Chainlink (LINK) has loved a pointy surge of greater than 21% over the previous 24 hours. Right here’s what knowledge suggests might be behind this rally.

Chainlink Has Stunned Crypto Market With Breakout In The Previous Day

Whereas most cryptocurrency sectors have seen flat or small inexperienced returns over the past 24 hours, Chainlink has proven a decoupling because it has noticed some sharp bullish momentum on this window.

Associated Studying

Here’s a chart that shows how LINK’s latest efficiency has regarded like:

With this sudden burst, Chainlink has touched the $16.7 mark for the primary time because the crash in the course of the first half of April. Whereas the asset has now retraced a serious a part of this plunge, it nonetheless hasn’t made a full restoration.

Ought to LINK’s bullish momentum proceed, although, it might not be too lengthy earlier than the cryptocurrency can reclaim the $17.8 stage it was buying and selling at simply earlier than the crash.

As for the place Chainlink stands within the wider market, the desk under reveals that, based mostly on market cap, it’s at present the fifteenth largest coin.

LINK isn’t too far off from Polkadot (DOT) now, so it’s attainable that if the worth rise continues, the coin will dethrone DOT and take over the 14th spot on the record.

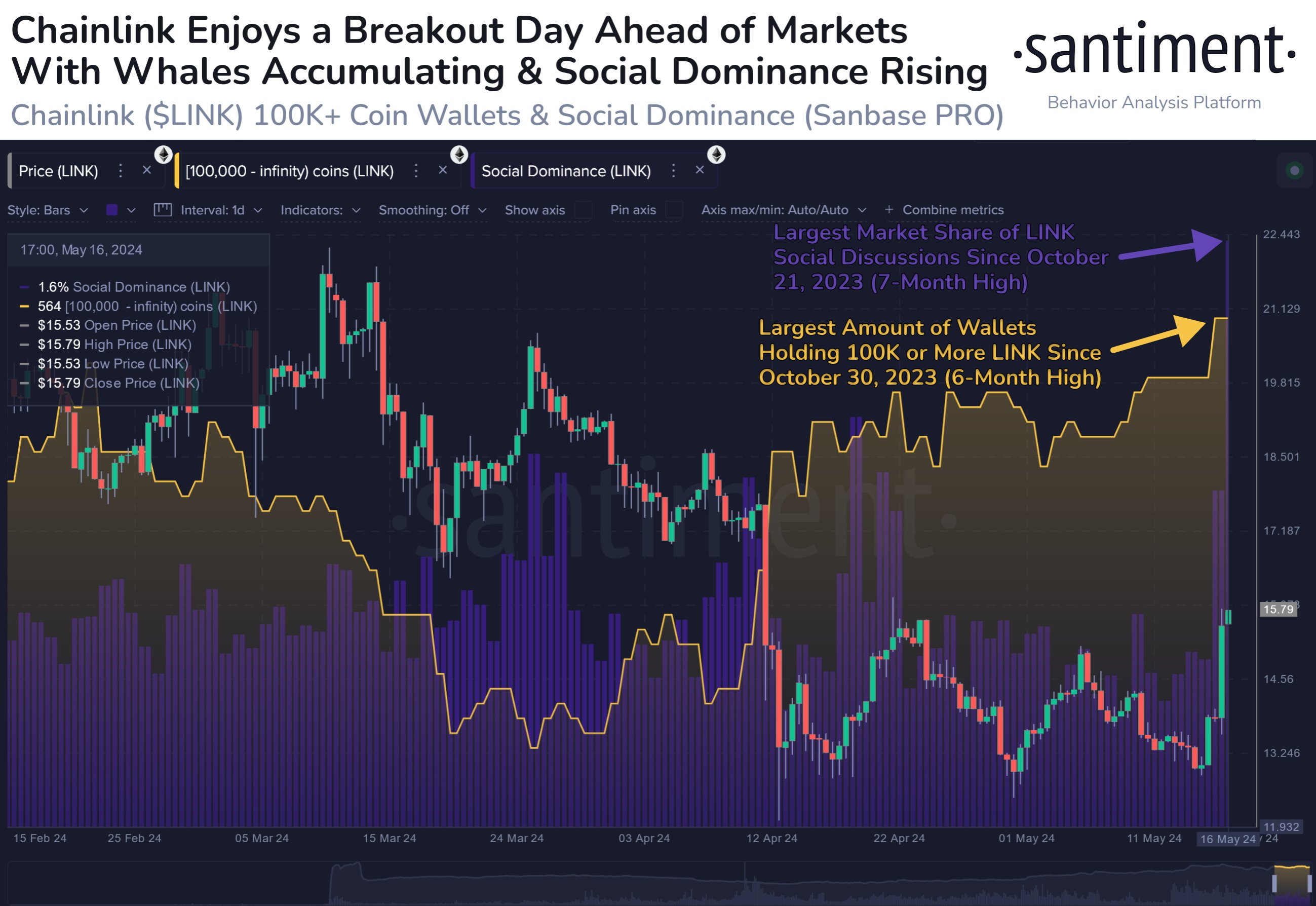

Now, what might be the explanation for Chainlink’s sudden decoupling from the remainder of the market? Knowledge from the on-chain analytics agency Santiment might maybe present some hints.

The Whole Quantity Of LINK Whales Is At A 6-Month Excessive Now

As identified by Santiment in a submit on X, Chainlink traders holding 100,000 tokens or extra of the asset of their steadiness have just lately seen their deal with rely enhance.

This cutoff is equal to round $1.67 million on the present LINK change fee. Buyers with holdings this massive are popularly known as whales.

Whales might be influential entities out there as a result of they’ll transfer a considerable amount of quantity in a brief span of time. As such, their conduct could also be value monitoring.

From the graph, it’s seen that Chainlink’s whole variety of whale addresses has hit 564 after the most recent rise, which is the very best the metric has been since October of final 12 months. This enhance within the variety of whales on the community could also be partially behind the surge that LINK has simply seen.

In the identical chart, the analytics agency has additionally hooked up the information for an additional indicator: social dominance. This metric tells us in regards to the share of cryptocurrency-related social media discussions that LINK occupies proper now.

Associated Studying

This indicator has shot up alongside this rally, implying the curiosity across the coin has spiked. Traditionally, such an increase in consideration has been a bearish signal for the asset, so it stays to be seen if these excessive values can be maintained. “If social dominance calms and FOMO doesn’t take over, bullish circumstances are forward,” notes Santiment.

Featured picture from iStock.com, CoinMarketCap.com, Santiment.internet, chart from TradingView.com