Ethereum (ETH) continued its upward trajectory Wednesday, clocking a ten% achieve in 24 hours to breach previous the vaunted $2,600 mark. Market watchers attribute this surge to a confluence of things, primarily fueled by anticipation of a forthcoming Ethereum exchange-traded fund (ETF) within the wake of the anticipated approval for a Bitcoin ETF within the US.

In a historic transfer that cryptocurrency aficionados hope will carry extra particular person and institutional traders into the market, the US Securities and Alternate Fee has authorized the primary spot bitcoin trade traded funds on Thursday.

Ethereum ETF Buzz Sparks Strategic Strikes

“There’s a noticeable development in direction of frontrunning the ether ETF,” famous Alex Onufriychuk, CEO of Kaminari, in a Telegram message. This sentiment aligns with the prevailing perception that Ethereum, the second-largest cryptocurrency by market cap, can be the subsequent candidate for an ETF after Bitcoin.

Including gas to the hearth, a distinguished investor, dubbed a “whale” within the crypto universe, made a strategic transfer by transferring 9,705 ETH (practically $23 million) from Binance to Compound. This was adopted by a 12 million Tether (USDT) mortgage, seemingly used to additional accumulate ETH. The whale subsequently executed three worthwhile ETH transactions, netting roughly $5 million.

This decisive motion signaled two issues: confidence in Ethereum’s future and the potential for profit-taking, which might introduce short-term volatility. Regardless of the chance, the whale’s exercise bolstered constructive market sentiment.

Ethereum at the moment buying and selling at $2,607.8 on the every day chart: TradingView.com

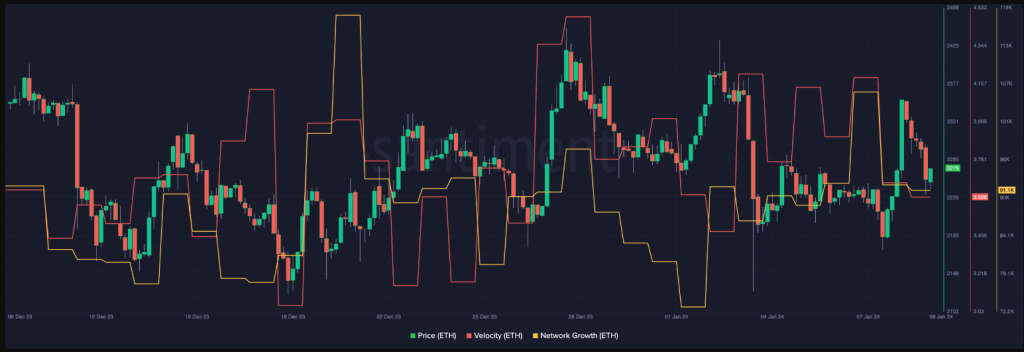

Additional validating this optimism, Ethereum’s community metrics skilled a surge. Each community development and token velocity noticed will increase, indicating heightened curiosity from new addresses and extra token motion. These on-chain metrics paint a promising image for ETH’s future.

ETH Futures Surge Amid ETF Optimism

Additionally including to the bullish case, Open Curiosity for ETH futures contracts jumped 15% in latest days, reaching $4.57 billion on the time of writing. This signifies extra merchants getting into the market and anticipating important worth positive factors following a possible ETF approval.

Ethereum vs. Bitcoin Open Curiosity | Supply: Velo Knowledge

Based on experiences, crypto merchants count on Ethereum’s worth to rise after a good ETF judgment, though Bitcoin is getting extra consideration within the media. If this example performs out, the value of ETH might quickly transcend $2,600.

Nonetheless, it’s essential to keep in mind that the cryptocurrency market stays unstable, and unexpected elements might nonetheless affect costs.

The timeline for an Ethereum ETF approval is unsure, and regulatory hurdles might create delays. Moreover, broader market situations and information on Ethereum improvement might additionally play a job.

Buyers ought to rigorously take into account their threat tolerance and conduct thorough analysis earlier than making any funding choices, notably within the dynamic and unpredictable world of cryptocurrencies.

Featured picture from Medium

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal threat.