In a brand new video replace, famend crypto analyst Michael van der Poppe dissected the present dynamics of the crypto market, emphasizing the potential of choose altcoins. VVan der Poppe’s evaluation gives a strategic viewpoint for potential traders, specializing in the intricate relationship between Bitcoin’s (BTC) value actions and the broader altcoin market.

Van der Poppe began by acknowledging the blended performances amongst altcoins, with some consolidating, others correcting, and some displaying exceptional power. The crux of his evaluation hinges on the intricate relationship between Bitcoin’s market conduct and the resultant impression on altcoins.

He highlighted the present consolidation part of Bitcoin, noting, “Bitcoin is at the moment a case of consolidating which implies that if Bitcoin is bottoming out… that may be the kickstart of altcoins to start out firing up.”

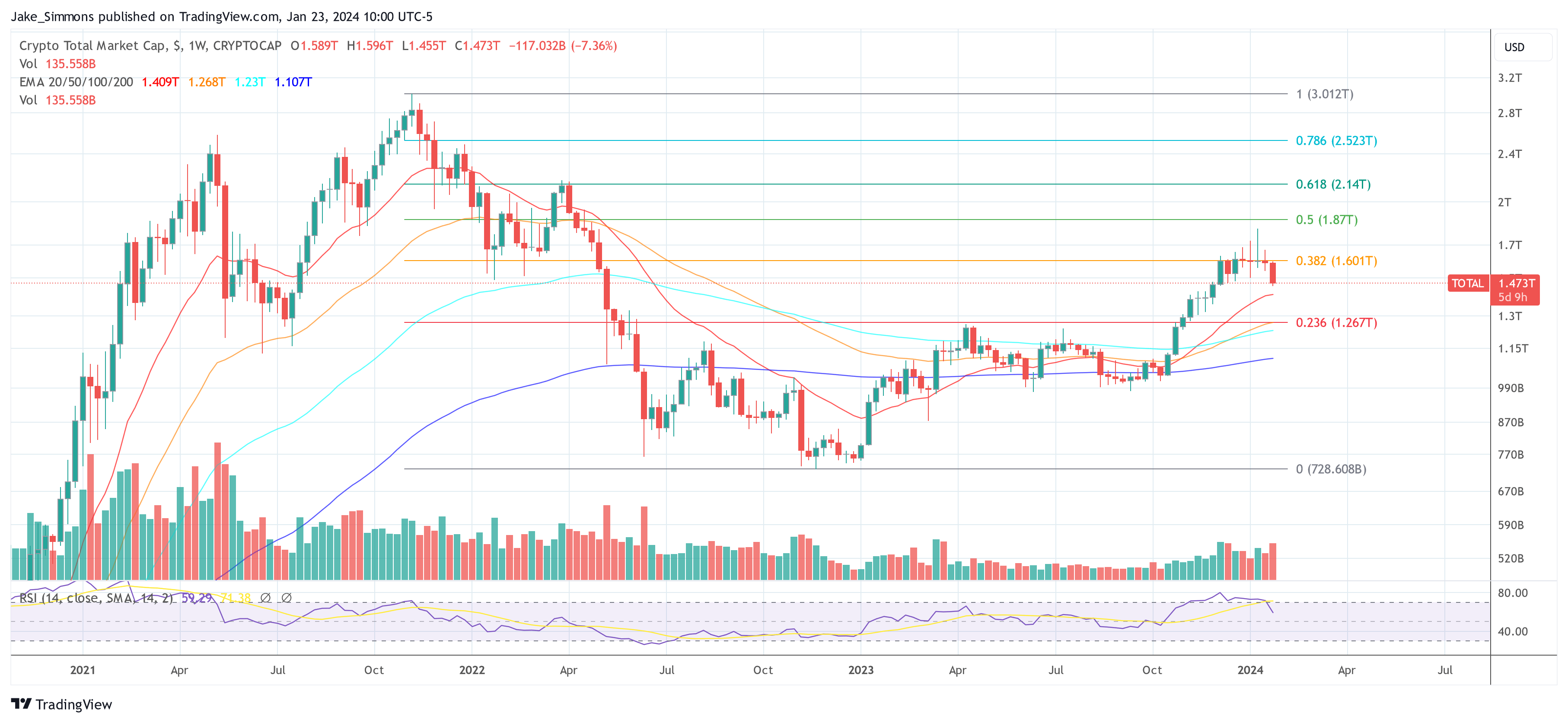

Moreover, the crypto analyst delved deep into market capitalization metrics, significantly emphasizing the Complete 2 market cap (excluding Bitcoin) and Complete 3 market cap (excluding Bitcoin and Ethereum), to underscore the latent potential in altcoins. He identified, “We’re on the ranges of March 2022… the overall market cap lagging says that we’re a case of different cryptocurrencies to start out trending outdoors of Bitcoin.”

High 3 Altcoins To Purchase Now

The primary altcoins which van der Poppe picked is Ethereum. He linked ETH’s value actions with broader market occasions, together with the Bitcoin halving and potential regulatory approvals and prompt, “Ether is all the time going to choose up in a tempo that is because of a interval of consolidation of Bitcoin.”

He added almost about the ultimate SEC deadline for an spot Ethereum ETF approval within the US, “the precise date that we have to deal with is Could, which in all probability goes to steer into such a momentum in the direction of these highs.”

With regard to a potential value goal on this bull run, the analyst revealed: “I believe that at this level ETH remains to be going to proceed working in the direction of the realm of 8K and we’re going to seek out ourselves right into a high at that particular degree.”

With respect to the 1-week ETH/BTC chart, van der Poppe remarked, “We’re seeing one essential degree that we have to break by 0.06. If we do, I believe the vary excessive at 0.0838 goes to be the goal. As a matter of reality you may really say $130 billion must be added in the direction of Ethereum. It’s a rally of roughly 43%.

Van der Poppe’s second decide is Chainlink. Highlighting LINK’s technical patterns and its correlation place towards BTC within the weekly chart, Van der Poppe highlighted that LINK hit resistance at 0.000448, dropped again down in the direction of 0.0002843 and is now consolidating.

As soon as that is completed, he expects Chainlink “to rally in the direction of the resistance and begin breaking out of this degree in the direction of the highs at 0.0009 to 0.0010.” He added, “By way of BTC worth, it’s very probably that it’s going to do a 2x,” emphasizing the potential for vital progress.

In USDT phrases, this might imply that LINK goes to $17 to $18. “From $17 to $18, it’s essential to do 2X, which is that this vary excessive, which is that this degree, which we are able to anticipate Chainlink to go to earlier than we’ve a reasonably substantial correction in your complete market,” he added.

The analyst’s third altcoin is Arbitrum. Specializing in ARB’s current value actions and potential for a big rally, Van der Poppe recognized key entry factors, stating, “Wherever on this ballpark between $1.67 and $1.50 is the place you wish to get your self into an entry level.” He underlined the potential progress, saying, “If there’s going to be one other impulse happening, it’s going to $3.50 or $5.”

At press time, the overall crypto market cap stood at $1.473 trillion after being rejected on the 0.382 Fibonacci retracement degree.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site solely at your personal danger.