In style crypto analyst Benjamin Cowen is warning that Ethereum (ETH) may out of the blue flip bearish within the final three months of the 12 months.

Cowen tells his 861,500 followers on the social media platform X that ETH could also be repeating the same 2016 sample on the month-to-month timeframe that might have it seeing pink within the fourth quarter.

Nevertheless, he says if ETH follows the same sample, it could put up huge good points within the first half (H1) of subsequent 12 months.

“With ETH going inexperienced in September, the 2016 sample continues to be monitoring. If it continues to play out, it could imply This fall is pink, adopted by inexperienced H1 2025. This fall 2019 was additionally pink for ETH, however October was barely inexperienced. Traits can change, however price following till it deviates.”

Ethereum is buying and selling for $2,375 at time of writing, down 3.3% within the final 24 hours.

Subsequent up, the analyst suggests that Tether Dominance (USDT.D) could have to interrupt under the pattern line on the weekly timeframe for Bitcoin (BTC) to begin rallying as a result of it could point out market contributors are utilizing their stablecoins to build up crypto property. Based on Cowen, a declining share of Tether’s market cap relative to different cryptocurrencies has a historic relationship with Bitcoin uptrends.

“I posted USDT dominance hitting its long-term pattern line on March 14th, 2024, which was the native prime for BTC. All of us have a approach of convincing ourselves that this time is totally different, however USDT dominance has been placing in larger lows ever since. This pattern line wants to interrupt earlier than any actual future rally can start.”

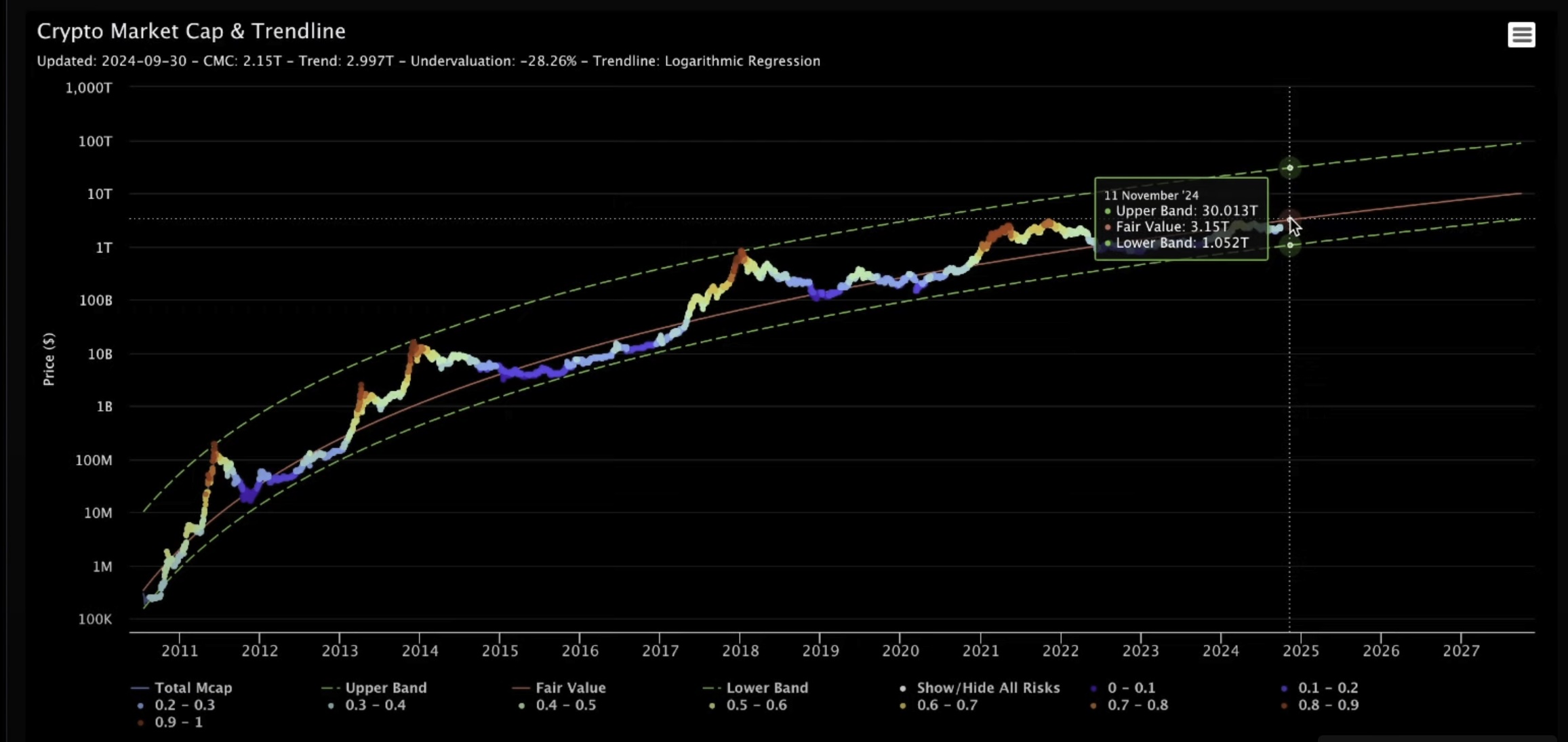

Lastly, the analyst shares a chart of the logarithmic regression band of crypto’s market cap, which is designed to trace the honest worth of an asset class utilizing “non-bubble knowledge.” He says that primarily based on historic priority the crypto market could not soar previous honest worth into the overvalued space till early subsequent 12 months.

“Final cycle, we went durably overvalued by the top of the halving 12 months. However the cycle earlier than that, it wasn’t till the primary or second quarter of 2017. The cycle earlier than that, it wasn’t till the primary quarter of 2013. So once more, we’d expertise a market that doesn’t durably go overvalued till probably subsequent 12 months. And if it did that, it wouldn’t actually be out of the unusual. It might really nonetheless be in step with what we noticed the cycles do beforehand.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney