The short-to-long-term realized worth (SLRV) ratio is an often-overlooked metric that gives nuanced insights into investor sentiment. The ratio compares the proportion of Bitcoin that was final moved inside a brief timeframe (24 hours) in opposition to the proportion moved in an extended timeframe (6-12 months) to point out whether or not the market leans extra in direction of hodling or buying and selling.

Nonetheless, the SLRV ratio alone often isn’t sufficient to determine broader tendencies, as there are vital each day variations within the metric. Making use of and analyzing the ratio via transferring averages, particularly the 30-day easy transferring common (SMA) and the 150-day SMA, permits us to get a transparent image of sustained market tendencies.

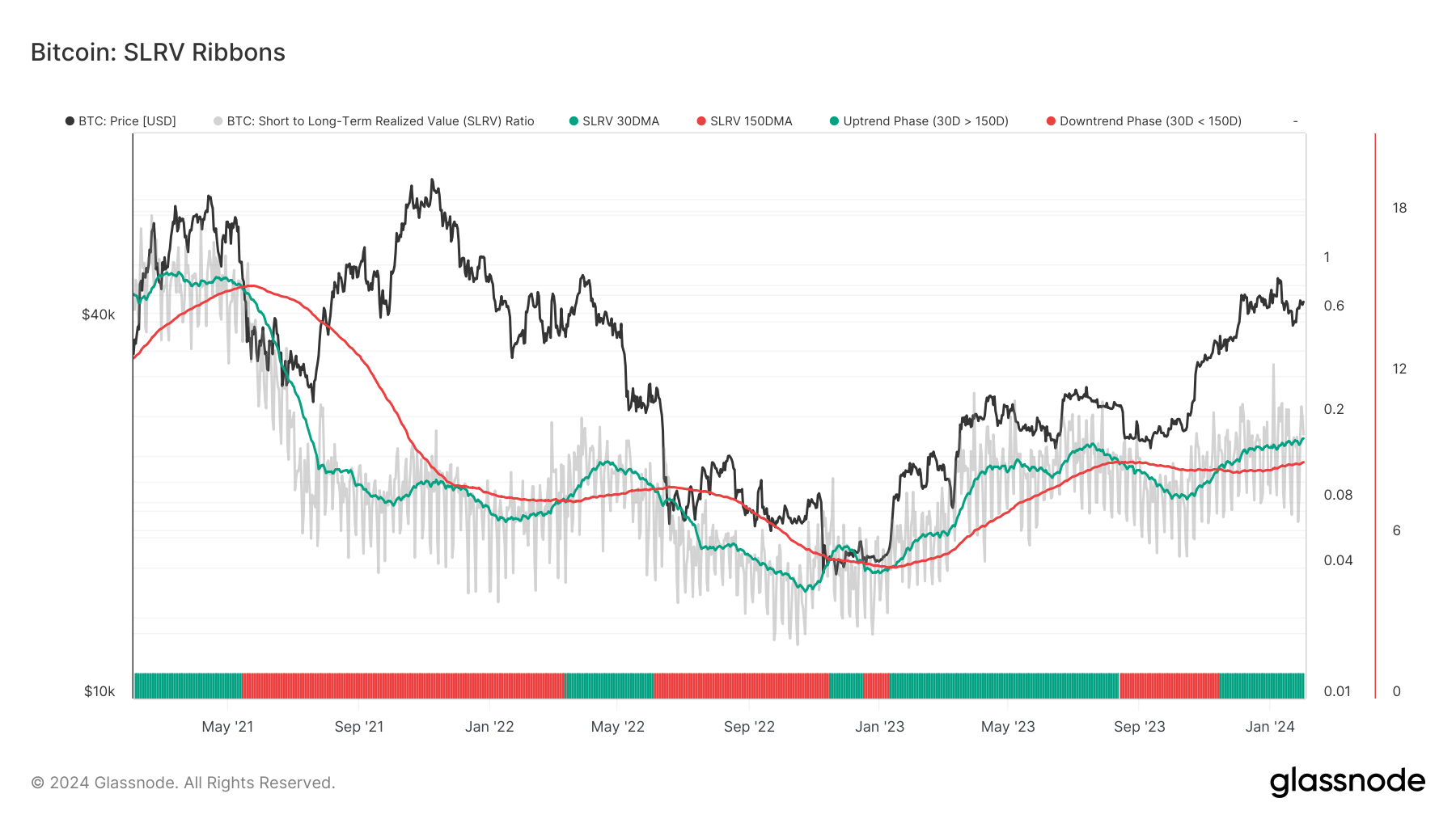

On Feb. 1, the SLRV 30D SMA reached its highest degree since July 2021 as Bitcoin’s value crossed $43,000. This peak represents a continuation of a optimistic uptrend that started on Nov. 14, 2023, when the SLRV 30D SMA crossed above the 150D SMA.

The SLRV 30D SMA reaching ranges not seen in two and a half years exhibits a big enhance in short-term transactional exercise relative to long-term holding. This could possibly be attributed to a myriad of various components, but it surely’s often a results of value volatility. The rise in short-term transactional quantity usually correlates with heightened market hypothesis as traders and merchants rush to capitalize on value actions. It could possibly point out a market pushed by bullish sentiment or elevated speculative curiosity spurred by current market developments.

The introduction and adoption of spot Bitcoin ETFs within the U.S. most certainly performed a big position. The highly-anticipated buying and selling product has pushed Bitcoin into the mainstream, bringing establishments and superior traders from tradfi into the market. Except for having a psychological impact available on the market and boosting investor confidence in BTC, these ETFs additionally present liquidity to Bitcoin. This elevated liquidity could cause greater buying and selling volumes, as traders can enter and exit their positions in Bitcoin via the ETFs extra rapidly, inflicting spikes within the SLRV 30D SMA in consequence.

It’s not simply the rise within the SLRV 30D SMA that exhibits a change in market sentiment. Its sustained place above the 150D SMA since mid-November exhibits that short-term transactional exercise not solely spiked however maintained the next degree over an prolonged interval.

The sturdiness of this development, which is on its strategy to enter its third consecutive month, exhibits that market exercise isn’t a short-lived speculative burst however a extra entrenched habits sample amongst traders.

Traditionally, short-term SMAs crossing above long-term SMAs have been used as a technical indicator for optimistic momentum and potential bullish tendencies in varied property, together with Bitcoin. The prolonged interval the place the SLRV 30D SMA stays above the 150D SMA may present a broader market transition from risk-off to risk-on allocations, the place traders are extra prepared to interact in speculative investments or allocate a bigger portion of their portfolio to Bitcoin.

The publish Brief-term buying and selling quantity peaks as Bitcoin crosses $43,000 appeared first on CryptoSlate.