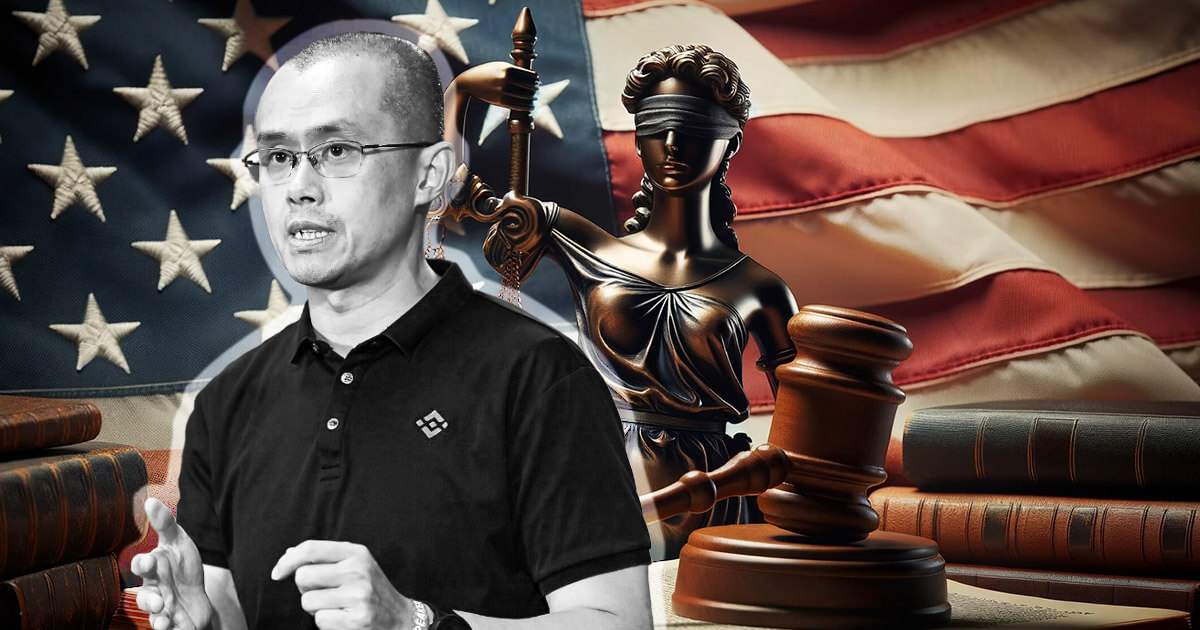

A U.S. District Court docket has as soon as once more denied Binance founder Changpeng ‘CZ’ Zhao’s request to journey internationally in a sealed order, Bloomberg Information reported.

CZ, who’s at present dealing with sentencing within the U.S. for prison fees, had filed a movement searching for permission to go to the UAE, the place his household resides. The movement was rejected by Choose Richard Jones of the Western District of Washington on Dec. 29.

It’s the second occasion the place CZ’s journey request has been blocked. The first concern raised by prosecutors is the potential flight threat posed by CZ, who’s value billions and a citizen of the UAE, which doesn’t have an extradition treaty with the U.S.

The choice comes regardless of CZ’s efforts to current arguments in opposition to the restriction. The main points of the arguments in opposition to the journey ban stay sealed within the courtroom’s ruling.

Awaiting sentencing

CZ, who has been a pivotal determine within the cryptocurrency and blockchain business by way of his management of Binance, pleaded responsible final month to a violation of the Financial institution Secrecy Act. Following his plea, he was launched on a considerable private recognizance bond of $175 million, accompanied by numerous monetary situations.

Based in 2017, Binance quickly emerged as a major participant within the crypto area, recognized for its in depth vary of cryptocurrencies and aggressive charges. CZ, a Chinese language-Canadian enterprise government with a sturdy background in software program growth and buying and selling methods, has been instrumental within the firm’s meteoric rise and affect within the business.

The trade’s fast development meant it generally reduce corners and didn’t have strong compliance measures in place, which allowed some illicit actors to misuse the platform for cash laundering and unlawful transactions. These lapses ultimately attracted regulatory consideration, with issues about cash laundering and the dearth of stringent know-your-customer (KYC) processes.

Regulatory management

CZ’s authorized challenges come amid a broader regulatory effort to ascertain management over the cryptocurrency market, traditionally characterised by its lack of regulation. This effort contains implementing stringent AML and KYC protocols, which have change into focal factors for governments worldwide, significantly within the U.S.

The case in opposition to Zhao and Binance highlights the strain between the decentralized nature of cryptocurrencies and the regulatory frameworks of world monetary methods. The end result of Zhao’s authorized proceedings is seen as pivotal, with potential implications for the operational and regulatory way forward for cryptocurrency exchanges globally.

CZ’s case represents a conflict between the historically unregulated nature of cryptocurrencies and the established regulatory frameworks of world monetary methods. It additionally raises questions on the way forward for decentralized finance (DeFi) and the stability between innovation within the crypto area and regulatory compliance.

Furthermore, CZ’s scenario displays the cultural and financial challenges confronted by worldwide enterprise executives working in rising technological sectors, particularly in areas like DeFi, the place innovation incessantly outpaces regulation.