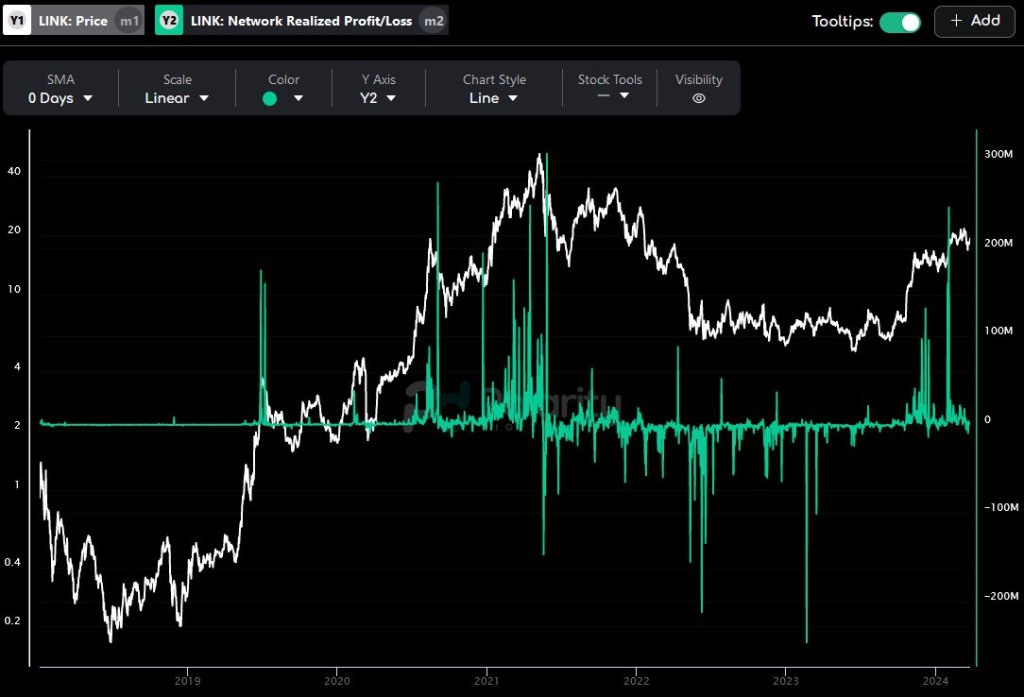

One analyst on X notes that Chainlink is going through a tug-of-war between bullish momentum and powerful upside resistance from profit-taking merchants. For bulls so as to add to their longs and lengthen the uptrend, the present oversupply should be moped, paving the way in which for extra beneficial properties above quick liquidation ranges.

Revenue Taking Slowing Down LINK Bulls

Trying on the LINK worth motion within the every day chart, it’s clear that consumers have the higher hand. Bulls have been relentless for the reason that token bottomed out in September 2023.

Since then, LINK has doubled, even breaking above the psychological spherical quantity at $20. At press time, consumers are nonetheless in management, snapping again to pattern regardless of the market-wide cool-off after Bitcoin crashed final week.

LINK is inside a broader vary, with clear caps at round $17.9 on the decrease finish and $21.7 on the higher finish. After protracted enlargement from September, the emergence of a ranging market may recommend that merchants are exiting their positions, slowing down the uptrend.

This has been confirmed by on-chain information that the analyst tagged, explaining the current slowdown. Certainly, on-chain information suggests traders have been cashing in on the current enlargement.

Because of this, the surplus provide must be absorbed by the market earlier than LINK Bulls builds sufficient momentum to drive the coin to new 2024 highs above $21.8.

Chainlink CCIP Adoption To Recharge Demand?

Regardless of the short-term headwinds, Chainlink bulls are banking on the widespread adoption of the Chainlink Cross-Chain Interoperability Protocol (CCIP) as a requirement catalyst. CCIP is crucial for blockchain interoperability. The answer permits safe communication between sensible contracts of linked blockchains and exterior information sources.

CCIP has been adopted by, amongst others, Metis, a layer-2 scaling answer for Ethereum. Circle, the issuer of USDC, a stablecoin, can also be leveraging the platform to reinforce interoperability.

Current information exhibits a surge in CCIP income, pointing in direction of elevated adoption of this multichain bridging platform. As of March 26, Dune Analytics information exhibits that the CCIP has generated over $484,000 in income. This determine will doubtless enhance as CCIP finds adoption and Chainlink integrates with much more protocols, companies, and blockchains.

Nonetheless, the tempo at which LINK breaks above March highs and registers contemporary 2024 highs can even demand the efficiency of different cash, together with Bitcoin and Ethereum. A resurgent BTC may draw extra capital, lifting altcoins, together with LINK, within the course of.

Characteristic picture from Shutterstock, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site totally at your individual danger.