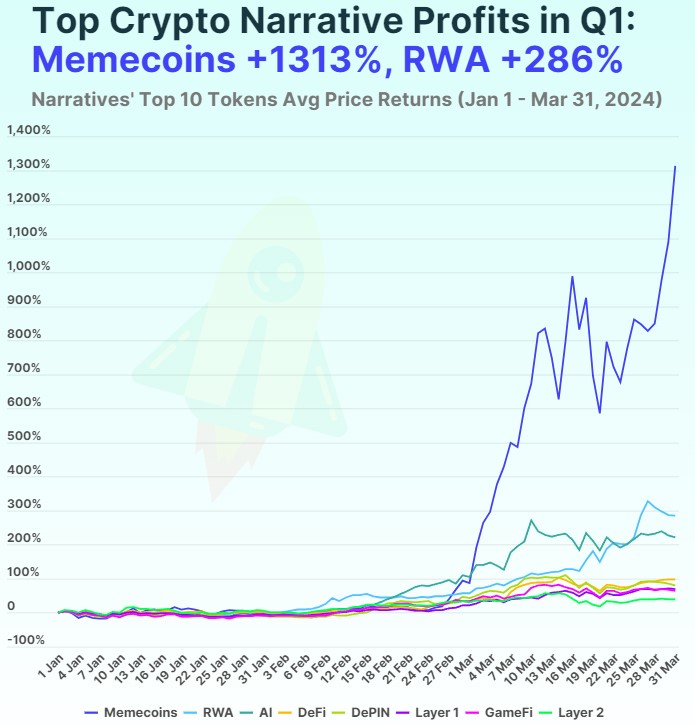

Within the first quarter of 2024 (Q1), memecoins emerged as essentially the most worthwhile crypto narrative, delivering huge common returns of 1312.6% throughout its high tokens, in line with a current research and report carried out by CoinGecko.

This determine far surpassed the returns of different narratives, highlighting the rising reputation and frenzy surrounding memecoins within the cryptocurrency market.

RWA Vs Memecoins

Three newly launched tokens have been among the many high 10 memecoins by market cap on the finish of the quarter: Brett (BRETT), BOOK OF MEME (BOME) and Cat in a canine world (MEW).

BRETT generated the very best returns since its launch with a acquire of 7727.6%, carefully adopted by dogwifhat (WIF) with a acquire of 2721.2% in the course of the quarter. Notably, the memecoin narrative outperformed different crypto narratives by a big margin.

In comparison with the second most worthwhile narrative, RWA, memecoins have been 4.6 instances extra worthwhile, and their returns have been 33.3 instances increased than these of the Layer 2 narrative, which skilled the bottom features in Q1.

The RWA narrative, which stands for “Actual-World Property“, returned 285.6% in Q1. Though it briefly held the title of essentially the most worthwhile narrative in early February, memecoins and synthetic intelligence-based (AI) tokens outperformed RWA when it comes to returns. Nonetheless, RWA managed to regain its place forward of the AI narrative by the tip of March.

Notable winners within the RWA class included MANTRA (OM) and TokenFi (TOKEN), which posted quarter-to-date (QTD) returns of 1074.4% and 419.7% respectively. XDC Community (XDC) was the one RWA token to say no, falling 15.6% for the quarter.

Synthetic intelligence carefully adopted RWA as the one different narrative to ship three-digit returns, reaching 222.0% in Q1. All large-cap AI tokens skilled features, with AIOZ Community (AIOZ) main the pack at 480.2% and Fetch.ai (FET) following carefully at 378.3%.

Even the bottom gainer within the AI class, OriginTrail (TRAC), returned a decent 74.9% in the course of the quarter, indicating the general curiosity in AI-related tokens.

Layer 1 Tokens Path Behind

The decentralized finance (DeFi) narrative delivered reasonable returns of 98.9% within the first quarter. In late February, DeFi returns have been boosted by the Uniswap (UNI) charge swap proposal. DeFi tokens that carried out properly included Jupiter (JUP) with features of 125.7%, Maker (MKR) with 121.2%, and The Graph (GRT) with 111.0% QTD.

In distinction, the Layer 1 (L1) narrative delivered comparatively decrease profitability with 70.0% returns in Q1 2024. Whereas Solana (SOL) garnered consideration as a preferred memecoin chain, the top-performing massive L1 cryptocurrencies have been Toncoin (TON) and Bitcoin Money (BCH) with features of 131.2% and 130.5%, respectively.

Bitcoin (BTC) achieved a 65.1% acquire, reaching new all-time highs, whereas Ethereum (ETH) posted a extra modest 53.9% improve, regardless of the anticipation surrounding US spot Ethereum ETF purposes.

Layer 2 (L2) emerged because the least worthwhile crypto narrative in Q1, with a comparatively decrease acquire of 39.5%. Established Ethereum L2 options underperformed, with Arbitrum (ARB) returning 5.6%, Polygon (MATIC) seeing a 1.2% acquire, and Optimism (OP) closing the quarter with a slight decline of 1.2%. Nonetheless, Stacks (STX) and Mantle (MNT) recorded comparatively sturdy returns of 142.5% and 95.8% QTD, respectively.

As of this writing, Dogecoin (DOGE), the biggest memecoin by market capitalization, is buying and selling at $0.1745. Over the previous 24 hours, it has skilled a value correction of practically 7%. Within the final month, Dogecoin has proven restricted bullish momentum, with a marginal acquire of solely 0.7% throughout this time interval.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site totally at your individual danger.