CoinPayments is a cryptocurrency gateway providing crypto cost options for companies and people. As a part of our ongoing dedication to enterprise and consumer security procedures and authorized compliance, we require companies to partake in KYB (Know Your Enterprise). KYB is obligatory and ensures CoinPayments complies with monetary laws and reduces dangers to its purchasers.

KYB includes verifying the identification of enterprise entities, assessing their repute, and evaluating potential dangers. By conducting KYB checks, companies can defend themselves towards monetary losses, authorized penalties, and reputational harm.

We’ve partnered with main verification platforms, similar to SumSub and RiskScreen, that are trusted by main monetary establishments globally, to make sure information security and privateness. These platforms are absolutely compliant with GDPR and different information safety laws, making certain that your data is in protected arms.

CoinPayments makes use of KYB to make sure that companies utilizing its platform are respectable and protected. After creating an account, the verification course of could be initiated by deciding on START VERIFICATION.

There are two major KYB pathways with CoinPayments:

- New service provider path – enterprise step-by-step information

- Present accounts with energetic (60 days) and expired grace interval

Let’s dive in!

New Service provider Path – Enterprise Step-by-Step Information

Step 1

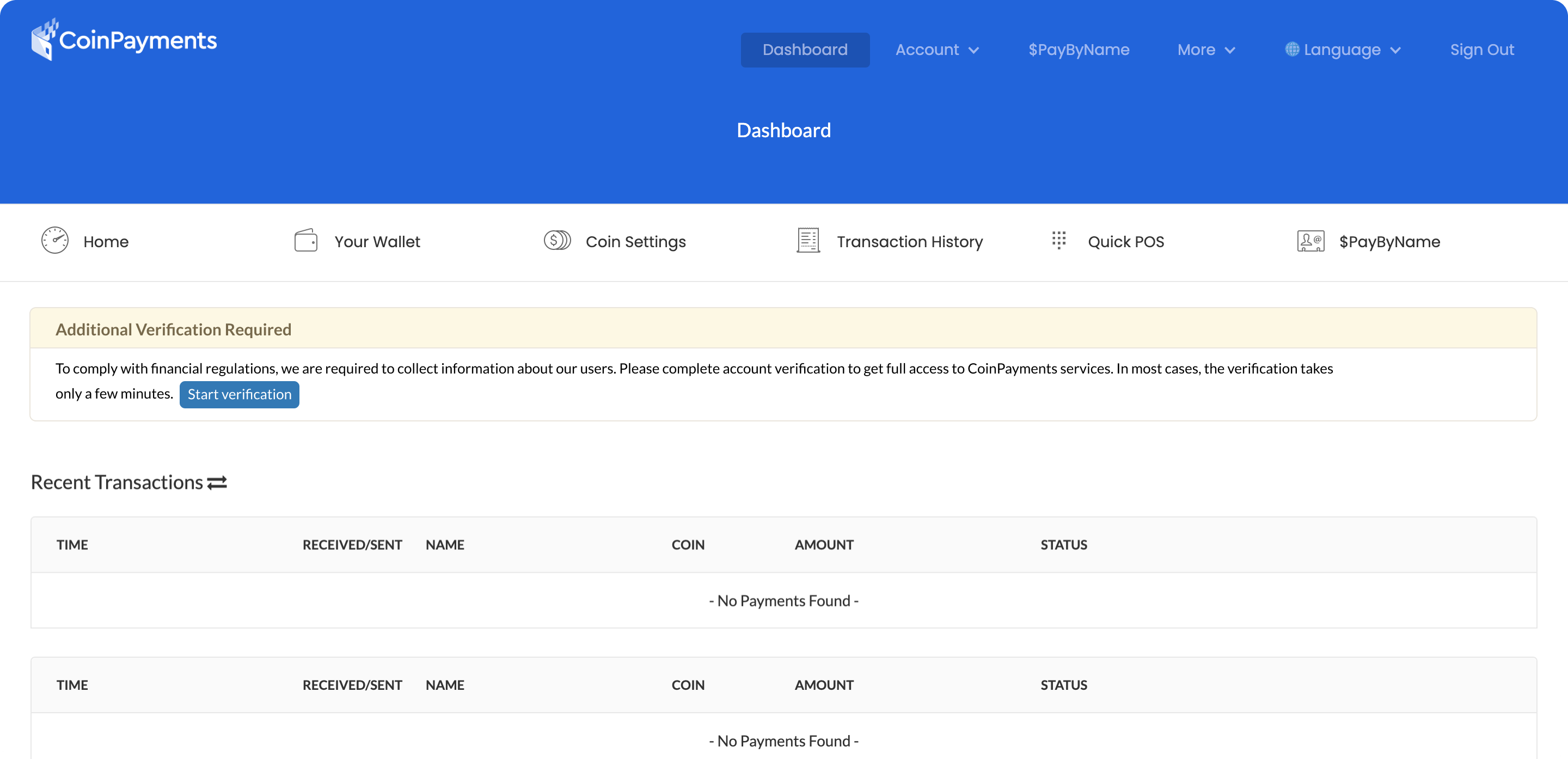

First, join a CoinPayments account and choose Begin Verification to offer the mandatory particulars.

Having created your account, the Account Verification Required immediate shall be displayed on all dashboard pages. Clicking the banner affirmation button will direct you to Step 2.

You possibly can check the cost processes utilizing the Litecoin Testnet (LTCT) digital asset. LTCT is a demo asset permitting customers to check the appliance performance. Customers can simulate withdrawals, deposits and check their APIs utilizing the asset.

Different belongings shall be unavailable till the KYC/KYB verification course of is full.

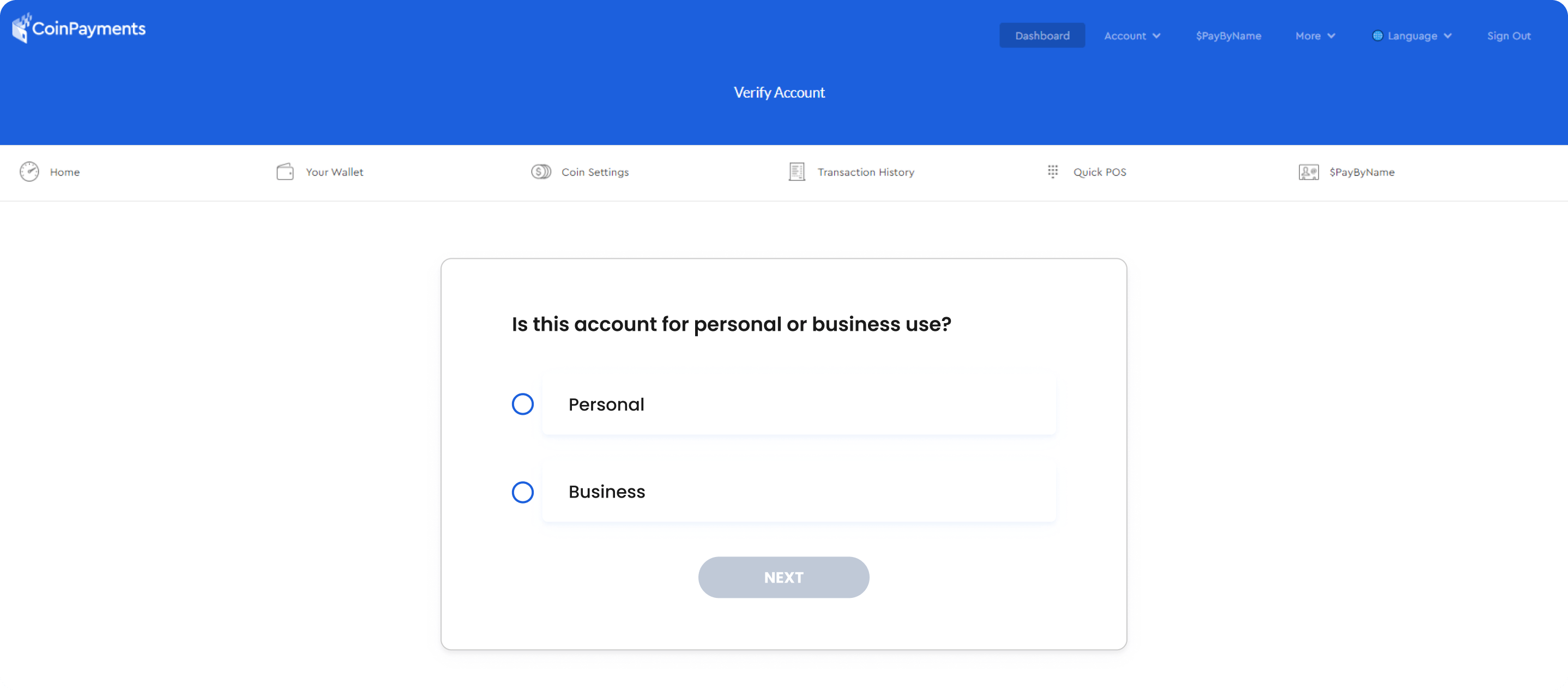

As soon as the verification is began, you will need to select between a Enterprise and a Private account.

Step 2

Select between a Private or Enterprise account.

When deciding on the Private account possibility, a affirmation immediate will seem.

The next steps are defined within the KYC weblog.

The Enterprise account registration course of is described beneath.

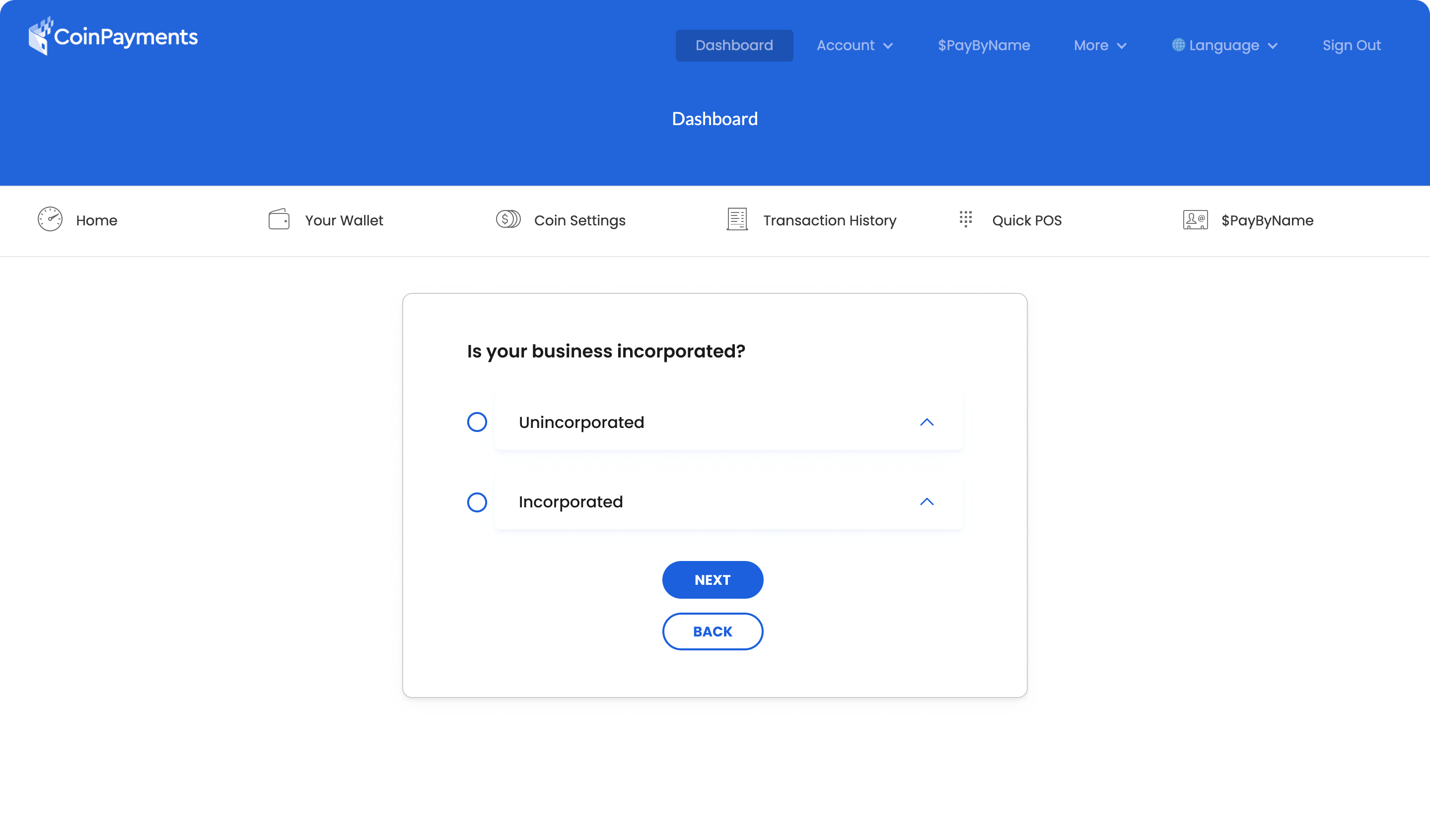

Step 3

Select what you are promoting sort (integrated or unincorporated) and full the KYB software.

One of many key distinctions between the 2 is that non-incorporated corporations are owned by people who’re personally chargeable for money owed. The verification necessities for such accounts are the identical as for Private accounts and could be discovered within the KYC weblog.

Included corporations, similar to statutory corporations, restricted corporations (public or personal), one-person corporations, partnerships, and NGOs, supply safety towards liabilities as separate authorized entities from their homeowners.

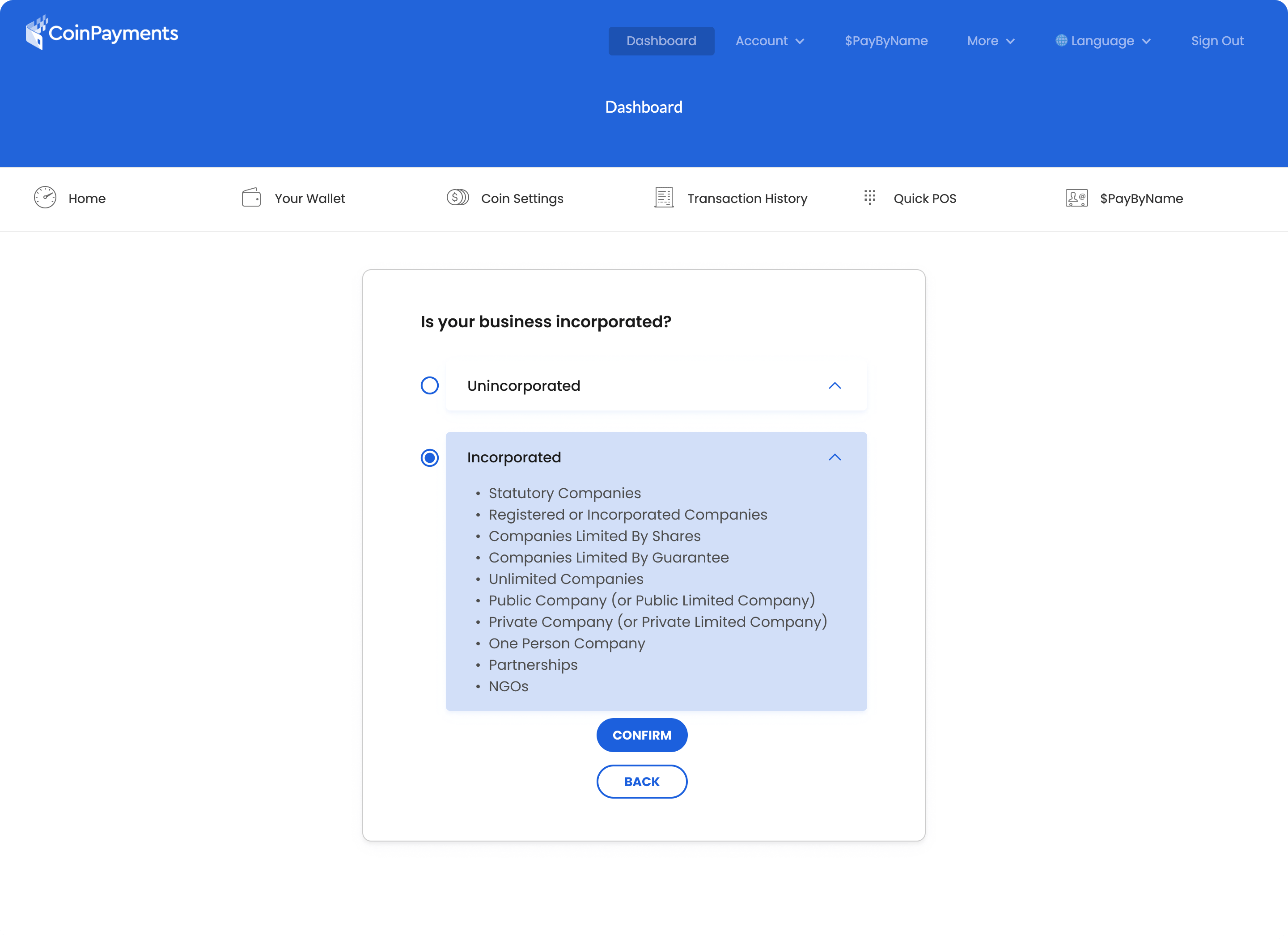

The enterprise sort choices are displayed as proven within the picture beneath:

Step 4

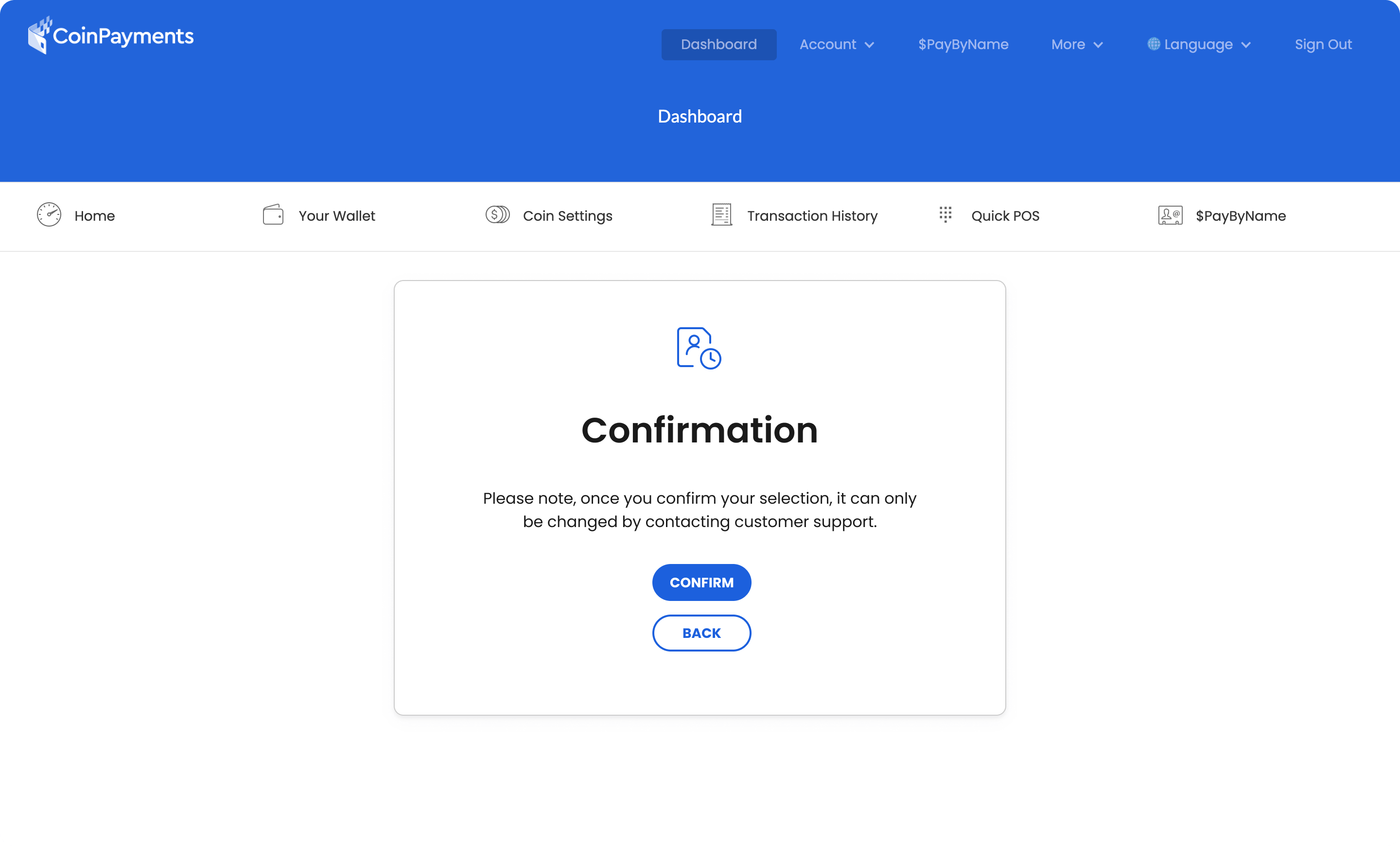

When you select the suitable possibility, a CONFIRMATION SCREEN shall be displayed as proven beneath. Solely the buyer help staff can modify your collection of the enterprise sort as soon as it’s submitted.

Step 5

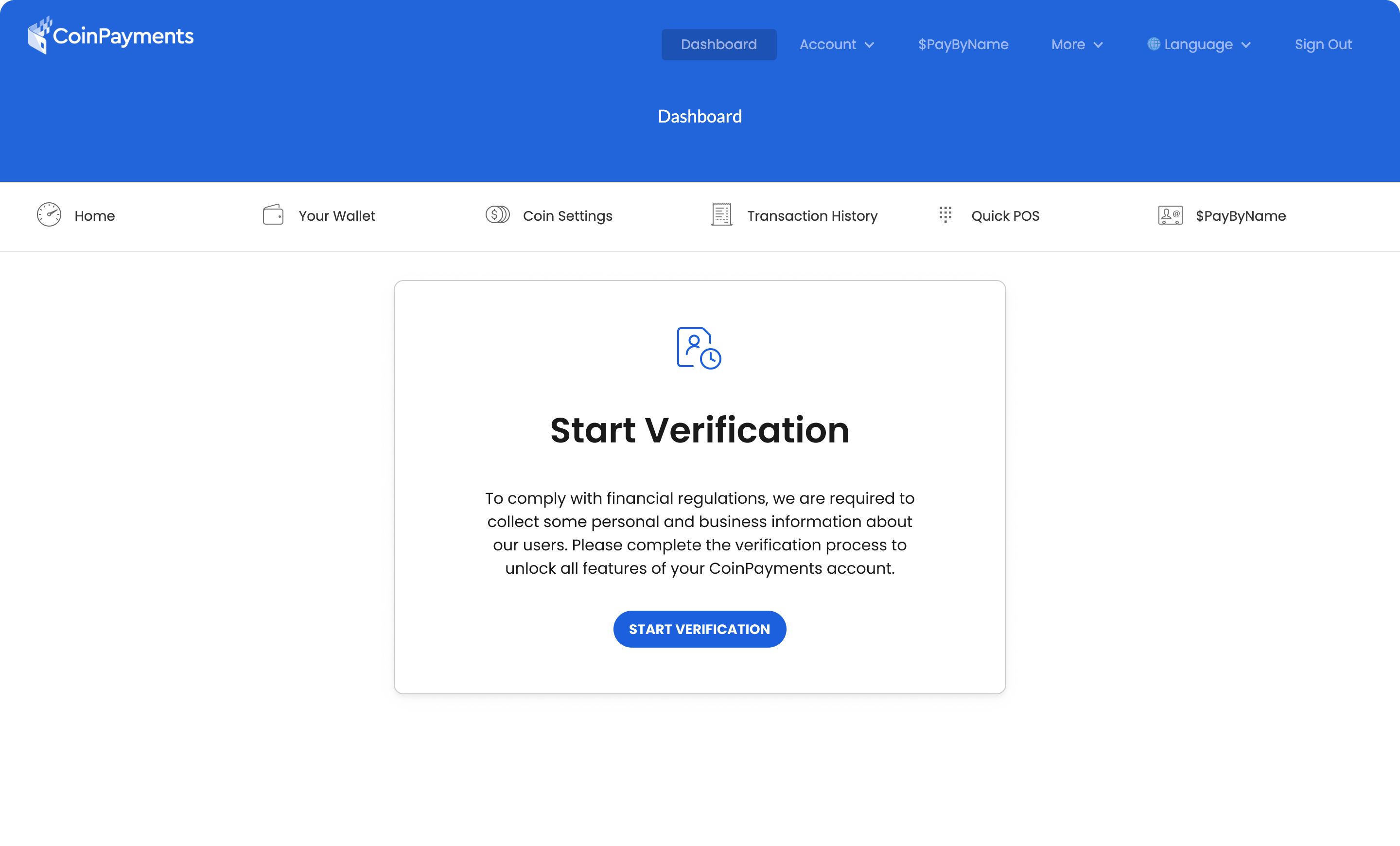

Click on “START VERIFICATION” to confirm the corporate particulars as beneath.

After selecting the suitable possibility, you’ll be redirected to our associate platforms for firm verification.

START VERIFICATION for “Non-Included” retailers will direct you to our associate (SumSubstance platform) for firm verification, equivalent to the KYC course of for private accounts.

START VERIFICATION for “Included” retailers will redirect you to our associate (RiskScreen platform) to carry out firm verification.

Watch for a novel verification code to be despatched to your e-mail.

Step 6

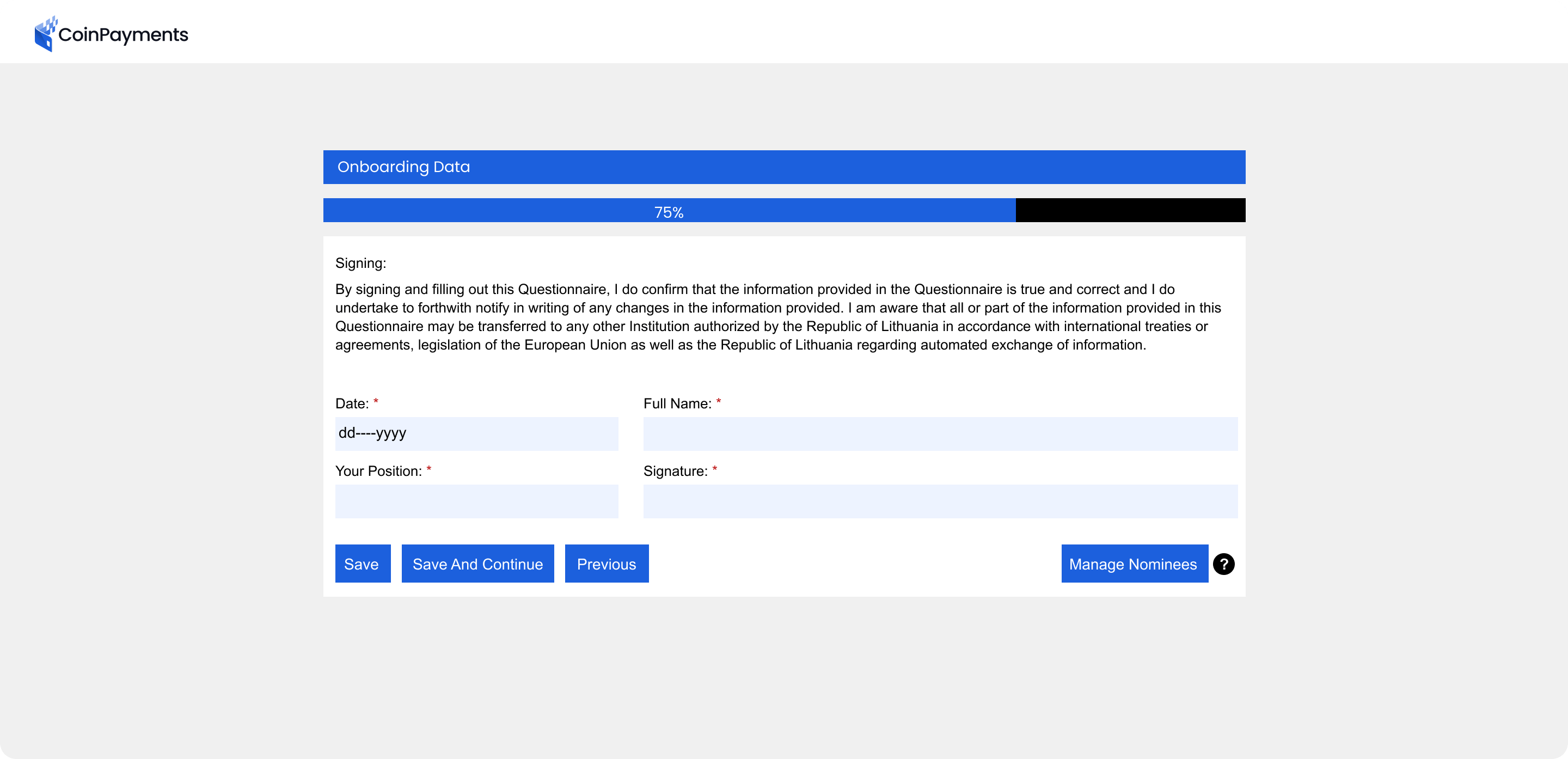

After receiving the verification code out of your registered e-mail, present the required basic, personnel, enterprise, and monetary data, together with particulars of administrators and supreme useful proprietor(s).

Disclose political publicity and full KYC steps for every Director or UBO.

Signal to verify the info submitted by your organization/staff is genuine.

Step 7

Add legitimate paperwork which can be no older than three months and in English.

For integrated retailers, the required paperwork embrace Incorporation paperwork, Article of Affiliation/Memorandum of Affiliation and Extract from Commerce Registry.

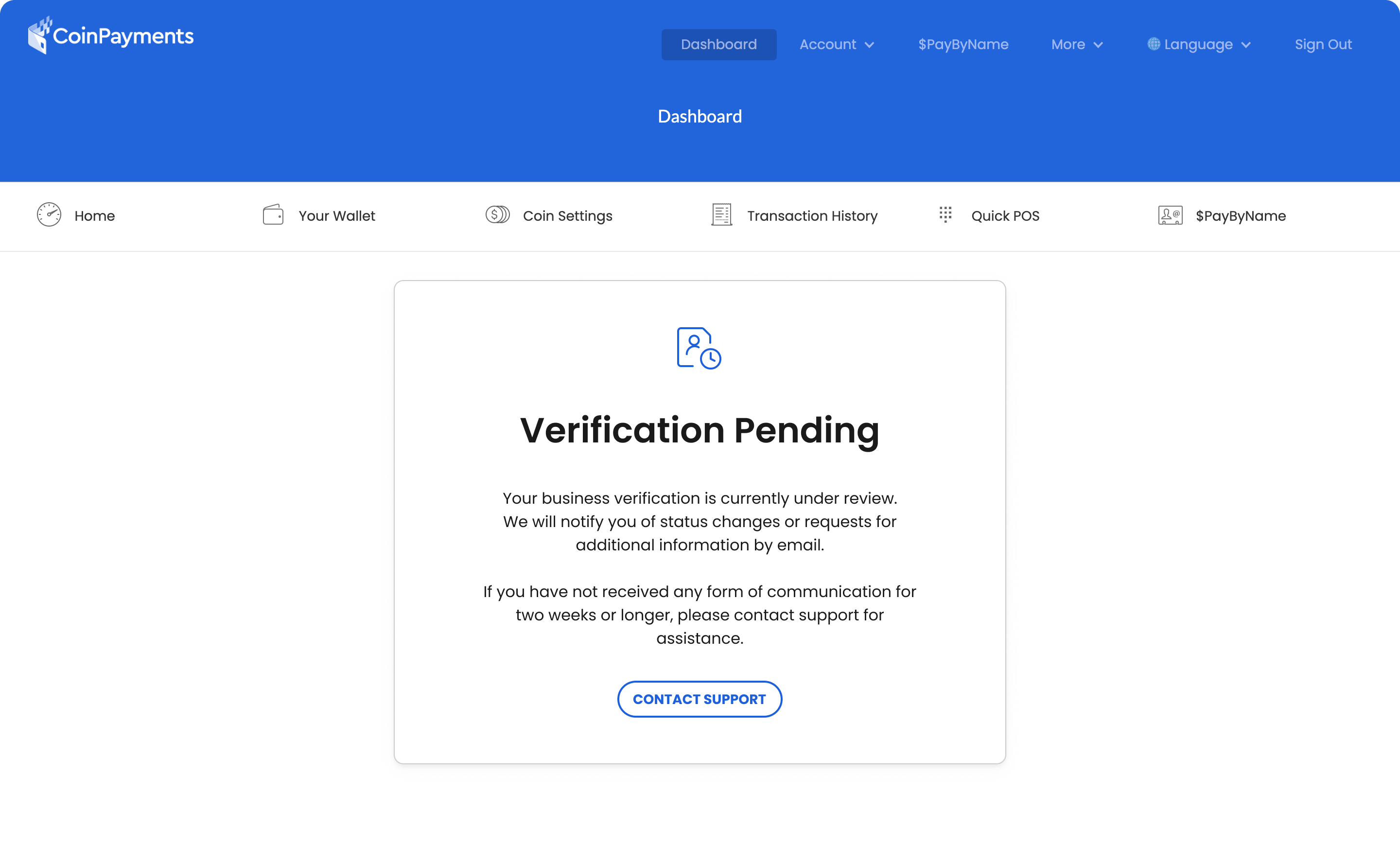

Your KYB software enters a processing interval that will last as long as 5 days. Throughout this era, the corporate’s data shall be reviewed, and a response shall be given to you.

Whereas ready for affirmation, you may check the performance of the appliance utilizing the Litecoin Testnet (LTCT) demo asset, as outlined above.

After profitable verification, you’ll obtain an e-mail notification confirming you’ve got full entry to all supported CoinPayments cryptocurrencies and options.

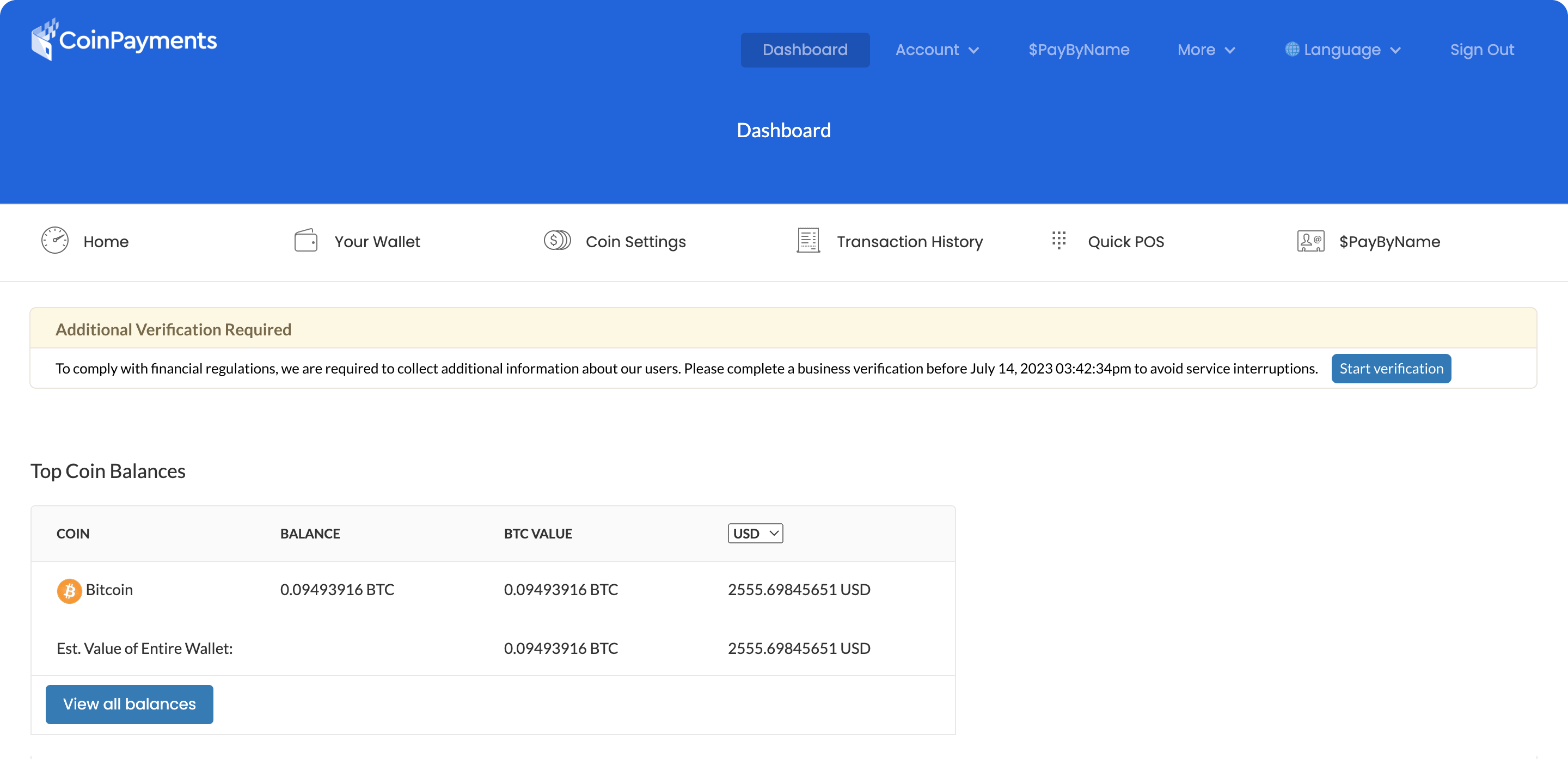

Present Accounts with Lively (60 days) or Expired Interval

All options stay obtainable for present CoinPayments customers with energetic grace intervals till the grace interval ends.

Listed here are the steps to observe to finish your KYB verification:

Step 1

Observe steps 2 by way of 10 described in New Service provider Path – Enterprise Step-by-Step Information.

For private and unincorporated accounts with accomplished identification verification, the beforehand supplied data shall be routinely carried over. Subsequently, minimal extra verification (or none) shall be mandatory.

Step 2

Throughout this service provider evaluate course of, all account options stay obtainable till the tip of the grace interval.

Step 3

- Verify your e-mail for directions on how you can proceed. You’ll obtain a notification on verification approval, lacking paperwork or different application-related data.

- . All relevant members of the enterprise will obtain an e-mail invitation to finish their identification verification. Guarantee every director and supreme useful proprietor (UBO) of the corporate passes the KYC course of. KYC, or Know Your Buyer, is a course of for consumer identification verification. KYC includes accumulating and verifying private data and documentation to make sure compliance with anti-money laundering and counter-terrorism financing laws.

In case you’d like to know the KYC course of and how you can confirm your self right here at CoinPayments, please click on right here to learn our educational information.

- We’ll evaluate your submission and ship an e-mail as soon as it’s authorised. If a submission is rejected, it’s not the tip, as you may resubmit your software in conditions when the rejection foundation was a defective add or unsupported doc sort. Our help staff shall be comfortable to information you in case you want help with recurring points.

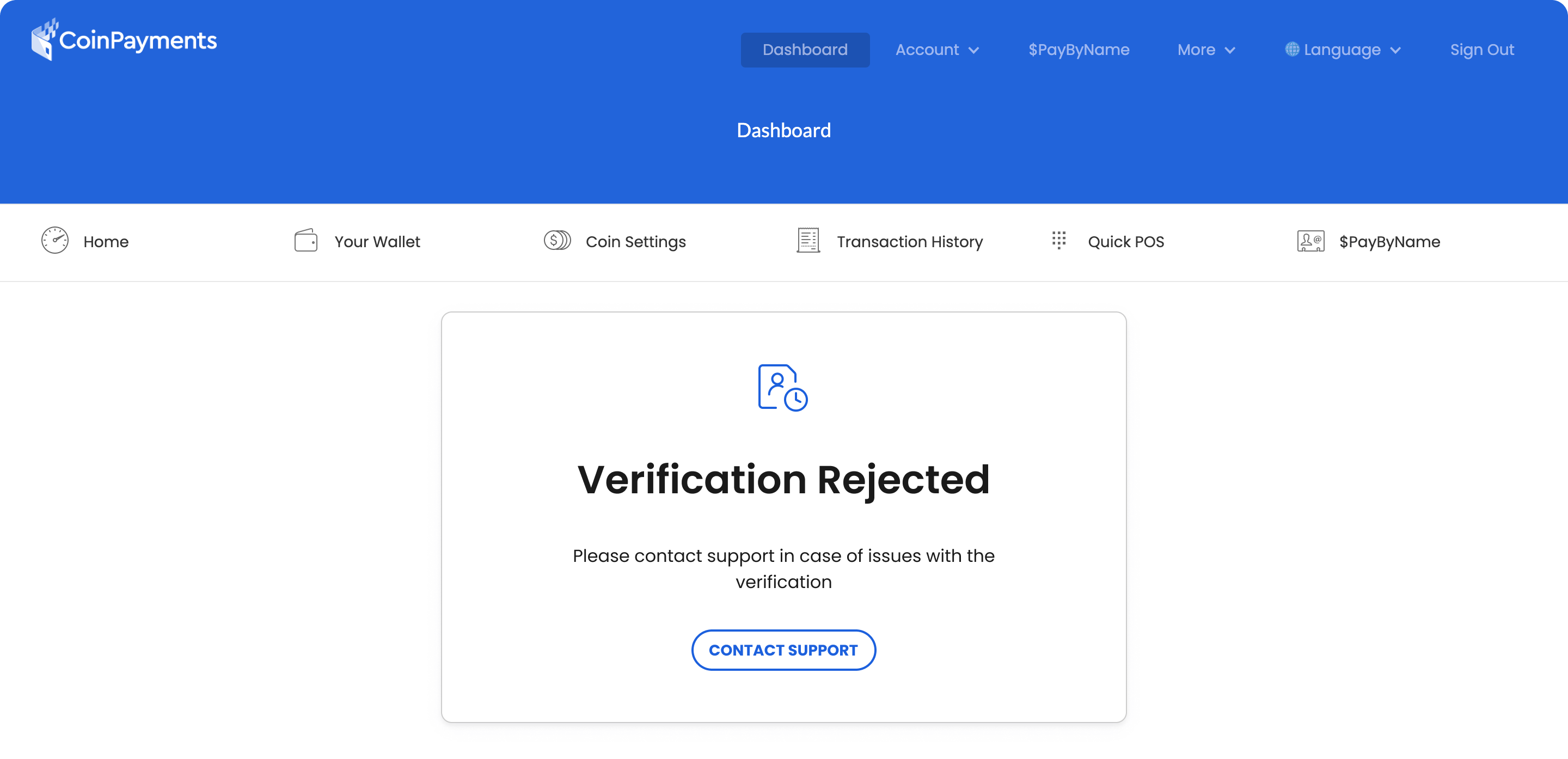

- As soon as our compliance staff approves the appliance, all account options turn into accessible. You’ll be notified if the appliance will get rejected.

- In case you lose entry to CoinPayments providers, observe the identical information to confirm your account.

You probably have any questions or issues in the course of the verification course of, please contact the CoinPayments’ help staff for help.

Step 4

As soon as our Compliance staff approves the appliance, all account options turn into accessible ✅

If the account is Rejected, the next banner shall be displayed:

In case you fall into the class of customers who’ve an present enterprise account with out KYB verification and have misplaced entry to our providers, observe the directions for brand new retailers.

Upon completion of the steps outlined on this information, what you are promoting will full its KYB verification and luxuriate in full entry to all CoinPayments’ options.