Fast Take

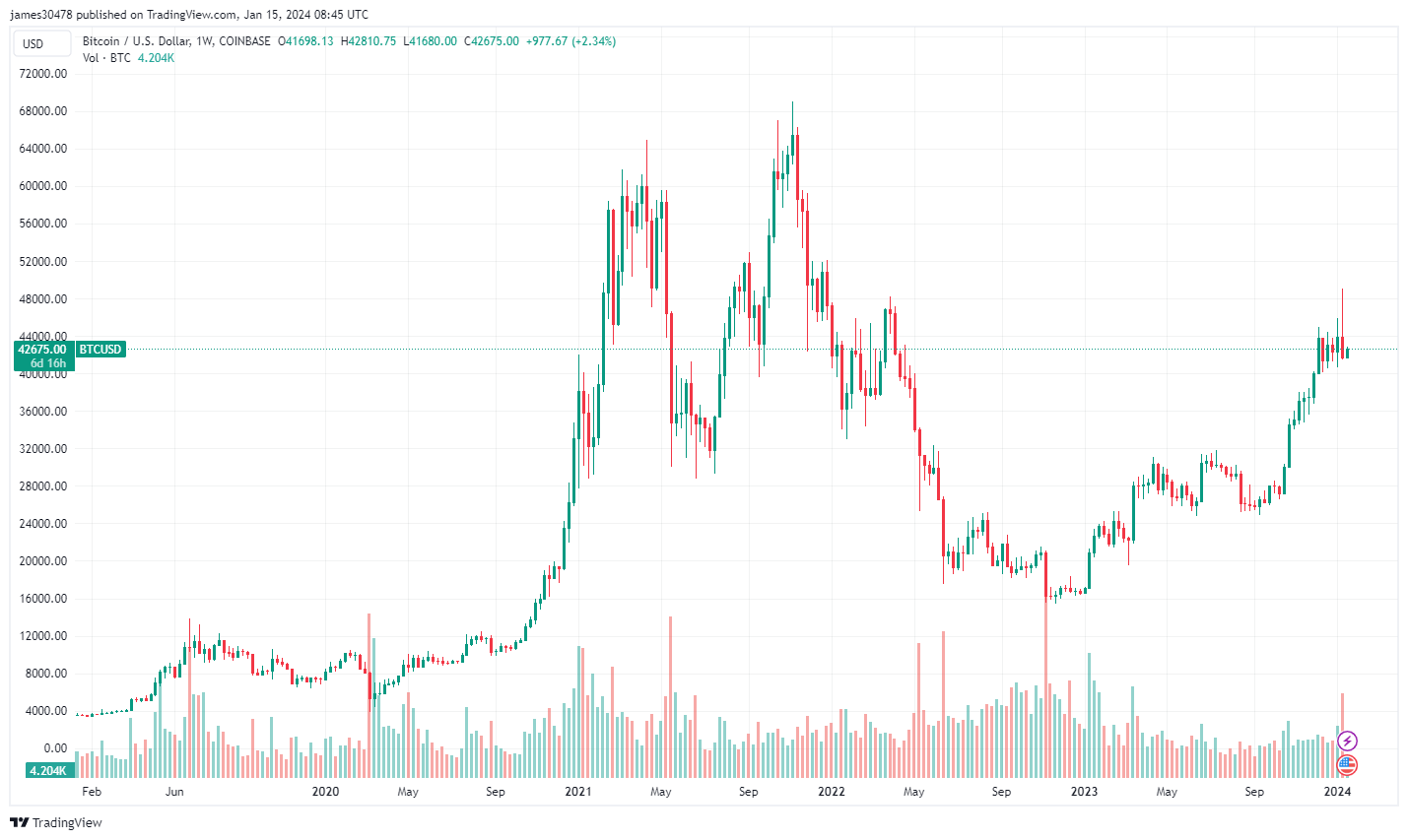

The current retracement of Bitcoin from a neighborhood prime of $49,100 to a low of $41,600, a drop of roughly 16%, has revealed notable market dynamics.

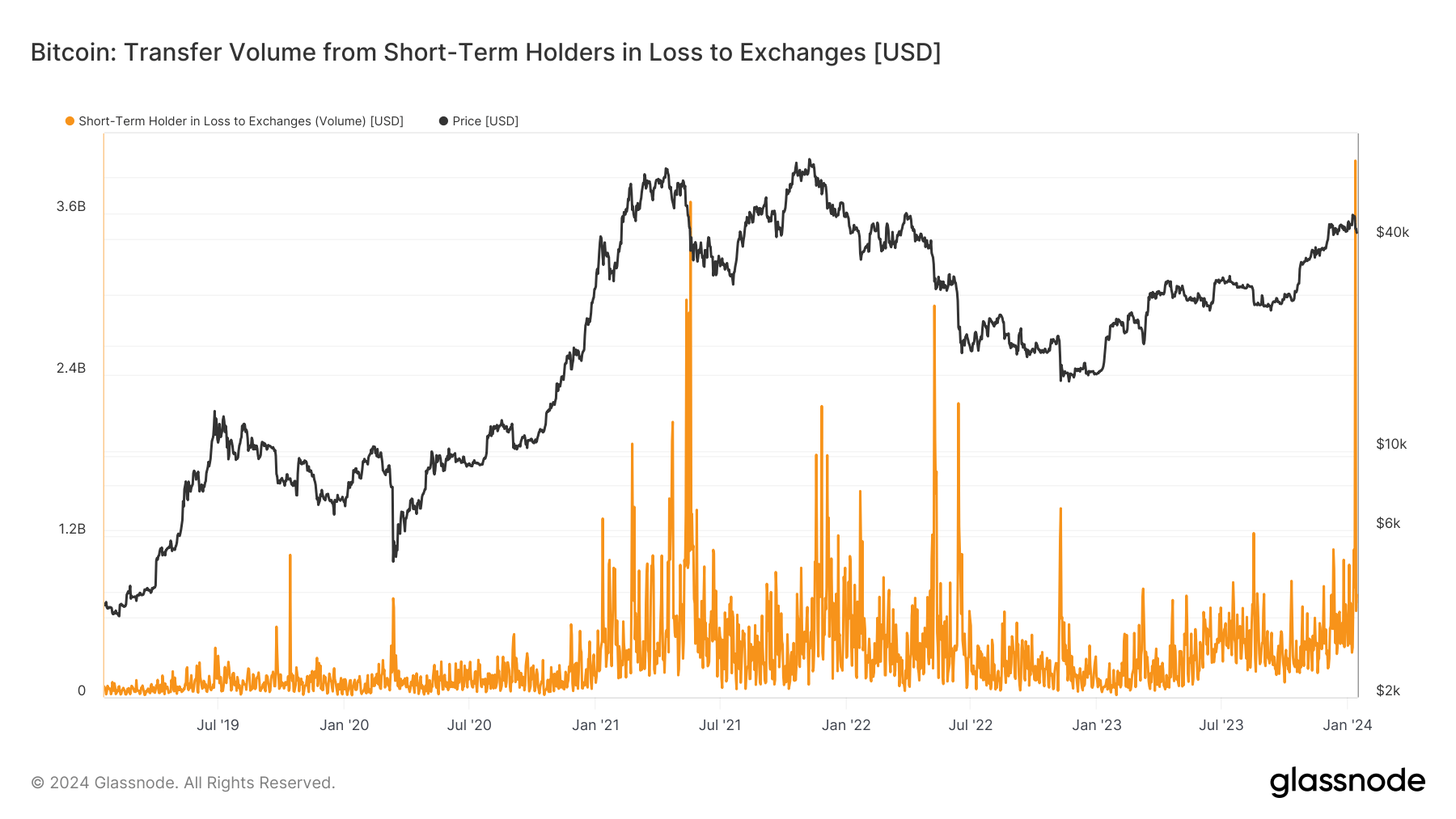

Patterns of capitulation look like rising, with the most important Bitcoin switch to exchanges at a loss from short-term holders – those that have held Bitcoin for lower than 155 days – occurring on Jan. 12.

On Jan. 12, CryptoSlate reported a record-breaking quantity of Bitcoin, equating to $2.271 billion in revenue, being despatched to exchanges by these short-term holders. Nevertheless, as Bitcoin’s worth plummeted on Friday, there was a big shift, with a record-breaking short-term holder loss to exchanges of $4 billion, signaling a possible market sentiment shift.

Including to this narrative, Coinbase’s BTCUSD pair, on the weekly timeframe, recorded its highest promoting quantity since November 2022, through the FTX collapse.

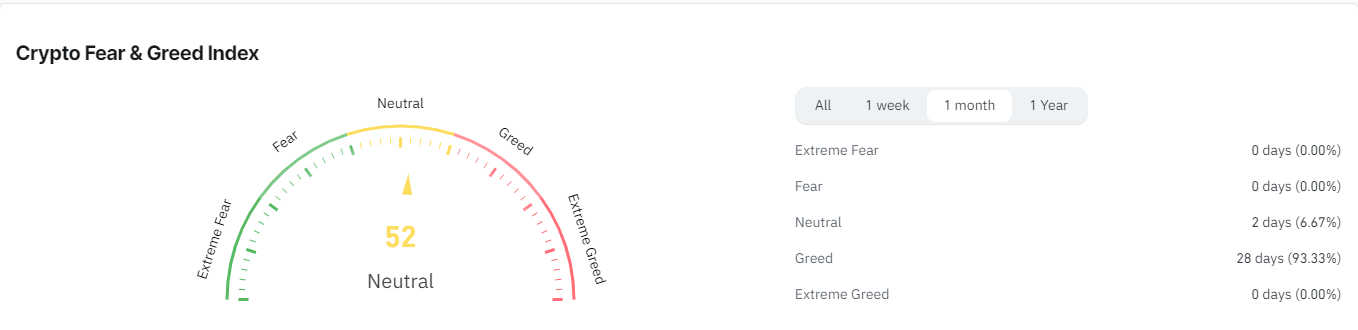

These components, mixed with the crypto concern and greed index returning to impartial after 28 days in greed out of the previous 30, underscore the digital property market’s extremely risky and unpredictable nature.

The submit Coinbase sees highest BTC promoting quantity since FTX collapse as Bitcoin drops appeared first on CryptoSlate.