Arthur Hayes, co-founder and former CEO of the cryptocurrency alternate BitMEX, took to X to supply an in depth evaluation of the US financial panorama and its potential results on the crypto market. With a fame for incisive commentary and a deep understanding of each conventional and digital finance, Hayes’s insights are intently watched by business individuals.

Why The Crypto Bull Run Will Return As Quickly As Monday

In a publish, Hayes famous a major enhance within the Treasury Basic Account (TGA), which he attributed to an inflow of roughly $200 billion from tax receipts. “As anticipated tax receipts added roughly $200bn to TGA,” Hayes said, setting the stage for a broader dialogue on potential implications for monetary markets.

Hayes then shifted focus to imminent selections by US Treasury Secretary Janet Yellen regarding the administration of the TGA. With a tone mixing respect and sternness, he outlined a number of potential eventualities, every with profound implications for market liquidity. “Neglect in regards to the Could Fed assembly. The 2Q24 refunding announcement comes out subsequent week. What video games will [Janet] Yellen play, listed below are some choices,” Hayes remarked.

Firstly, he instructed that by “stopping issuing treasuries by working down the TGA to zero,” Yellen might unleash a $1 trillion liquidity injection into the economic system. This technique would contain utilizing the accrued funds within the TGA for federal spending with out issuing new debt, thus straight boosting the cash provide.

Secondly, Hayes speculated about “shifting extra borrowing to T-bills, which removes cash from RRP,” leading to a $400 billion liquidity increase. This maneuver would contain the Treasury choosing shorter-duration debt devices, which generally carry decrease rates of interest however enhance the turnover of presidency securities. This might doubtlessly draw funds away from the in a single day reverse repo market, the place monetary establishments briefly park their extra money.

Combining these two approaches, in accordance with Hayes, might result in “a $1.4 trillion injection of liquidity” if Yellen decides to each stop long-term bond issuance and ramp up the issuance of payments whereas depleting each TGA and RRP accounts. Hayes emphatically famous, “The Fed is irrelevant, Yellen is a foul bitch, you greatest respect her.” This assertion underscores his perception within the important impression of Treasury actions over Federal Reserve insurance policies within the present financial setup.

Hayes predicted that these actions might result in a bullish response within the inventory market and, extra crucially, a fast acceleration within the crypto market. “If any of those three choices occur, anticipate a rally in stonks and most significantly a re-acceleration of the crypto bull market,” he defined.

The implications of such fiscal methods are important. Elevated liquidity sometimes diminishes the attraction of low-yield investments like bonds and encourages the pursuit of upper returns in riskier belongings, together with equities and cryptocurrencies. Furthermore, a shift in market sentiment towards ‘risk-on’ might see substantial capital flows into the crypto area, perceived as a high-growth, albeit unstable, funding frontier.

In conclusion, Hayes’ evaluation means that the approaching week – the refunding announcement comes on Monday, April 29 – might be essential for market watchers. His perspective, drawing from deep monetary experience, factors to a doable pivotal shift in US fiscal coverage that might ripple by international markets. For crypto traders, these developments might sign essential actions, underlining the necessity for vigilance and readiness to reply to new financial alerts.

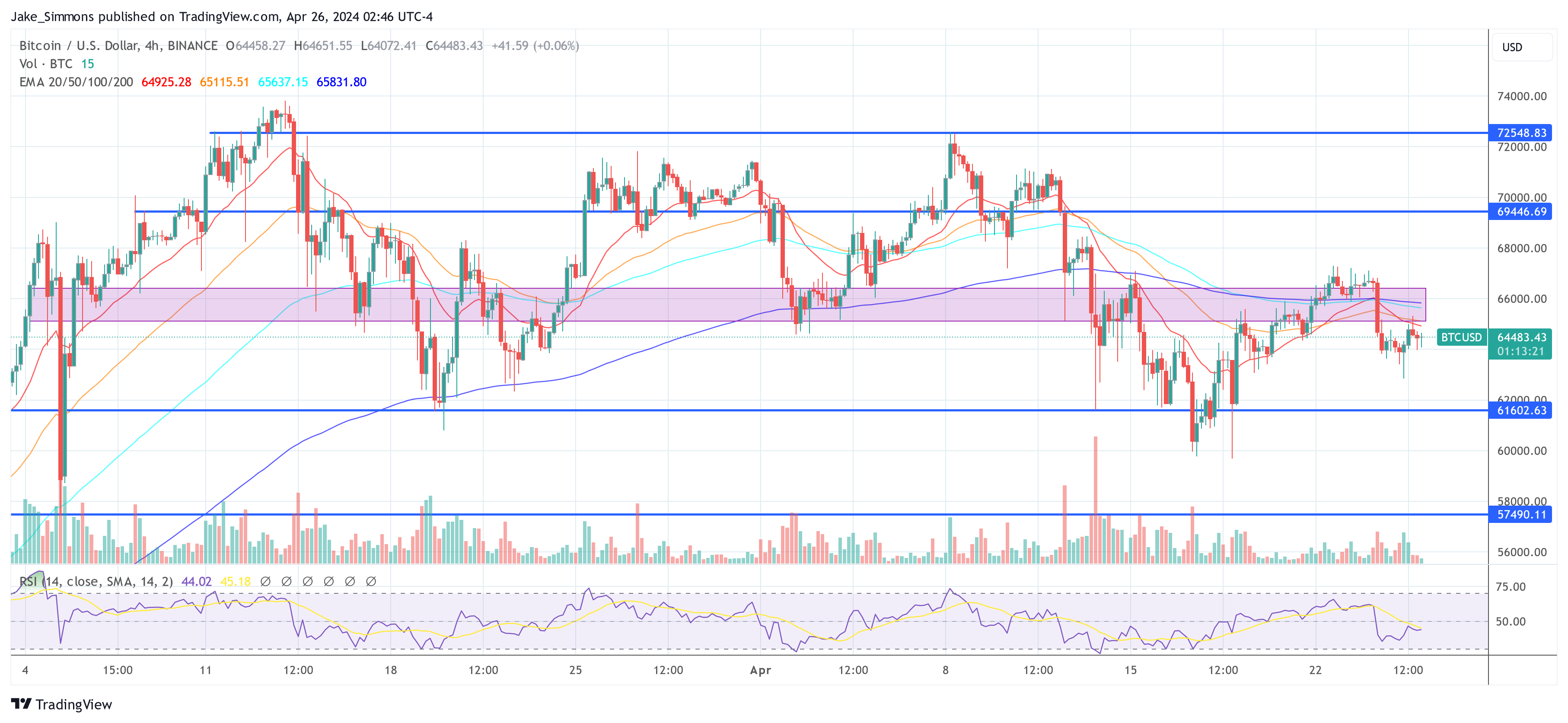

At press time, BTC traded at $64,483.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal danger.