Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has created a perplexing state of affairs for traders not too long ago. Regardless of a noticeable decline in its value, on-chain knowledge reveals that enormous traders, also known as “whales,” are accumulating ETH. This might sign a possible shopping for alternative, although technical indicators counsel a weakening uptrend, leaving Ethereum’s near-term future unsure.

Associated Studying: Solana Looking For Course: Will SOL Break Free Or Fall Flat?

Ethereum Whales See Alternative In Value Dip

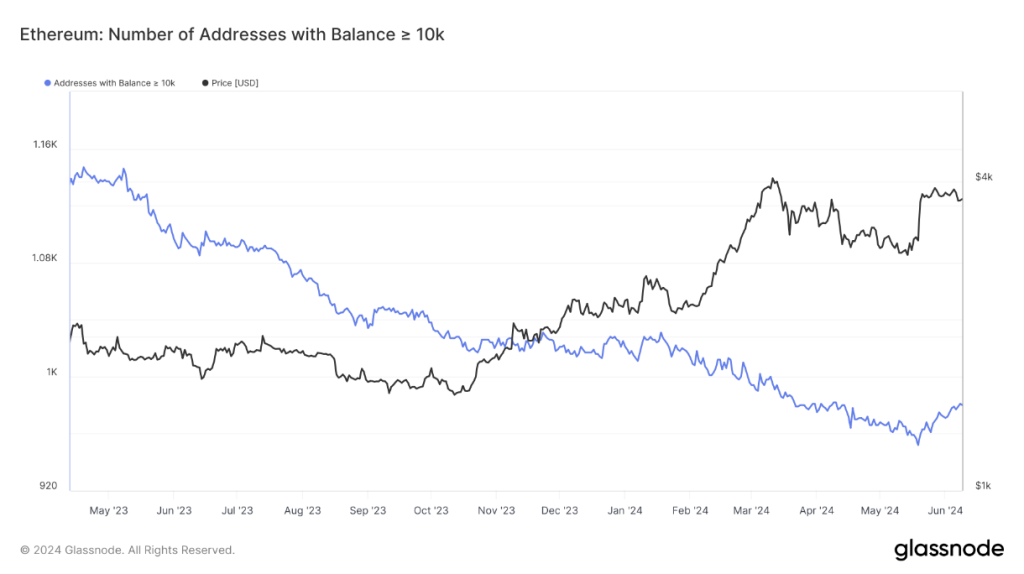

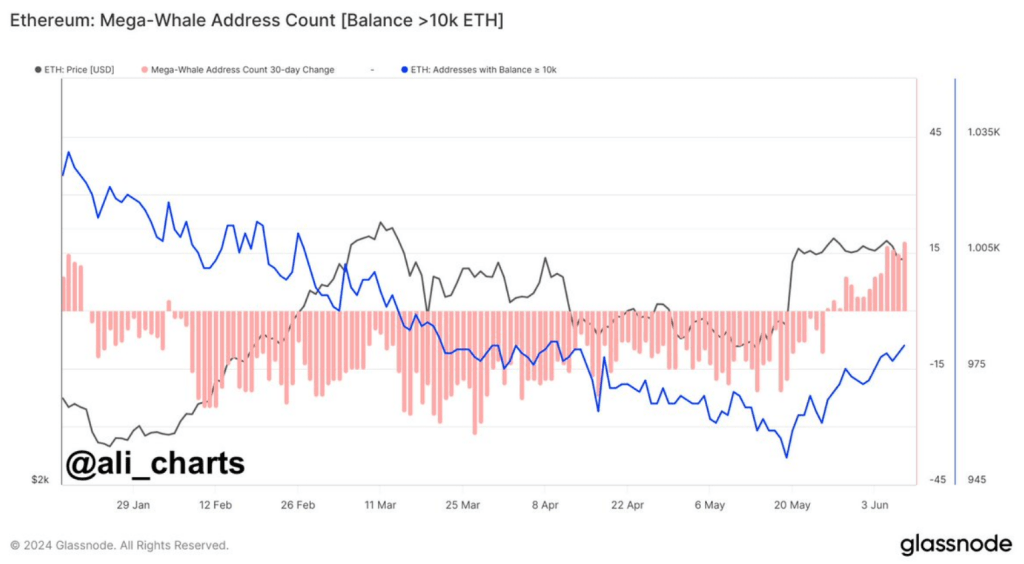

In current evaluation by NewsBTC, it was revealed that wallets holding over 10,000 ETH have been steadily buying extra tokens for the reason that finish of Could. This era of accumulation, primarily based on Glassnode knowledge, coincides with a drop in Ethereum’s value from round $3,074 to its present value of $3,670. The numerous enhance in holdings by these giant traders means that they see the present value decline as a sexy entry level, anticipating a future value rise.

Including to the bullish sentiment, CryptoQuant’s Netflow knowledge for Ethereum has proven a dominance of detrimental flows in current weeks. This implies extra ETH is leaving exchanges than getting into them, a conventional indicator that traders are holding onto their ETH quite than promoting it. This conduct can cut back the accessible provide in the marketplace, doubtlessly pushing costs up in the long term.

Associated Studying: $2 Billion Crypto Funds Movement Into Market On Fee Lower Buzz

Technical Indicators Increase Crimson Flags

Regardless of the optimistic indicators from whale accumulation and alternate outflows, technical indicators paint a much less rosy image. Ethereum has been buying and selling in a slender vary round $3,600 for the previous three days, displaying a slight decline of roughly 0.8% at the moment. Whereas the Relative Energy Index (RSI) stays above 50, indicating a slight uptrend, it’s presently on a downward trajectory. If this pattern continues and the RSI falls under the impartial line, it might counsel a possible value dip.

The variety of #Ethereum addresses holding 10,000+ $ETH has elevated by 3% within the final three weeks, signaling an necessary spike in shopping for stress! pic.twitter.com/7qq5HgGP37

— Ali (@ali_charts) June 9, 2024

The RSI’s downward motion signifies weakening momentum, which, if not reversed, would possibly result in additional declines in Ethereum’s value. This bearish technical outlook contrasts sharply with the optimistic on-chain knowledge, creating a fancy scenario for traders making an attempt to foretell the market’s subsequent transfer.

Market Awaits A Important Catalyst

The near-term way forward for Ethereum seems to hinge on the emergence of a big catalyst. Broader market sentiment might play an important function, with a optimistic shift doubtlessly reigniting the uptrend. Moreover, upcoming information or developments particular to the Ethereum community might additionally function a catalyst for value motion. Profitable upgrades or elevated adoption of decentralized purposes (dApps) constructed on the Ethereum blockchain might set off renewed investor curiosity and drive costs increased.

Featured picture from Harbor Breeze Cruises, chart from TradingView