Since March, the value of BNB, beforehand also called Binance Coin, has barely fallen under $500, regardless of the broader crypto market downturn. Following heavy losses from main cryptocurrencies, BNB has proven some spectacular resistance to the value drop, supported by sturdy demand.

Associated Studying

Regardless of this power, the most recent BNB value forecast by CoinCodex nonetheless estimates the coin may rise by 25% and attain $650 by October 10, 2024. In the meantime, investor sentiment is bearish, and the Concern & Greed Index additionally stands at 33, reflecting that uncertainty out there.

This blended outlook brings up questions on BNB’s near-term trajectory. Whereas there may be a risk of progress in the long term, short-term conservatism is required, extra so from the latest coin volatility and broader market dynamics.

BNB’s Sideways Motion And Robust Demand

Since March, BNB has moved inside a sideways sample that posts heavy ups and downs. Nonetheless, after each fall, BNB has strongly rebounded above $500, that means that there’s sturdy demand for the coin. For example, on September 6, it fell as little as $470 however later rebounded to commerce at $520 at press time.

That is additionally in step with the rising expectations of an altseason, as a decline in Bitcoin dominance tends to spice up altcoins like BNB. Traders appear assured that BNB would possibly proceed taking advantage of this pattern in a method that it all the time has traditionally when stronger demand for various cryptocurrencies was triggered.

On-Chain Knowledge: Exercise And Community Demand

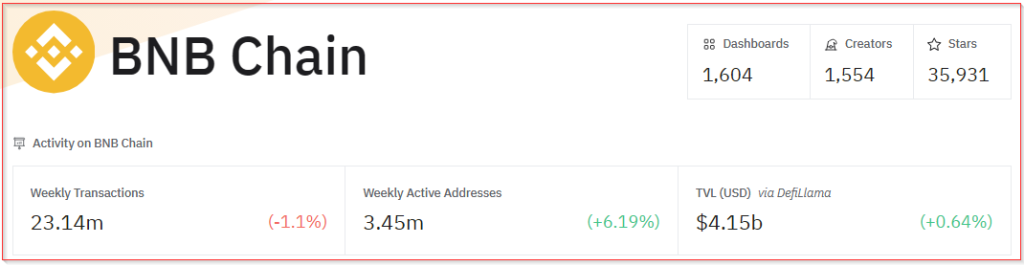

Latest on-chain knowledge from Dune Analytics factors to each some promising and regarding tendencies in BNB. The variety of lively addresses on the Binance Good Chain elevated by 6% week-over-week, indicating that extra persons are all in favour of getting on the community.

This improve in lively addresses didn’t, nevertheless, mirror an identical uptick in transaction volumes, which declined 1.1% over the week, hinting that elevated participation has not but translated into sturdy community exercise.

The decline in community charges additionally displays diminished exercise, which can affect the trail that the BNB value might take. To make sure, excessive community utilization has all the time seen comparatively excessive demand for the BNB traditionally, and its extended depressed exercise can cap the upside potential of the coin.

A Rally Round The Nook?

Some analysts assume it may very well be arrange for a run, regardless of the bearish sentiment and up to date value swings, significantly as soon as altseason begins to warmth up. Normally, when Bitcoin dominance weakens, that enables different belongings to seize market consideration and capital, which is the place altcoins, particularly BNB, are inclined to do properly.

Whereas the projection for a 25% achieve in value by CoinCodex may very well be the type of factor which may counsel that BNB will proceed to rise, the short-term prospects for the token stay unsure.

Associated Studying

Whereas the coin did handle to put up inexperienced days of 47% over the past month, the value volatility of 4.62% nonetheless confirmed dangers. The bearish sentiment and market worry, together with blended community exercise, all indicate prudence by buyers within the speedy future.

BNB might very properly stick with its resilience and doubtless develop much more. This crypto asset is one to keep watch over. However with blended indicators in on-chain knowledge and markets feeling their method cautiously, the dangers concerned must be thought of first earlier than buyers dabble into the digital asset.

Whereas a rally is most positively attainable, the market has not ended fluctuations simply but, and that short-term volatility should be a difficulty.

Featured picture from Zipmex, chart from TradingView