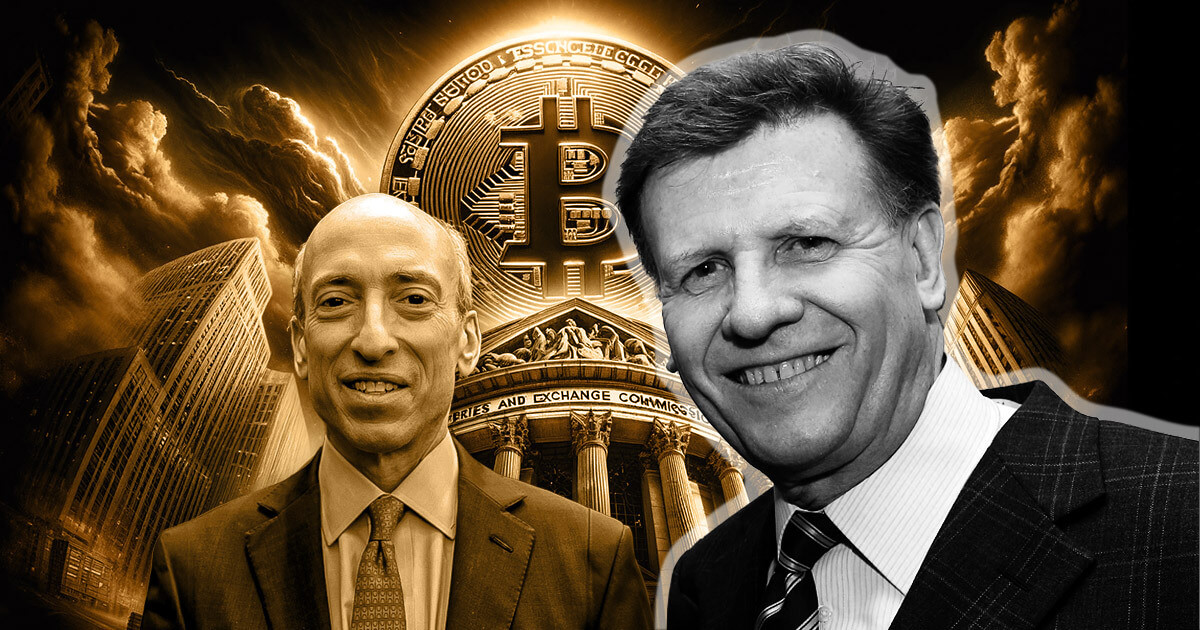

Information anchor Joe Kernen defended Bitcoin in a spirited trade with SEC Chair Gary Gensler throughout an interview on CNBC’s “Squawk Field” on Feb. 14 after the regulator questioned the flagship crypto’s decentralized nature.

The dialog, which veered right into a wide-ranging dialogue about crypto, investor safety, and the current approval of spot Bitcoin ETFs, highlighted differing viewpoints on the digital asset’s function within the monetary market.

“Not that decentralized”

Gensler’s remarks forged a shadow over the often-celebrated decentralized side of Bitcoin. He stated:

“It’s not that decentralized, Joe.”

The SEC Chair argued that as a result of there are solely a handful of exchanges the place Bitcoin might be traded implies that it’s not as decentralized as folks assume. He has additionally beforehand known as spot Bitcoin ETFs “ironic” as a consequence of their centralized nature.

Gensler additional acknowledged that solely the “accounting ledger” underpinning crypto was decentralized. These assertions sparked a robust rebuttal from Kernen, who championed Bitcoin’s decentralized ledger as a foundational characteristic that bolsters its integrity and enchantment amongst buyers.

Kernen added:

“It’s in a ledger that everybody has… that may’t be double-counted. It’s nearly immutable, and that’s why folks assume it has an inherent worth.”

Kernen additional questioned why somebody who had taught about Bitcoin at MIT would take such a detrimental stance towards crypto.

“Benefit Impartial”

In the course of the interview, Gensler emphasised the SEC’s merit-neutral stance on cryptocurrencies, indicating that the approval of Bitcoin ETFs was not an endorsement of Bitcoin itself however a transfer to permit for its buying and selling inside regulated exchange-traded merchandise (ETPs).

He highlighted the significance of investor safety and compliance with securities legal guidelines, stating that whatever the funding’s nature, corporations should present full, truthful, and truthful disclosures to the general public.

Kernen pushed again on Gensler’s cautious method to Bitcoin, suggesting that the SEC’s stance appeared lower than impartial and extra hesitant. He emphasised that the recognition and extensive adoption of Bitcoin amongst buyers was proof of its legitimacy and worth past being a mere speculative asset.

Illicit monetary exercise

The dialogue additionally touched on issues about fraud and manipulation inside the crypto house, the speculative nature of crypto investments, and the function of centralization in finance.

Gensler identified the dangers related to investments in cryptocurrencies and confused the significance of regulatory frameworks to guard buyers from fraud and manipulation.

Nonetheless, Kernen was fast to level out that crypto solely made up a fraction of the proportion of illicit monetary flows across the globe in comparison with the US greenback.

Genlers stated in response that Bitcoin was the “token of selection” for ransomware.