Fast Take

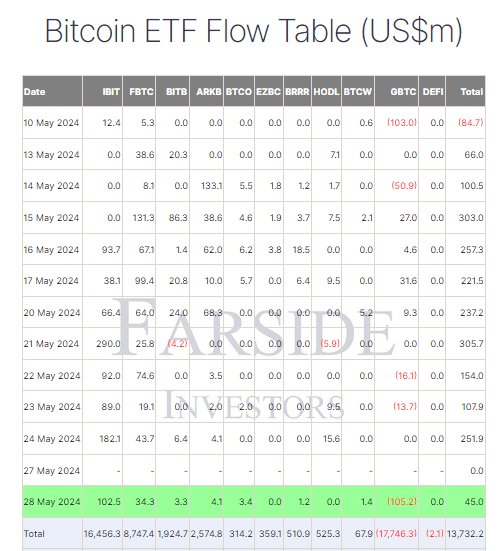

Farside knowledge reveals that Bitcoin (BTC) Alternate-traded funds (ETFs) skilled $45 million in inflows on Might 28. Seven of 11 ETFs recorded optimistic inflows, reflecting broad curiosity amongst issuers. BlackRock’s IBIT ETF led the inflows with $102.5 million, elevating its complete internet influx to $16.5 billion. Constancy’s FBTC ETF noticed $34.3 million in inflows, bringing its complete to $8.7 billion. Conversely, Grayscale’s GBTC ETF skilled a $105.2 million outflow, growing its internet outflows to $17.7 billion. The cumulative internet inflows throughout all ETFs have now reached $13.7 billion.

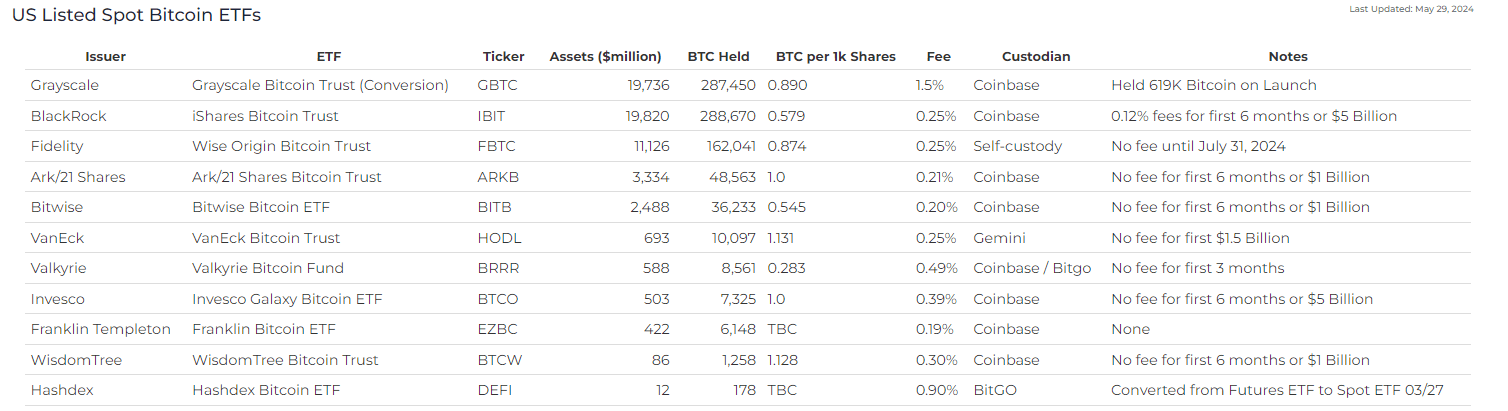

When it comes to Bitcoin holdings, BlackRock’s IBIT has overtaken Grayscale’s GBTC, changing into the biggest US Bitcoin ETF. HeyApollo knowledge reveals IBIT now holds 288,670 BTC, in comparison with GBTC’s 287,450 BTC.

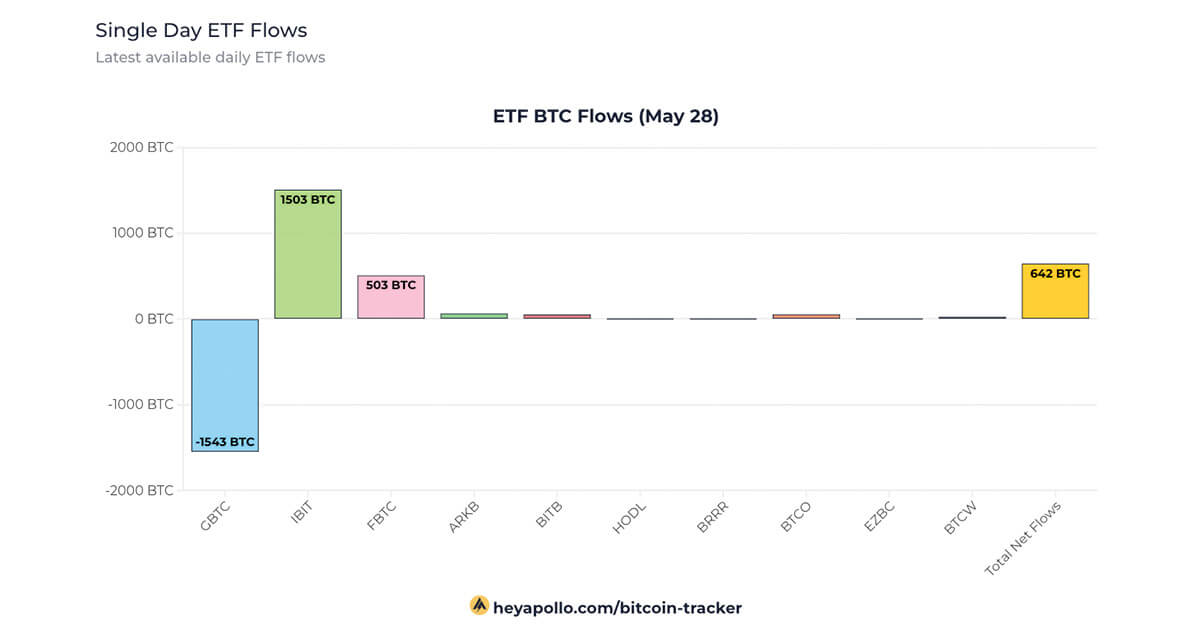

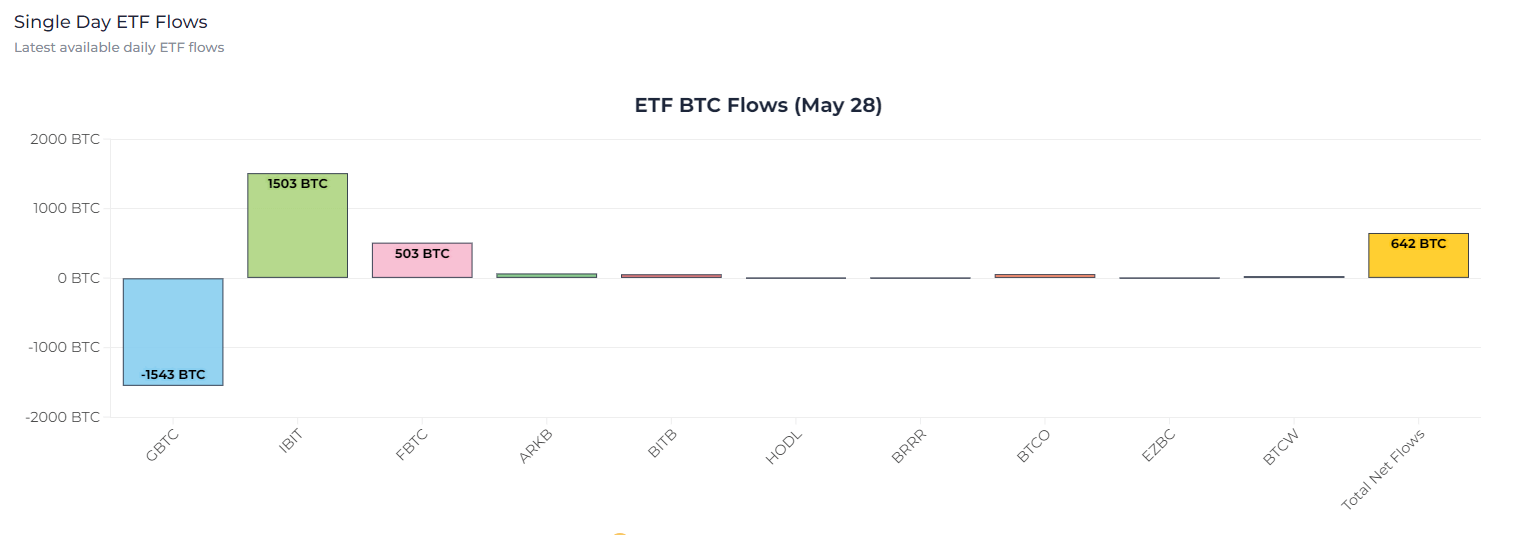

The online accumulation of Bitcoin by ETFs on Might 28 amounted to 642 BTC, in line with heyapollo.

The put up BlackRock’s IBIT overtakes Grayscale’s GBTC Bitcoin holdings amid influx surge appeared first on CryptoSlate.