The next is a visitor article from Vincent Maliepaard, Advertising Director at IntoTheBlock

What’s BlackRock’s BUIDL Fund?

The BUIDL fund, formally referred to as the BlackRock USD Institutional Digital Liquidity Fund, represents BlackRock‘s enterprise into tokenized property on a public blockchain. Using the Ethereum community, BUIDL invests in money, short-term debt securities, and U.S. Treasury bonds.

The launch of BlackRock’s BUIDL fund excited many within the trade as a result of it showcases how conventional monetary devices can combine with the revolutionary capabilities of DeFi.

Nevertheless, BlackRock just isn’t the primary to discover this expertise. Different notable companies have additionally made important strides on this space. As an example, Abrdn, a serious UK asset supervisor, launched a tokenized model of its £15 billion Lux Sterling cash market fund on the Hedera Hashgraph DLT in June 2023 (Ledger Insights).

Equally, Hamilton Lane, one other funding supervisor, opened a tokenized feeder fund on the Polygon blockchain in early 2023. This fund permits particular person traders to entry non-public fairness with considerably diminished minimal funding necessities in comparison with conventional variations (markets.businessinsider.com).

Quite a few examples from the blockchain trade have contributed to a rising area of interest ecosystem inside the bigger blockchain trade referred to as “Actual-world Belongings,” or RWAs.

Actual-World Belongings in Crypto

Actual-world Belongings (RWA) have emerged as one of the crucial important areas of focus within the blockchain trade this 12 months. Initiatives on this area intention to channel yield and property from the standard economic system into the digital area. This integration leverages the inherent interoperability of DeFi, enabling new types of asset utilization and yield technology.

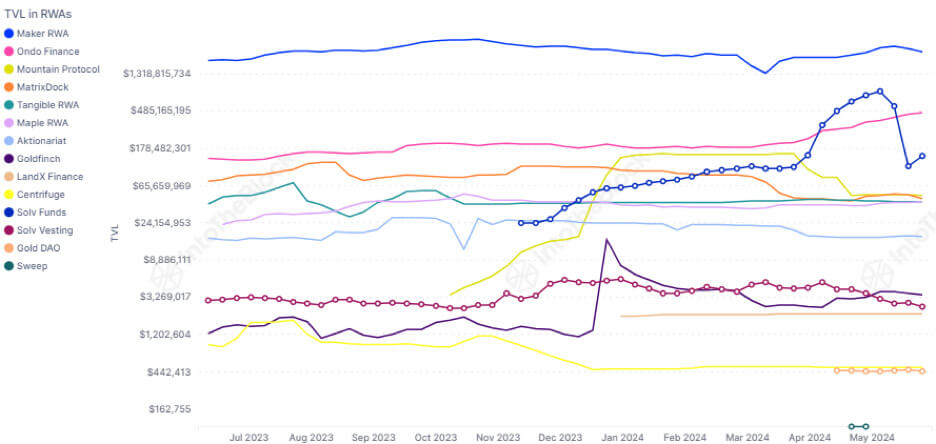

In 2023, important strides have been made on this sector, marked by efficiently incorporating U.S. Treasury bond yields into DeFi by way of protocols like Mountain Protocol. Consequently, the full worth locked (TVL) in RWA protocols soared to over $2.9 billion. Prime protocols within the RWA ecosystem now depend over 194,000 RWA protocol token holders between them, reflecting its fast adoption and rising affect.

Growth and Progress of the BUIDL Fund

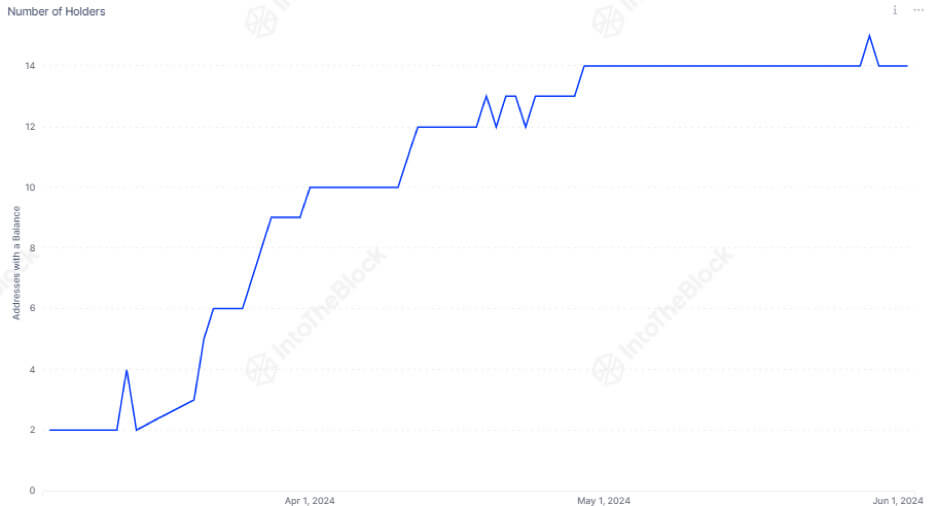

The construction of BlackRock’s BUIDL fund is designed to cater to institutional traders, requiring a minimal funding of $5 million per entity. The fund has 14 holders and has showcased gradual however notable progress since its launch.

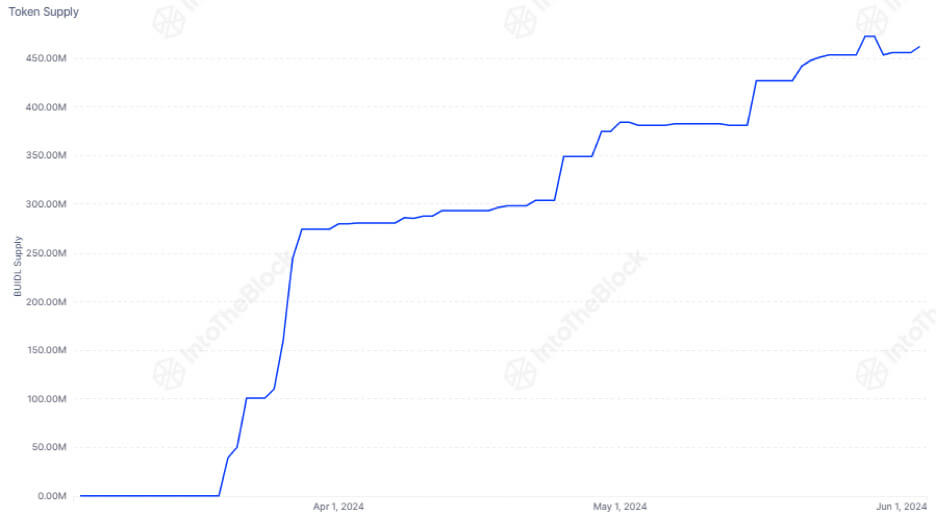

Whereas the variety of holders might develop steadily, every new investor considerably boosts the fund’s complete holdings. Present information exhibits there are 462,542,901 circulating tokens, every representing roughly $1, bringing the full fund worth to $462 million.

The Way forward for BlackRock’s BUIDL Fund and RWA in DeFi

Because the DeFi sector continues attracting consideration from conventional monetary gamers, integrating RWAs like these within the BUIDL fund is anticipated to speed up. This pattern is pushed by the inherent benefits of tokenization, together with elevated transparency, liquidity, and entry to a broader vary of traders. This evolution extends past the blockchain trade and units the stage for a extra interconnected and environment friendly international monetary system.