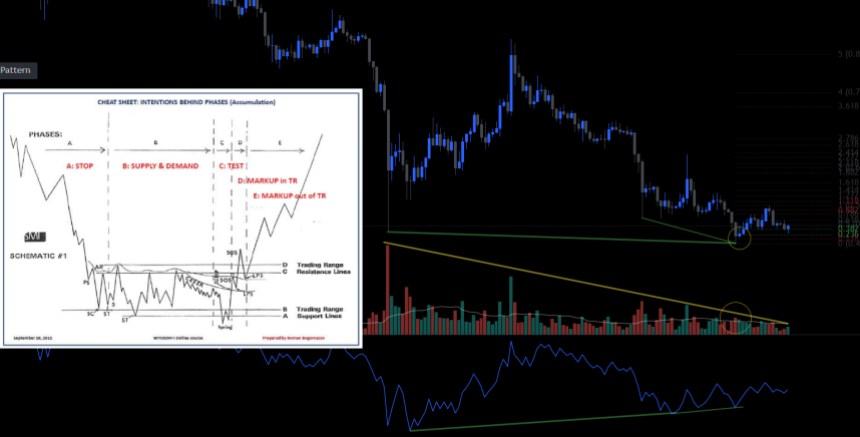

Thankfully, with some buying and selling training & expertise, the timing of these items turns into a lot much less of a guessing recreation. In case you research Elliott’s Wave evaluation, Wyckoff Schematics, chart patterns, quantity, and many others. When carried out appropriately (as seen within the MATICUSD chart beneath) you may be on the bleeding edge of those runs. Which ends up in a really blissful Buying and selling account.

The place I transfer weight to subsequent has been at clear Fibonacci extensions of the runners, (which I’ve gauged from their prior actions). On this place I’ve seen it too many instances to not perceive and worth that historical past might not repeat, however it typically rhymes. You may most simply establish the subsequent runners by way of their technical breakouts that occurred as Bitcoin crept up the fib scale and corrected on the main POI’s (as seen on the chart beneath).

The mechanic of capital inflows, circulate down the road, right through the small caps, micro caps & NFT’s, and many others. The best way to catch huge features is comparatively simple in a bull market should you’re in it from the start. The following trick is to maintain income.

Step Three – Securing Income

To retain income there are a variety of the way to gauge targets as talked about earlier than with Fibonacci extensions, quantity paired with weekly candles, sentiment, Fibs, Elliott’s Waves and Wyckoff’s Distribution Schematics are greater than sufficient to come back out of every run with suitcases of revenue. So if that’s one thing that’s vital to you, both take the time to place the work in to be taught for your self or all the time be on the whim of others’ recommendation.

In case you’re concerned about retaining updated with the path of capital inflows, what I’m doing and when, hold a lookout on NewsBTC or observe me on Twitter for breakout and different related charts once I launch them, because the run continues, or DM me if you wish to be taught.

I’ll depart you with just a few warnings that I’ve tried to share with my college students and folks near me, that are spoken from expertise and solely acknowledged in hopes that these phrases will shield anybody studying this from the identical arduous classes I and everybody I do know on this place have discovered the arduous means, a minimum of as soon as…

If you really feel invincible, take income. When your prolonged household or associates begin asking on your recommendation on shopping for crypto, take income, and inversely once they let you know to promote, don’t. Lastly, one of the vital helpful items of recommendation I’ve discovered is, solely ever goal for the “meat of the transfer” not the precise high.

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal threat.