Wyckoff Evaluation (WA) goals to know why costs of shares and different market objects transfer because of provide and demand dynamics. It usually is utilized to any freely traded market the place bigger or institutional merchants function (commodities, bonds, currencies, and many others.). On this article we are going to apply WA to the cryptocurrency Cosmos ($ATOM) to make a forecast for approximate future occasions.

Cosmos Worth Information from MEXC Futures | Supply: ATOMUSDT.P on tradingview.com.

Hyperlink to the uncooked picture: https://www.tradingview.com/x/r8asKWOI

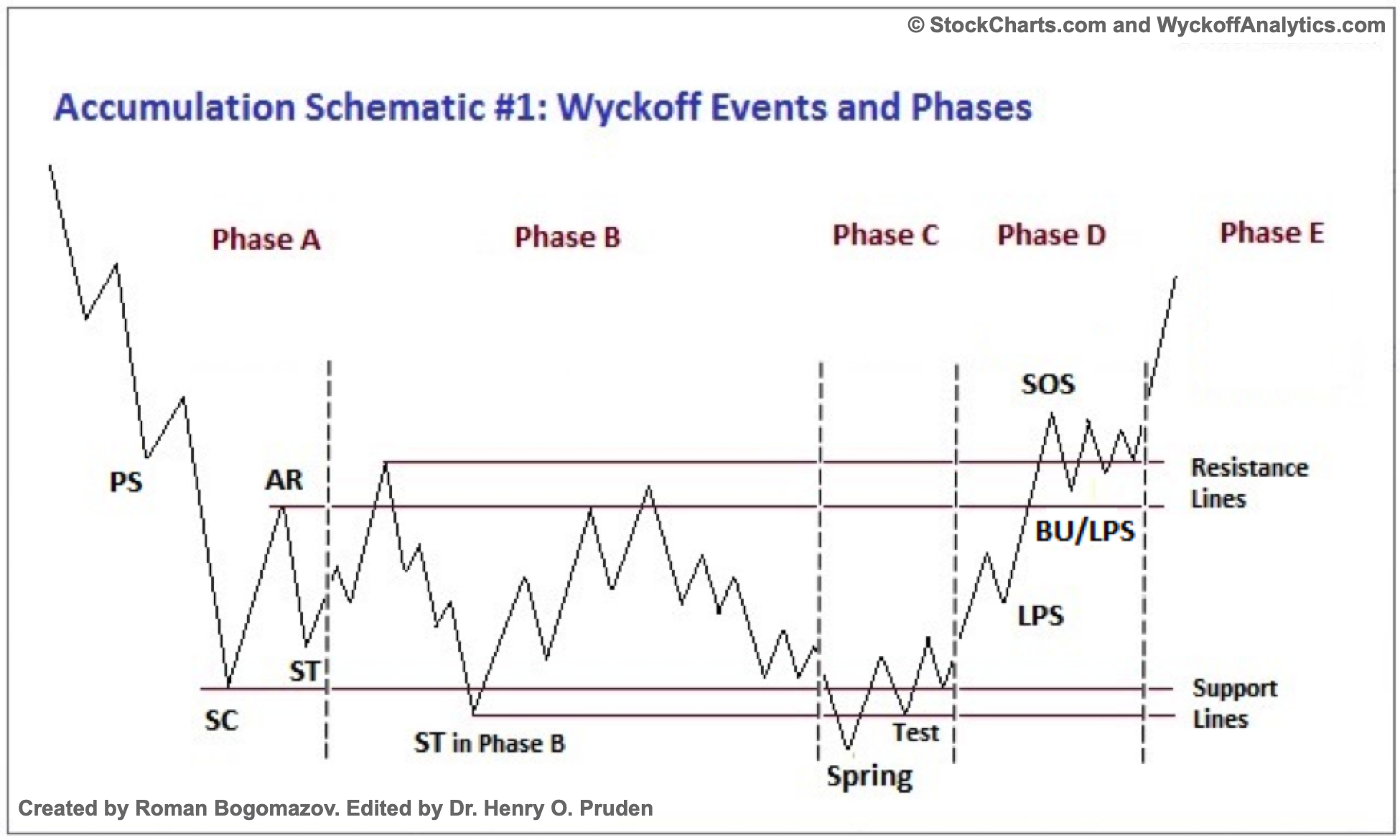

Cosmos $ATOM is at present in Section D of a Wyckoff Accumulation Schematic #1. Be aware the amount spike close to the place I positioned the SC and Spring. In Wyckoff Evaluation these usually should align even when the general kind isn’t excellent. The one slight anomaly is that the ST dips sharply under the SC breaking the ICE (not labeled). There are Superior Schematics that you could find on-line that accommodate many of those anomalous formations.

Section D is the place demand vastly overcomes provide main the rallies on larger (or noticeably growing) quantity. When an LPS happens that’s usually a good (even optimum) place for a protracted place. It not too long ago completed a Reaccumulation, to which it’s rallying sharply. Beneath are the everyday schematics for each Wyckoff Accumulation Schematic #1 and a Reaccumulation for reference.

Wyckoff Accumulation Schematic #1 | Supply: StockCharts.com

Wyckoff Reaccumulation Schematic | Supply: StockCharts.com

Cosmos Worth Targets

The fundamental goal (per the schematic) is the highest of the buying and selling vary. On this case it’s at $18, however $15 is a preliminary goal it should concretely clear first. Performing some extra work utilizing the Horizontal Depend technique with PnF charts yields completely different outcomes. My settings are at present a $0.25 field measurement and a 3 field reversal on a Excessive-Low lookback.

When utilizing the Horizontal Depend technique Prolonged Congestions must be accounted for in a different way. The primary factor is discovering the related column out and in to create the Congestion Field. In our case that’s from 13 to twenty December 2023 spanning 7 bars. Since it is a Reaccumulation “breakout” we might want to add the worth from the components the Horizontal Depend makes use of.

7 x $0.25 x 3 = $5.25

The related low so as to add this to is $10.25 so the PnF goal is $15.5.

Glossary

All quotes are from the primary hyperlink in Supplemental Studying.

Preliminary Help (PS) – “the place substantial shopping for begins to offer pronounced help after a protracted down-move”

Promoting Climax (SC) – “the purpose at which widening unfold and promoting strain normally climaxes and heavy or panicky promoting by the general public is being absorbed by bigger skilled pursuits at or close to a backside”

Computerized Rally (AR) – “happens as a result of intense promoting strain has vastly diminished”

Secondary Take a look at (ST) – when “value revisits the realm of the SC to check the provision/demand stability at these ranges”

Spring – “enable the inventory’s dominant gamers to make a definitive check of accessible provide earlier than a markup marketing campaign unfolds”

Take a look at – the place bigger merchants “check the marketplace for provide all through a TR”

Signal of Energy (SoS) – “a value advance on growing unfold and comparatively larger quantity”

Final Level of Help (LPS) – “a pullback to help that was previously resistance, on diminished unfold and quantity”

Again Up (BU) – “a typical structural ingredient previous a extra substantial value mark-up, and might tackle quite a lot of kinds, together with a easy pullback or a brand new TR at a better degree”

Supplemental Studying

“The Wyckoff Methodology: A Tutorial” by Bogomazov & Lipsett

“Reaccumulation Overview” by Bruce Fraser (2018)

“Leaping the Creek: A Overview” by Bruce Fraser (2018)

“Distribution Overview” by Bruce Fraser (2018)

“Introduction to Level & Determine Charts” from StockCharts

“P&F Worth Targets: Horizontal Counts” from StockCharts

“The Wyckoff Methodology in Depth” by Rubén Villahermosa (2019)

“Wyckoff 2.0: Buildings, Quantity Profile and Order Circulation” by Rubén Villahermosa (2021)

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site solely at your personal threat.