Fast Take

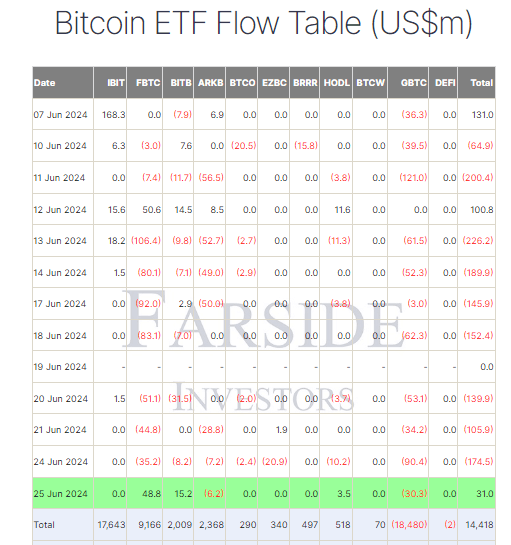

Farside knowledge exhibits that on June 25, Bitcoin (BTC) exchange-traded funds (ETFs) skilled the primary internet influx since June 12, with $31.0 million getting into the market.

Constancy’s FBTC led the cost with a $48.8 million influx, elevating its whole internet influx to $9.2 billion. Bitwise’s BITB additionally noticed a notable influx, attracting $15.2 million and bringing its whole internet influx to $2.0 billion. In distinction, Grayscale’s GBTC struggled with outflows, dropping $30.3 million and pushing its whole outflow to $18.5 billion. In line with Farside knowledge, the full internet inflows to BTC ETFs now stand at $14.4 billion.

Curiously, BlackRock’s IBIT ETF recorded no internet inflows or outflows, but its buying and selling quantity surged to $1.1 billion, in response to Coinglass knowledge. For comparability, GBTC solely managed a quantity of $341 million, inserting IBIT at quantity 18 total in buying and selling quantity amongst all US ETFs. This raises hypothesis about IBIT’s potential to develop into a key institutional foundation commerce Bitcoin ETF, given its sturdy buying and selling exercise regardless of the absence of internet inflows or outflows.

The publish BlackRock’s IBIT buying and selling quantity surges to $1.1 billion regardless of no inflows appeared first on CryptoSlate.