In a brand new put up on X, Miles Deutscher, a famous crypto analyst with over half 1,000,000 followers, has proclaimed the present market situation as “some of the bullish setups” he has seen in his six-year profession within the crypto business. Deutscher outlined ten pivotal catalysts that he believes are primed to drive the cryptocurrency markets larger within the close to time period.

“There was loads of discuss not too long ago about headwinds (Germans promoting, Gox, macro and so on.). However the actuality is, there’s A LOT to stay up for,” Deutscher emphasised.

10 Causes To Be Extremely Bullish On Crypto

#1 German Authorities BTC Gross sales: Deutscher notes that the German authorities has exhausted its BTC reserves to promote, which removes a big promoting strain in the marketplace. “The most effective factor about overhang is that after promoting is priced into the market, there’s a flooring on draw back and headroom for worth to maneuver larger. We nonetheless have Gox, however there’s now gentle on the finish of the tunnel,” he defined.

#2 Bitcoin ETF Inflows: In keeping with Deutscher, the robust inflows into Bitcoin ETFs are underappreciated. Over the previous month, these ETFs have seen inflows exceeding $1 billion, signaling sustained investor curiosity.

“I feel many individuals are underestimating the magnitude of the long-term affect of the ETFs on BTC. It gives a robust passive bid for the market, and urge for food for the ETF isn’t going away (we’ve had +$1b this previous month),” Deutscher added.

Associated Studying

#3 US Presidential Election: The crypto analyst identified betting markets like Polymarket, the place Trump is favored to win. A Trump presidency is considered as a constructive catalyst for crypto, given his administration’s perceived help for the business.

#4 Trump Advocacy at BTC 2024 Convention: Deutscher additionally highlighted Trump’s scheduled look on the BTC 2024 convention, the place he’s anticipated to advocate for Bitcoin and cryptocurrencies extra broadly. Rumors have it that Trump may make one other main announcement. Bitcoin Journal CEO David Bailey has floated the thought of creating BTC a strategic reserve asset for the USA.

#5 FTX Repayments: The compensation of $16 billion to collectors by FTX is a much less mentioned however essential issue. “Many of those recipients will probably re-enter the market, resulting in a contemporary bid,” Deutscher predicts, suggesting a possible enhance in shopping for exercise within the crypto markets.

#6 International Liquidity Cycle: Deutscher additionally talked about the correlation between world liquidity and crypto costs. “It’s loopy how correlated crypto (particularly BTC) is to world liquidity. Curiously, we’ve been carefully following a 65-month cycle. This may counsel a late 2025 peak,” Deutscher predicted.

Associated Studying

#7 Spot ETH ETFs: The imminent launch of Spot ETH ETFs is one other main catalyst. This marks the primary time an altcoin has acquired such an funding automobile, probably increasing Ethereum’s market publicity and investor base dramatically.

#8 Goldman Sachs Tokenization Tasks: Goldman Sachs’ involvement in three tokenization tasks lends vital credibility to the crypto area. This institutional endorsement is predicted to profit a big selection of altcoins and associated real-world asset (RWA) functions.

#9 Anticipated Charge Cuts: In keeping with the CME FedWatch software, the market is at present factoring within the chance of three price cuts till the tip of the yr, with a 90% likelihood of a 25 foundation level discount in September. This might serve a large tailwind.

#10 Ahead-Wanting Markets: Lastly, Deutscher emphasised the reflexive nature of crypto markets, the place constructive sentiment itself can set off substantial rallies. “Over the approaching months, you’re prone to see the market worth in these tailwinds. As crypto is very reflexive, a constructive bid off the again of elevated sentiment can, in and of itself, result in a significant rally,” Deutscher concluded.

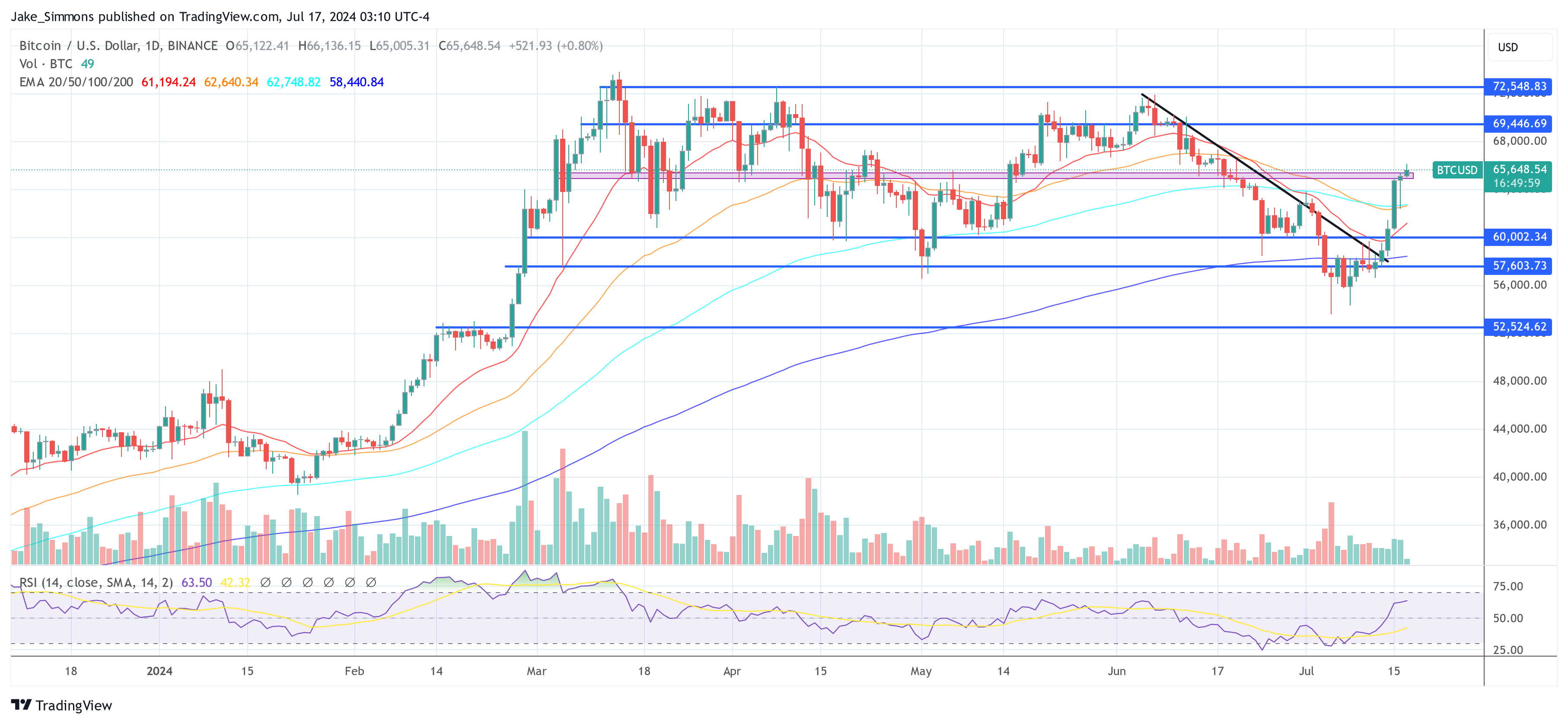

At press time, BTC traded at $65,648.

Featured picture created with DALL·E, chart from TradingView.com