Ki Younger Ju, the founding father of CryptoQuant, a crypto analytics platform, predicts a extreme Bitcoin “sell-side liquidity disaster” within the subsequent six months. On this occasion, the founder thinks that not solely will costs erupt to new ranges, surpassing expectations, however the disaster will seemingly result in a market disruption.

Bitcoin Data New All-Time Highs

Bitcoin is buying and selling at round new all-time highs following sharp worth features on March 11. The coin roared to print new all-time highs of $72,800 earlier than cooling off to identify ranges.

Though the upside momentum has waned as costs transfer horizontally when writing, the uptrend stays. Accordingly, extra merchants count on BTC to ease above yesterday’s highs as bulls goal seven digits at $100,000. If bulls break above this psychological quantity, technical and elementary analysts say will probably be an important inflection level for Bitcoin.

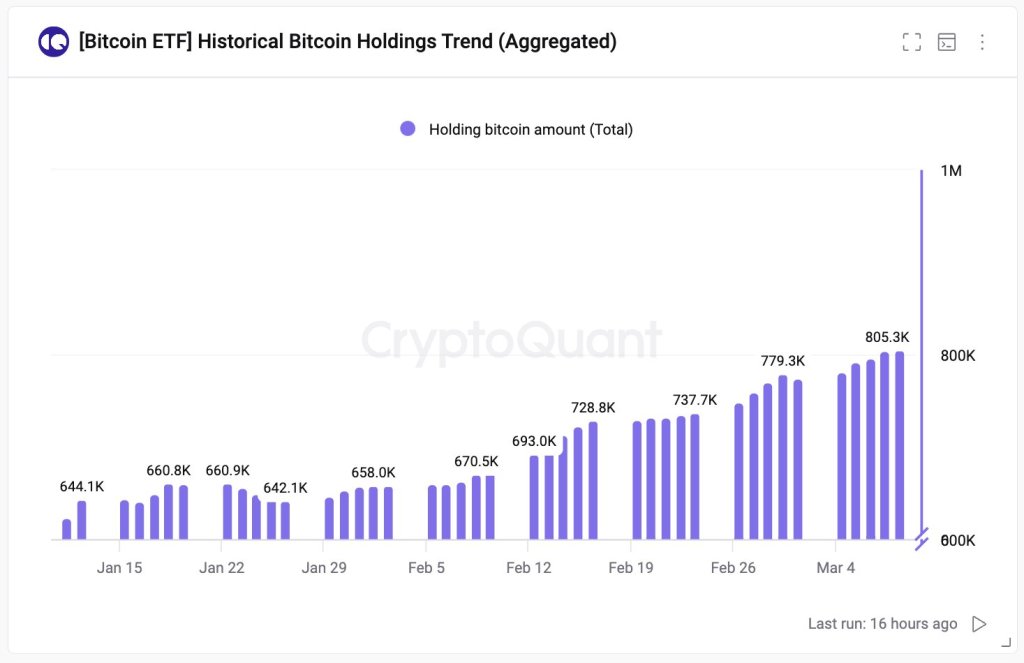

The founder expects Bitcoin costs to blow up within the subsequent six months primarily due to two components. The primary, Ju notes, is the large inflow of demand from establishments by way of spot Bitcoin exchange-traded funds (ETFs). Up to now, analysts have linked the present upswing in Bitcoin to institutional demand.

Final week, Ju noticed a internet influx of over 30,000 BTC. Which means that establishments are taking away extra cash from circulation at an unprecedented stage, contributing to shortage. Establishments and rich people can achieve publicity to BTC by means of spot ETFs with out essentially proudly owning it straight.

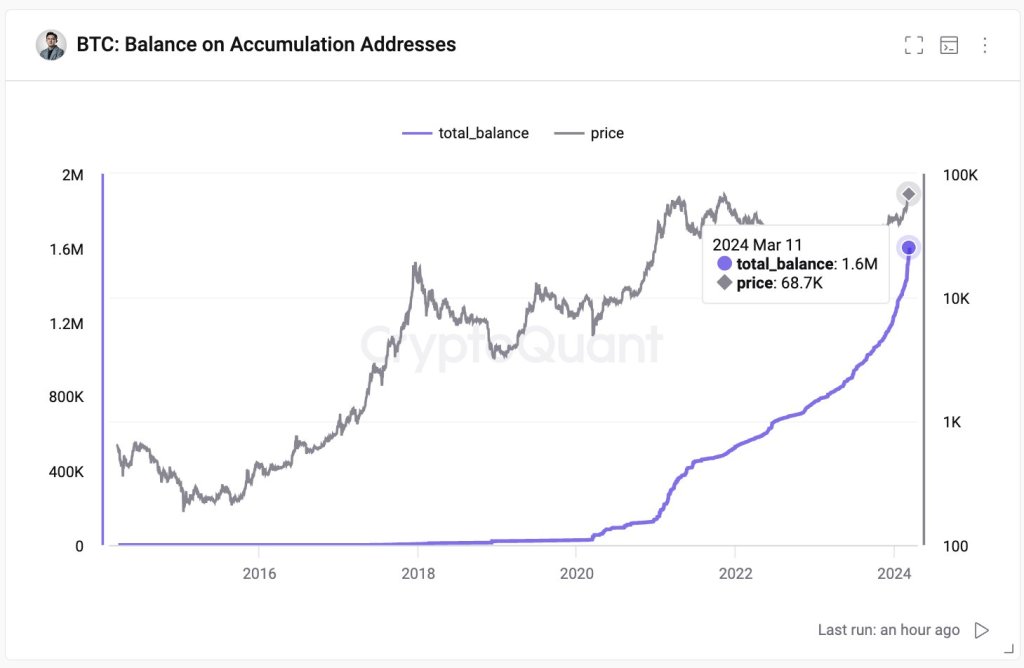

Past this, the priority lies within the restricted variety of cash held throughout centralized exchanges and recognized entities, particularly miners. The founder estimates that exchanges and miners personal roughly 3 million BTC. Ju explains within the publish that entities in america maintain 1.5 million BTC.

BTC Shortage Disaster Anticipated

The founder notes that rising demand from spot ETFs and a constrained provide will create a “sell-side liquidity disaster” inside six months. This state of affairs might result in a state of affairs the place there aren’t sufficient sellers to satisfy the excessive purchaser demand, additional lifting costs to contemporary ranges.

The Bitcoin community will slash miner rewards by half in April from the present 6.125 BTC. Due to this, BTC’s emissions will drop, that means solely small quantities of cash will likely be launched into circulation, additional worsening the state of affairs.

As such, if the present stage of demand stays and establishments proceed to double down, the anticipated shortage disaster could seemingly trigger a serious disruption available in the market, benefiting coin holders.

Function picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.