Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Inbox:

The Securities and Change Fee at this time charged Stoner Cats 2 LLC (SC2) with conducting an unregistered providing of crypto asset securities within the type of purported non-fungible tokens (NFTs) that raised roughly $8 million from traders to finance an animated internet collection known as Stoner Cats.

Deep breaths.

Stoner Cats is an “NFT grownup animated brief collection”, which suggests mainly nothing in concept however in observe appears to be like like this:

Pay attention up mfs (my associates): episode 6 comes out December twenty third!! 👵🏼❤️🤶🏼 pic.twitter.com/hgQrvcaE4i

— Stoner Cats (@stonercatstv) December 15, 2022

[please if anyone watches this and recognises the sound at 0:15 when the packet hits the fire let us know it’s driven FTAV insane . . . is it from a video game? arrgghhh.]

A 2021 article by Forbes requested . . .

. . . however didn’t actually make any try to reply that presumably simple query. The SEC frames it thusly:

Actor Mila Kunis (whose manufacturing studio Orchard Farm Productions produced this manufacturing) and her himbo husband Ashton Kutcher, the article says, known as Stoner Cats a “new mannequin for watching a cartoon TV present a couple of group of weed smoking felines”. We don’t know what the previous mannequin was.

Anyway, Kunis and Kutcher voiced some cats, whereas Vitalik Buterin (who co-founded Ethereum) additionally performed a personality, blah blah blah the passage of time. Now:

In accordance with the SEC order, on July 27, 2021, SC2 provided and bought to traders greater than 10,000 NFTs for roughly $800 every, promoting out in 35 minutes. The order finds that each earlier than and after Stoner Cats NFTs have been bought to the general public, SC2’s advertising marketing campaign highlighted particular advantages of proudly owning them, together with the choice for homeowners to resell their NFTs on the secondary market.

As well as, the order finds that, as a part of the advertising marketing campaign, the SC2 workforce emphasised its experience as Hollywood producers, its information of crypto initiatives, and the well-known actors concerned within the internet collection, main traders to count on income as a result of a profitable internet collection might trigger the resale worth of the Stoner Cats NFTs within the secondary market to rise.

Additional, the order finds that SC2 configured the Stoner Cats NFTs to offer SC2 a 2.5 per cent royalty for every secondary market transaction within the NFTs and it inspired people to purchase and promote the NFTs, main purchasers to spend greater than $20 million in not less than 10,000 transactions. In accordance with the SEC’s order, SC2 violated the Securities Act of 1933 by providing and promoting these crypto asset securities to the general public in an unregistered providing that was not exempt from registration.

Carolyn Welshhans, affiliate director of the SEC’s house workplace, mentioned:

Registration of securities, together with crypto asset securities, protects traders by offering them with disclosures to allow them to make knowledgeable investing selections. Stoner Cats wished all the advantages of providing and promoting a safety to the general public however ignored the authorized tasks that include doing so.

The Stoner Cats didn’t land on their ft, and seem to have rolled over:

With out admitting or denying the SEC’s findings, SC2 agreed to a cease-and-desist order and to pay a civil penalty of $1 million.

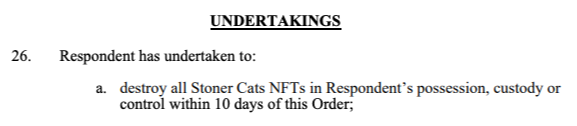

You most likely must giggle, else you’d cry. However Alphaville, which regularly does each, was most interested in this part from the SEC’s order:

Wha . . . ? In addition to the truth that the firm claimed the ten,000 NFTs bought out inside minutes — what is that this speculated to imply? (Nb the SEC used the “destroy” phrase in one other order, in opposition to Affect Principle, final month.)

An NFT, as has been identified advert nauseam, boils all the way down to a novel identifier saved on a blockchain that factors to a sometimes digital asset (ie a shitty JPEG), its proprietor, and the related good contract. The asset component is simply referenced by a hyperlink, which might break and is subsequently one in all many, many causes NFTs are dumb.

On this context, the one little bit of the NFT that’s intrinsically the NFT is the identifier itself.

However this component is on the blockchain, which suggests it could possibly by no means be destroyed! On the danger of sounding, effectively, stoned, how does one destroy an un-destroyable digital commodity?

The widespread observe on this state of affairs appears to be to switch the NFT to a pockets that no person controls, and that acts like an enormous communal trash can — a course of referred to as “burning” the NFT. So it’s nonetheless there, however no person can get it.

Will the SEC be proud of this idea of destruction? We’ve requested regulators the query, and can replace if we get a response.