Liquidity throughout crypto exchanges has surged this 12 months, in accordance with the digital asset analytics agency Kaiko.

Kaiko notes in a brand new evaluation that a rise in buying and selling quantity and bettering sentiment drove that soar in liquidity, which has been significantly prevalent for Bitcoin (BTC) markets within the US.

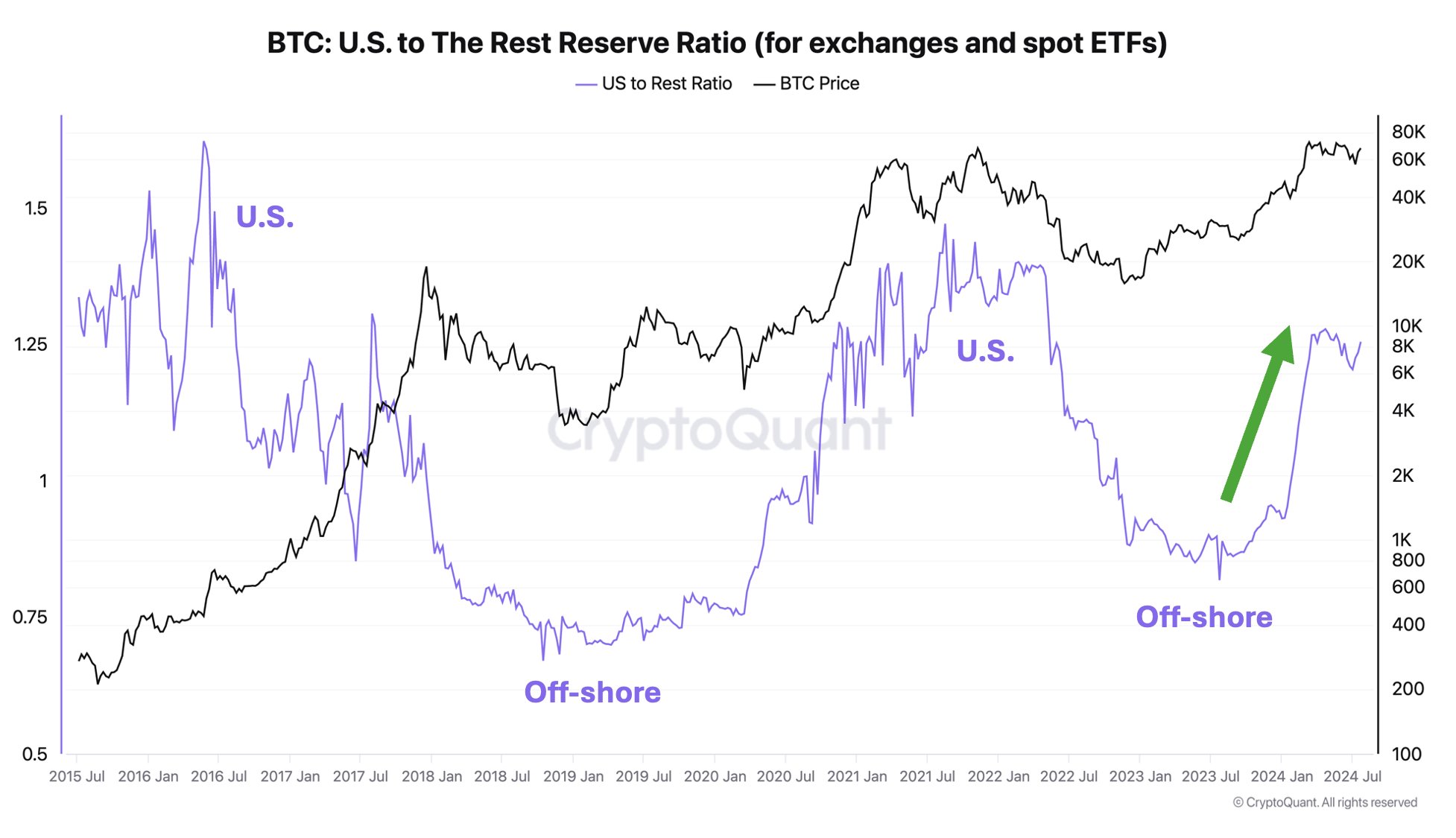

“The approval of spot BTC ETFs within the US this 12 months has possible contributed to the rise, as extra institutional companies take part out there. US exchanges now account for over 60% of BTC’s 1% market depth, up from round 45% firstly of 2023.”

The analytics agency additionally notes that Bitcoin dominance relative to altcoins has jumped on US exchanges however lowered on offshore markets.

“Traditionally, BTC dominance has been greater on US platforms because of greater institutional participation within the US, with merchants preferring BTC over riskier altcoins. Apparently, regardless of BTC’s value decline in Q2, BTC’s share on US markets continued growing, suggesting that the launch of spot ETFs may additional exacerbate this development.”

Kaiko isn’t the one agency to focus on this development: Ki Younger Ju, the chief government of the analytics platform CryptoQuant, just lately famous on the social media platform X that Bitcoin is getting into the US.

BTC is buying and selling at $66,381 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: DALLE3