Bitcoin has noticed a plunge throughout the previous day, taking the asset’s worth beneath $67,000. Right here’s the historic help degree that the asset might go to subsequent.

Bitcoin Is Now Not Far From The Brief-Time period Holder Realized Value

As analyst James Van Straten identified in a submit on X, the Realized Value of the Bitcoin Brief-Time period Holders has been going up lately and at present sits across the $64,000 degree.

The “Realized Value” right here refers to an on-chain metric that retains observe of the associated fee foundation of the common investor within the BTC market. This indicator is predicated on the “Realized Cap” mannequin for the cryptocurrency.

Associated Studying

When the asset’s spot worth is larger than the Realized Value, it means the traders are carrying some web unrealized earnings proper now. Alternatively, the coin’s worth beneath the metric suggests the dominance of losses out there.

Within the context of the present subject, the Realized Value of a selected sector section is of curiosity: the Brief-Time period Holders (STHs). The STHs embrace all of the traders who purchased their cash inside the previous 155 days.

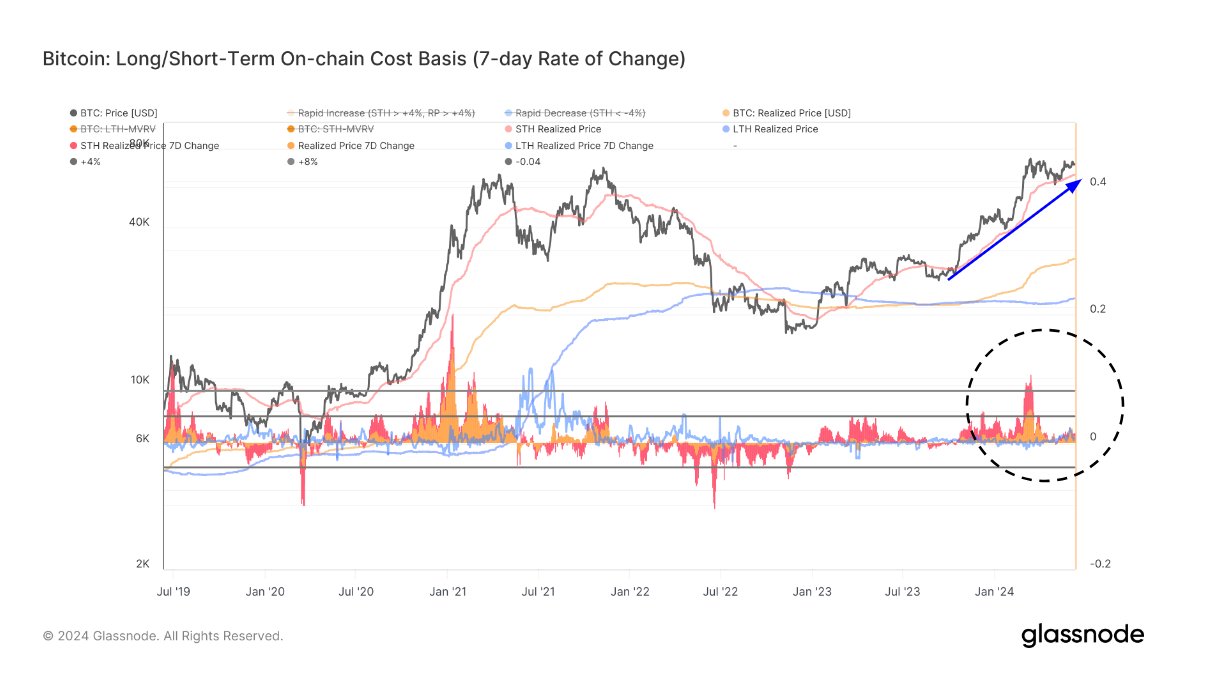

Here’s a chart that reveals the development within the Realized Value of the Bitcoin STHs over the previous few years:

As displayed within the above graph, the Bitcoin STH Realized Value quickly climbed throughout the rally in the direction of the all-time excessive worth (ATH) earlier within the yr. This development naturally is smart, because the STHs characterize the brand new traders out there, who would have had to purchase at larger costs because the asset climbed up, thus pushing the cohort’s common up.

Since BTC’s consolidation part following the March ATH, the indicator’s uptrend has slowed, however its worth is growing nonetheless. After the most recent enhance, the metric has approached $64,000.

Now, what significance does the Realized Value of the STHs have? Traditionally, this indicator has taken turns performing as a significant help and resistance line for the cryptocurrency.

Throughout bullish intervals, this metric can facilitate backside formations for the cryptocurrency, thus holding it above itself, whereas bearish developments usually witness the road performing as a barrier stopping the coin from escaping above it. Transitions past this degree have usually mirrored a flip development for the coin.

This obvious sample has held up seemingly as a result of the STHs, being the comparatively inexperienced arms, might be fairly reactive. The price foundation is a vital degree for any investor, however this cohort, specifically, might be extra more likely to panic when a retest of their price foundation takes place.

When the sentiment out there is bullish, the STHs might resolve to purchase extra when the worth drops to their common price foundation, believing the drawdown to be merely a “dip” alternative. In bearish phases, although, they might react to such a retest by panic promoting as an alternative.

Associated Studying

The chart reveals that Bitcoin discovered help round this line throughout the crash on the finish of April/begin of Might, probably implying a bullish sentiment has continued to be dominant.

With BTC seeing a drop beneath $67,000 prior to now day and the STH Realized Value closing in at $64,000, it will likely be attention-grabbing to see how a possible retest would play out this time.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $66,800, down over 3% prior to now week.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com