The Cardano (ADA) worth is experiencing a notable lower, dropping by 12% for the reason that begin of the week, with a 2.6% dip recorded at the moment alone. Regardless of this, with a market capitalization of $20.27 billion, ADA maintains its place because the ninth largest cryptocurrency.

This current downturn comes amidst a broader crypto market experiencing principally sideways to downward motion, with ADA recording extra vital losses in comparison with its friends like ETH, which is down by 7.4%, BNB by 6.4%, Solana by 6.3%, and XRP by 6.1%.

Grayscale Dumps Cardano From GDLC

A pivotal issue behind Cardano’s sharper decline may very well be linked to the current liquidation of all ADA holdings by the Grayscale Digital Massive Cap Fund (GDLC). The fund, which at present boasts property underneath administration (AUM) price $579 million, had Cardano constituting 1.62% of its portfolio on January 4, which quantities to roughly $9.4 million.

On Thursday, Grayscale Investments introduced the choice as a part of its first quarter 2024 overview. In line with the official press launch, the adjustment to GDLC’s portfolio entailed the promoting of Cardano and reallocating the money proceeds to present Fund Parts, proportional to their weightings.

This rebalancing led to the elimination of ADA from GDLC’s portfolio. The ultimate composition of the fund as of April 3, 2024, contains Bitcoin (70.96%), Ethereum (21.84%), Solana (4.52%), XRP (1.73%) and Avalanche (0.95%).

The press launch detailed, “In accordance with the CoinDesk Massive Cap Choose Index methodology, Grayscale has adjusted GDLC’s portfolio by promoting Cardano (ADA), and utilizing the money proceeds to buy present Fund Parts in proportion to their respective weightings. Because of the rebalancing, Cardano (ADA) has been faraway from GDLC.”

Grayscale additionally highlighted the quarterly evaluations of the GDLC, DEFG, and GSCPxE Fund compositions, geared toward updating present Fund Parts or together with new ones based mostly on index methodologies supplied by the Index Supplier. This apply ensures that the funds’ holdings mirror essentially the most present market tendencies and asset efficiency.

Notably, the Grayscale Sensible Contract Platform Ex-Ethereum Fund nonetheless accommodates Cardano. The cryptocurrency is the second-largest place after Solana (58.41%), with a weighting of 14.56%.

In response to those developments, Charles Hoskinson, the founding father of Cardano, supplied a terse commentary through X, stating, “Wall Road give; Wall Road take.”

This succinct comment encapsulates the unstable nature of crypto investments and the numerous impression that main monetary gamers like Grayscale can have available on the market dynamics of digital property.

Wall Road give; Wall Road take https://t.co/dkyrhHW4WS

— Charles Hoskinson (@IOHK_Charles) April 5, 2024

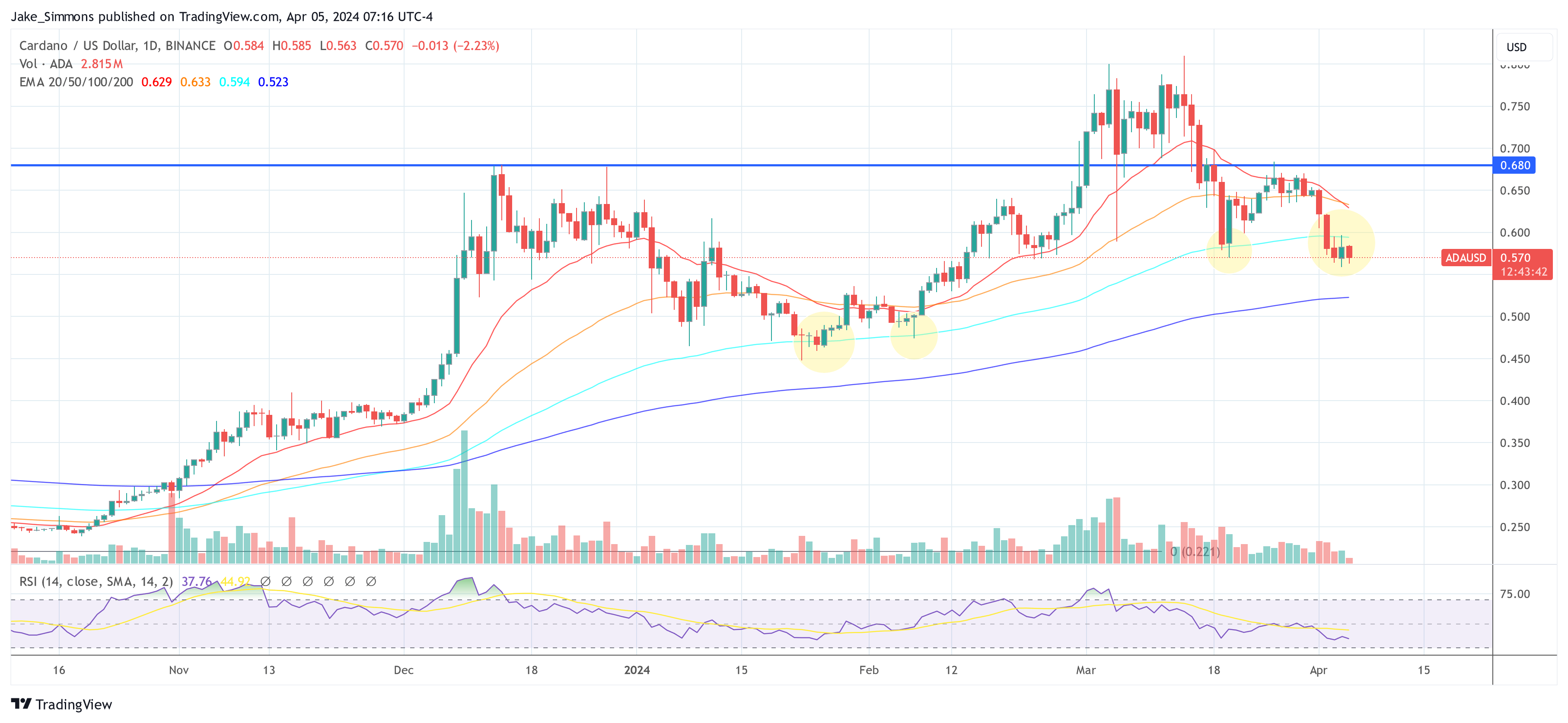

At press time, ADA was buying and selling at $0.57. Within the quick time period, the 100-day EMA at $0.58 is the important thing resistance that ADA wants to beat with the intention to develop new bullish momentum. The 100-day EMA has served as robust help 3 times since mid-January. After the current dip beneath this indicator, ADA is struggling to reclaim it. Within the medium time period, the bulls want to interrupt above the $0.68 stage.

Featured picture from Guarda Pockets, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site fully at your individual threat.