On September 5, 2020, Chef Nomi, the pseudonymous creator of SushiSwap, shocked the neighborhood by eradicating his vital share of SUSHI/ETH liquidity and changing it to ETH.

The motion, generally known as a “rug pull,” resulted in Chef Nomi gaining roughly $14 million value of ETH – leaving the SushiSwap neighborhood dissatisfied and feeling betrayed.

Dashed Potential

On the time, SushiSwap was positioned to develop into a robust decentralized competitor to Uniswap. It had efficiently executed a “vampire assault” by attracting liquidity suppliers and migrating their funds from Uniswap to SushiSwap.

Customers had moved round $1 billion in Uniswap liquidity tokens to SushiSwap, signaling a major shift within the DeFi panorama.

Neighborhood Outrage

Chef Nomi defended his choice to money out on Twitter, claiming he needed to focus on the event of the protocol. He in contrast his actions to these of Charlie Lee, who bought his Litecoin on the peak of the 2017 bull market.

Nevertheless, the transfer had already enraged the neighborhood, main many to declare the undertaking useless because of a lack of belief. The timing of Nomi’s actions raised doubts about whether or not he really supposed to observe by on plans at hand over the developer-owned contracts to a community-owned multisig pockets.

From the start, many trade leaders have been skeptical concerning the Uniswap clone. With the SUSHI token halving in worth inside a single day, it appeared like a dramatic finish for a undertaking that had rapidly accrued over $1 billion in liquidity.

Regardless of these doubts, discussions about transferring management to the neighborhood continued, although with much less enthusiasm.

Nomi Returns Funds, Apologizes

Chef Nomi in the end responded to the continued accusations of an exit rip-off by returning over $14 million value of Ethereum taken from the developer allocation.

In a sequence of tweets, he apologized to the DeFi neighborhood, acknowledged his mistake, and relinquished management of the undertaking to different builders, together with FTX CEO Sam Bankman-Fried.

What Has Occurred To SushiSwap Since?

Regardless of a considerably profitable restoration following the neighborhood takeover from Chef Nomi, SushiSwap has continued to have its share of ups and downs.

After an extended interval of inner battle, SushiSwap applied a serious governance overhaul on the finish of 2021. This launched a hierarchical construction to enhance administration and tackle previous points.

In October 2022, the neighborhood elected Jared Grey as the brand new “head chef” (CEO) and the Sushi DAO neighborhood authorized a reorganization proposal to create three authorized entities to interface the administration of the undertaking with its real-world processes.

The undertaking minimize useless weight within the type of its Kashi Lending and Miso Launch Pad, seeking to give attention to its DEX to regain some market traction.

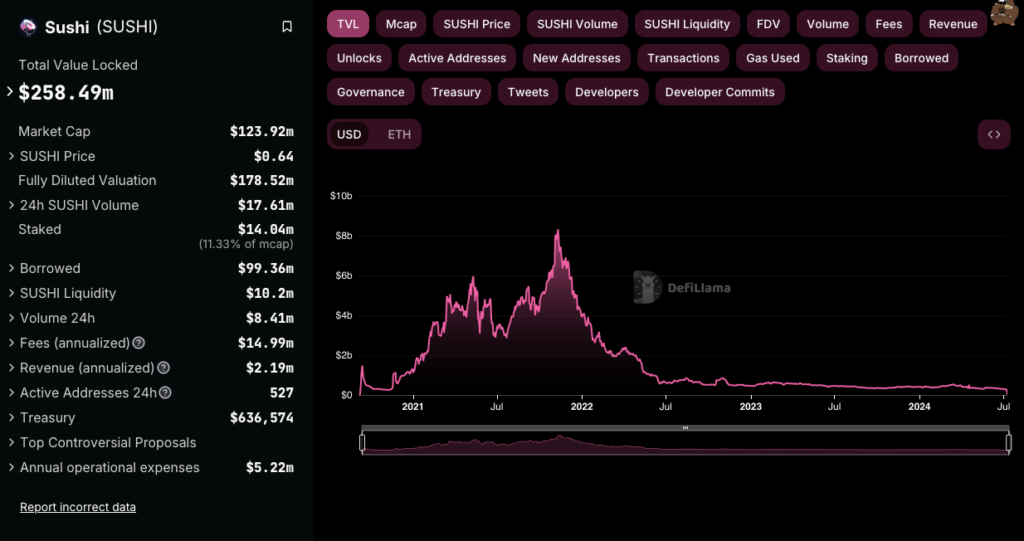

Sushi Whole Worth Locked (TVL) | Supply: Defillama.com

Sushi peaked with a TVL of over $8 billion on Ethereum, nonetheless in the present day it solely holds round $258 million in person funds on the community.

The protocol is broadly deployed, nonetheless, at the moment working on 30+ blockchains.

2024 Rebrand To Sushi Labs

In 2024, SushiSwap rebranded to Sushi Labs. It now goals to introduce cross-chain options together with a extra agile governance mannequin, utilizing a council for day-to-day choices whereas retaining Sushi DAO for extra vital choices.

Sushi Broadcasts its Rebrand to Sushi Labs | Supply: Sushi.com Weblog

This rebranding has included the launch of Susa, a brand new derivatives change for US-based merchants and efforts to regain market quantity and inflows.