The crypto market is presently buzzing with anticipation as Bitcoin choices merchants place themselves for what they foresee as a “substantial worth rally” in September.

Significantly, the derivatives market is expressing confidence, with a big variety of merchants betting on Bitcoin surpassing the $100,000 mark.

Bitcoin Market Optimism Amidst Whale Actions

Latest evaluation from trade consultants highlights a big development in Bitcoin choices that factors to rising optimism amongst merchants. In line with insights from QCP Capital, a noticeable shift has occurred within the threat reversals panorama, with calls (choices to purchase) now priced increased than places (choices to promote).

QCP Capital famous that this transformation underscores a “stronger demand” for potential worth will increase quite than hedges towards declines.

The choice for name choices, notably these pegged at formidable strike costs of $75,000 and $100,000 for September, underscores the bullish sentiment permeating by the market.

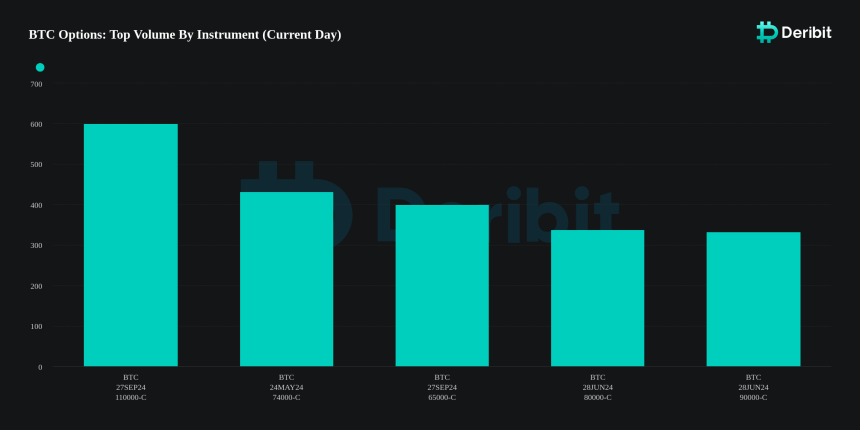

Information from the Deribit derivatives change corroborates this development, revealing that decision choices with a strike worth of $110,000 for the top of September are presently seeing the best quantity.

This enthusiasm within the choices market is a robust indicator of the merchants’ bullish outlook for Bitcoin, suggesting that many are betting on a big worth uptick by the top of the third quarter.

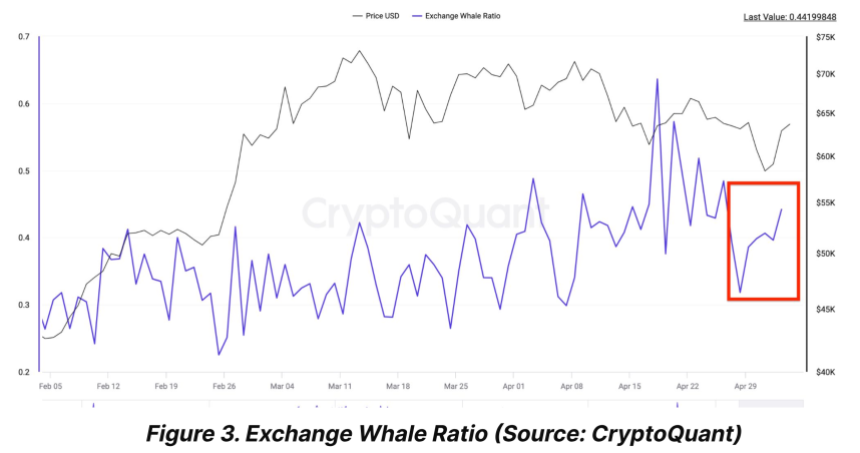

Nonetheless, the skies usually are not clear. Bitfinex analysts have identified actions by Bitcoin whales which may sign potential short-term volatility. The whale ratio on exchanges—a metric indicating the quantity of Bitcoin massive holders are shifting to exchanges—has seen an uptick.

This might usually recommend that these main gamers are contemplating promoting, which may introduce elevated promote stress available in the market.

Bitfinex’s latest Alpha report revealed that whereas the short-term holders of Bitcoin appear to be at a pivot level with a realized worth of $58,700 performing as an “necessary help stage,” the elevated exercise by whales on exchanges would possibly result in heightened worth fluctuations.

Lengthy-Time period Views And Market Recoveries

Regardless of these potential short-term pressures, the broader Bitcoin market has proven indicators of restoration. After a drop from its peak above $73,000 in March, Bitcoin has demonstrated resilience with a 5.8% improve over the previous week and a 2.8% rise within the final 24 hours alone. This restoration has introduced its buying and selling worth to round $63,791 on the time of writing.

Including to the long-term confidence in Bitcoin, Michael Saylor of MicroStrategy shared his views on the long run catalysts for Bitcoin’s worth.

In his perspective, regulatory choices, notably these rejecting spot exchange-traded funds (ETF) functions for different cryptocurrencies, will additional solidify Bitcoin’s standing as an unmatched digital asset.

Saylor disclosed that this regulatory moat may doubtlessly steer extra institutional investments in the direction of Bitcoin, because it stays the ‘metal’ of the cryptocurrency world—unparalleled and indispensable.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.