In a latest submitting with the US Securities and Alternate Fee (SEC), the BlackRock International Allocation Fund disclosed its possession of 43,000 shares of the asset supervisor’s Bitcoin ETF, iShares Bitcoin Belief, as of April 30.

This announcement follows two earlier filings by BlackRock on Could 28, which disclosed the fund’s publicity to Bitcoin in its Strategic International Bond Fund and Strategic Earnings Alternatives Portfolio.

BlackRock Bitcoin ETF Funding Plan

The funding big’s transfer in direction of Bitcoin integration grew to become evident in March when it submitted a submitting to the SEC, expressing its intention to incorporate Bitcoin ETFs in its International Allocation Fund.

BlackRock’s goal is to spend money on Bitcoin ETFs that straight maintain BTC, aiming to reflect the efficiency of the digital forex market.

The corporate’s submitting specified that the International Allocation Fund could purchase shares in exchange-traded merchandise (ETPs) that search to replicate the value of Bitcoin by straight holding the cryptocurrency. Nevertheless, it clarified that investments in Bitcoin ETPs will probably be restricted to these listed and traded on acknowledged nationwide securities exchanges.

Associated Studying

This initiative aligns with BlackRock’s broader funding technique for its International Allocation Fund, a mutual fund designed to diversify traders by means of a variety of belongings, together with equities, bonds, and probably Bitcoin ETPs.

With $17.8 billion in belongings beneath administration (AUM) and a year-to-date return of 4.61% as of March 2024, the fund goals to capitalize on world funding alternatives whereas successfully managing danger and pursuing long-term capital development and earnings.

This marks the third inner BlackRock fund to spend money on Bitcoin by means of the iShares Bitcoin Belief (IBIT) ETF. The Strategic International Bond Fund, Strategic Earnings Alternatives Portfolio, and now the International Allocation Fund have all acknowledged the potential of Bitcoin as an funding asset.

Bitcoin Value Evaluation

Prior to now 24 hours, Bitcoin has proven resilience by reclaiming the $61,780 stage after experiencing a dip to as little as $58,000 on Monday. This restoration means that the main cryptocurrency is withstanding the promoting stress it has encountered over the previous week, indicating a possible continuation of its halted uptrend.

In accordance to technical analyst Ali Martinez, Bitcoin is forming an Adam & Eve bottoming sample, which may result in a projected 6% improve in direction of $66,000 if BTC maintains a candlestick shut above the $62,200 stage.

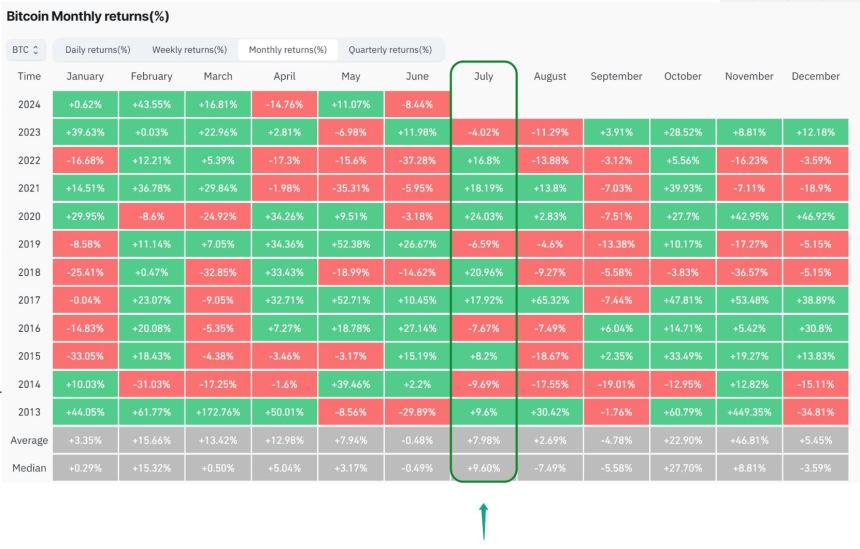

Moreover, historic knowledge signifies that July has traditionally been favorable for Bitcoin’s worth development, significantly in years of Halving.

Analyzing the picture above, 7 out of the earlier 11 July months resulted in optimistic positive factors. The inexperienced months, particularly, generated a powerful upside of 16.52%, whereas the pink months skilled a draw back of 6.99%.

Analyzing the efficiency of Bitcoin within the third quarter (Q3), the information presents a extra balanced image. Out of the earlier 11 Q3 durations, 5 had been optimistic. Inexperienced Q3s, on common, produced a big upside of 33.52%, whereas pink Q3s generated a median draw back of 16.023%.

Associated Studying

Whether or not historic worth efficiency will repeat itself, main to cost positive factors for BTC, stays to be answered. If historical past had been to repeat on this state of affairs, it may probably lead to Bitcoin retesting its all-time excessive, which reached $73,700 in March, probably even surpassing it.

Featured picture from DALL-E, chart from TradingView.com