USDC, Boston-based funds agency Circle’s flagship product, is at present seeing probably the most demand out of all regulated stablecoins, says crypto intelligence agency Kaiko.

In a brand new report, Kaiko says that following Circle’s announcement that its USDC and EURC merchandise would now be compliant with European Markets in Crypto-assets Regulation (MiCA), each stablecoins have seen robust will increase in quantity.

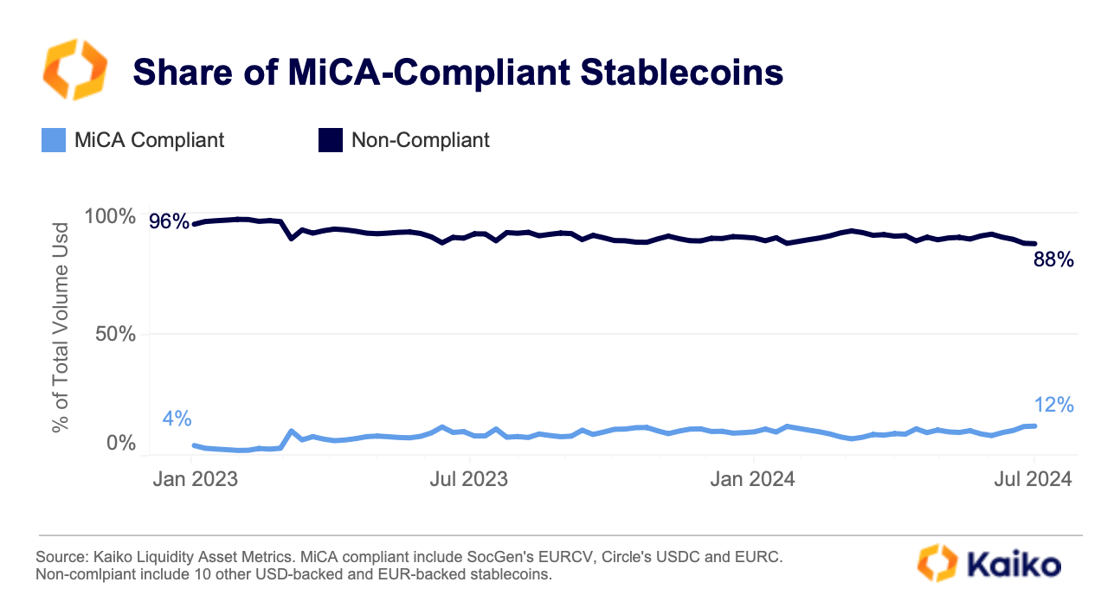

Whereas “non-compliant” stablecoins nonetheless rule the markets, Kaiko says that over the past yr, regulated merchandise have seen a rise in quantity, presumably on account of an urge for food for transparency.

“At present, non-compliant stablecoins dominate the market, accounting for 88% of the whole stablecoin quantity. MiCA might shift this stability as exchanges and market makers favor compliant stablecoins over non-compliant options. Main crypto exchanges like Binance, Bitstamp, Kraken, and OKX have already carried out restrictions, delisting non-compliant stablecoins for his or her European clients.

Alternatively, the share of compliant stablecoins has elevated over the previous yr, suggesting elevated demand for transparency and controlled options. To this point, this development has principally benefited USDC.”

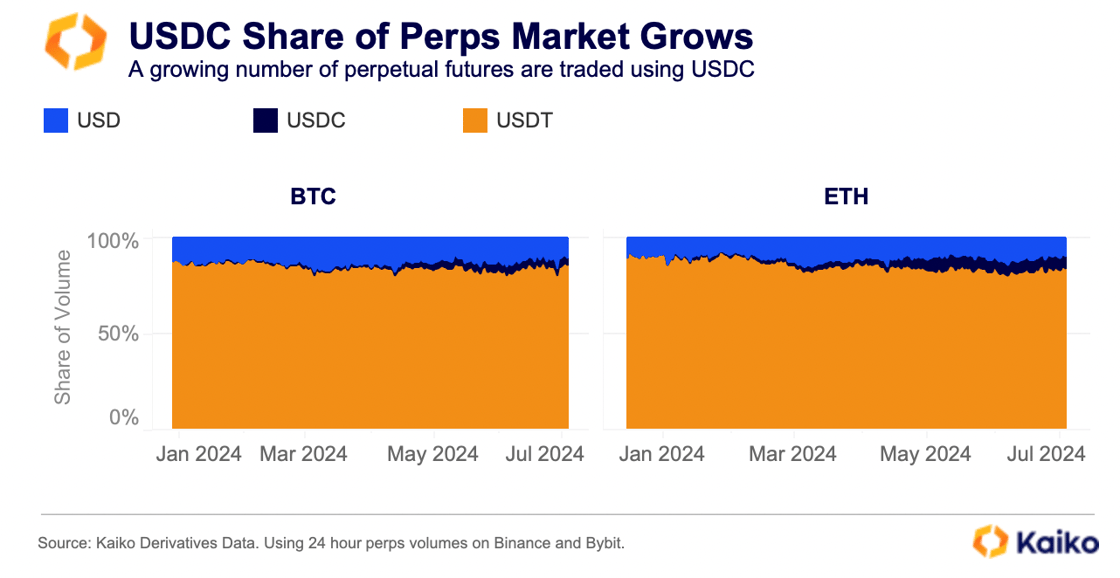

Kaiko additionally experiences that one other issue contributing to USDC’s progress is the truth that its utilization for perpetual futures settlement is surging – although it’s nonetheless minuscule in comparison with Tether’s USDT.

“One other issue contributing to this development is the elevated utilization of USDC for perpetual futures settlement. The share of BTC perpetuals denominated in USDC, traded on Binance and Bybit, rose to three.6% from 0.3% in January.

USDC’s utilization in ETH perpetuals buying and selling was even larger, with ETH-USDC commerce quantity rising to over 6.8% from 1% firstly of the yr. Whereas USDC’s market share in these perpetual markets is only a fraction of USDT’s, its rising utilization for perpetual settlement speaks to buyers’ altering preferences as stablecoin laws come into impact.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Natalia Siiatovskaia/Tithi Luadthong