Fast Take

Bitcoin just lately skilled the fifth-largest realized loss because the FTX collapse, sending Bitcoin beneath 54k. Whereas some commentators attribute this decline to the German authorities’s sale of their Bitcoin reserves or the Mt. Gox redemption narrative, it appears extra believable {that a} vital correction was overdue following an 18-month interval of constant worth will increase.

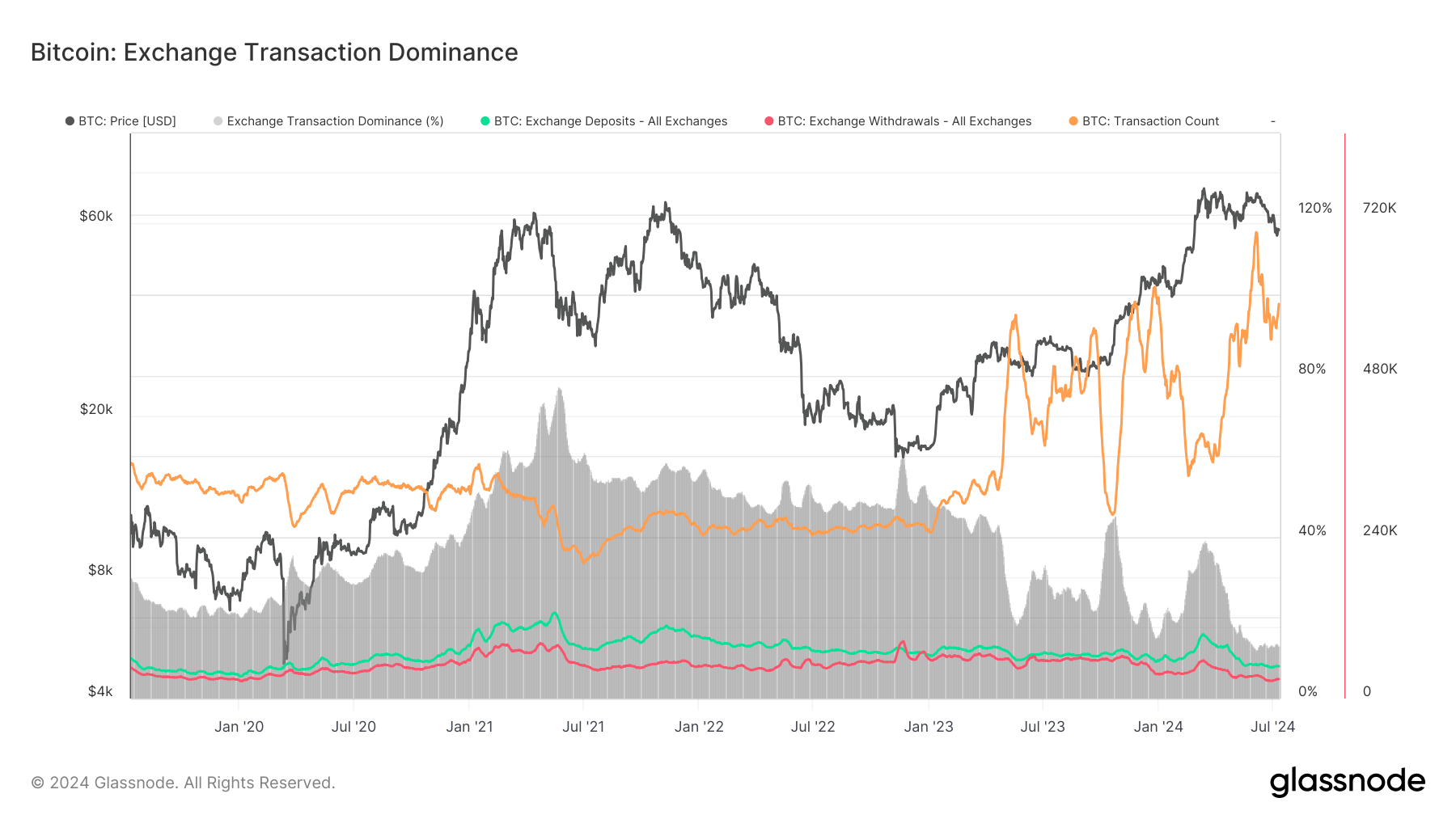

Analyzing the latest Glassnode information on exchange-related deposits and withdrawals reveals a number of key insights. Notably, trade withdrawals have decreased to twenty-eight,500 BTC, down from a mid-March peak of roughly 50,000 BTC, indicating fewer cash being withdrawn from exchanges.

Presently, trade deposits are round 47,000 BTC, persistently outpacing withdrawals. This divergence has grown, contrasting with 2023, when deposits and withdrawals have been intently matched, contributing to Bitcoin’s worth rise that 12 months. Traditionally, situations in early 2021 and early 2024 confirmed worth will increase accompanied by considerably larger deposits than withdrawals, suggesting that savvy traders have been promoting into the bull run peaks.

For a more healthy market, it could be preferable to see withdrawals begin to tighten with deposits, indicating extra balanced and doubtlessly sustainable worth will increase.

The publish Change withdrawals at 5-year low of 28.5k BTC appeared first on CryptoSlate.