AVAX, native token of the Avalanche community, made a powerful entrance into the cryptocurrency markets on the onset of the yr, establishing itself as a distinguished participant and outpacing many different altcoins.

The preliminary enthusiasm surrounding AVAX, nonetheless, underwent a notable transformation because the narrative took an sudden flip. Presently, the token finds itself perched at $36.65, reflecting a marked shift from its earlier bullish trajectory. Over the past seven days, AVAX has encountered a difficult interval, sustaining a 15% loss.

AVAX Downturn Sparks Considerations, Social Silence

The explanations behind this current downturn could possibly be multifaceted, starting from market sentiment shifts to exterior elements influencing broader cryptocurrency tendencies. Traders and market analysts are carefully monitoring the state of affairs to discern the underlying dynamics at play and decide whether or not this can be a short-term correction or indicative of a extra sustained development.

Moreover, a curious case emerges – the dwindling social quantity. Regardless of AVAX’s resilience, on-line chatter surrounding the platform has taken a nosedive, elevating questions concerning the sustainability of the coin.

The diminishing social quantity would possibly counsel a divergence between market efficiency and investor sentiment, prompting a better examination of things influencing each the cryptocurrency’s worth and the notion inside the neighborhood.

Positively, although, the market capitalization of Avalanche has risen by greater than 5% previously few days, indicating a larger inflow of buyers.

AVAX market cap presently at $12.647 billion. Chart: TradingView.com

Not too lengthy after Grayscale’s Digital Giant Cap Fund adopted the layer-1 blockchain, Avalanche noticed a sturdy comeback. With billions of cryptocurrency belongings underneath its administration, Grayscale is without doubt one of the largest digital asset managers.

The inclusion of AVAX in Grayscale’s fund signifies that establishments will nonetheless be curious about Avalanche till 2024 and past.

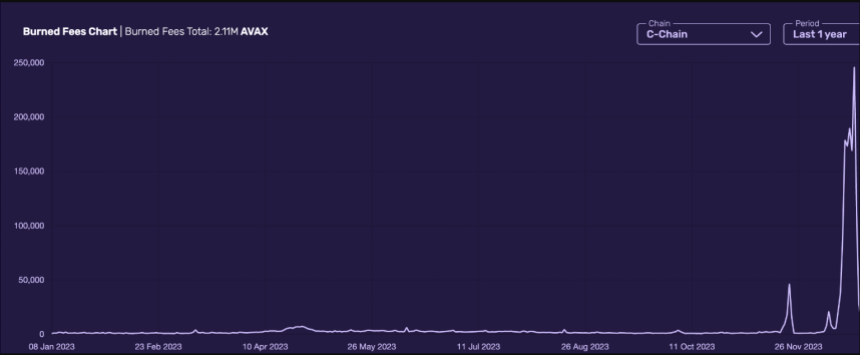

In the meantime, Avalanche’s circulating provide shrank considerably within the latter half of 2023, fueled by a surge in exercise surrounding “inscriptions.”

Avalanche Surges: Document Token Burns Celebrated

These data-on-chain creations generate transaction charges, that are then completely faraway from circulation by means of the community’s burn mechanism.

Supply: AVASCAN

December alone noticed a file 195,000 token burn, a testomony to the rising recognition of inscriptions on Avalanche.

Specialists attribute this development to a number of elements. Inscription-based transactions, initially in style on Bitcoin, are discovering new life on Avalanche as a consequence of their artistic potential and contribution to the burn mechanism.

This creates a constructive suggestions loop, attracting customers and additional lowering the circulating provide. Moreover, the rise of inscription exercise suggests a rising and engaged Avalanche neighborhood, which bodes nicely for the community’s long-term well being.

Nevertheless, the implications of this development are nuanced. Whereas token shortage might result in elevated AVAX worth over time, just like Bitcoin, it additionally raises issues about rising transaction charges and potential centralization if giant inscription tasks management a good portion of the charge pool.

Featured picture from Shutterstock

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal threat.