Matt Hougan, Chief Funding Officer (CIO) of Bitwise, claims in a brand new memo to traders following the 2024 Bitcoin Convention that the market might not be bullish sufficient about the way forward for BTC. The convention was a watershed second that attracted large political consideration and will affect the long run trajectory of Bitcoin closely.

Why You Are Not Bullish Sufficient On Bitcoin

The convention featured quite a few groundbreaking statements from high-profile political figures. At the start, GOP’s presidential candidate Donald Trump’s assertion about constructing a nationwide Bitcoin reserve triggered enormous waves. Trump articulated a imaginative and prescient of America because the “crypto capital of the world” and proposed the institution of a “strategic Bitcoin stockpile”.

Senator Cynthia Lummis (R-WY) offered a invoice that will require the US Treasury Division to acquire 1 million Bitcoin. Rep. Ro Khanna (D-CA) known as on the Democratic Occasion to maneuver away from earlier restrictive insurance policies and embrace cryptocurrencies as an integral a part of the US monetary system.

Associated Studying

In an much more bold name, impartial presidential candidate Robert F. Kennedy Jr. prompt that the US Treasury ought to purchase 4 million Bitcoin. This determine is meant to be equal to the US’s share of the world’s gold reserves.

Based on Hougan, the political discourse surrounding Bitcoin has quickly developed from skepticism to strategic acceptance, a metamorphosis punctuated by latest crises and regulatory challenges. The collapse of FTX in late 2022, which marked one of the crucial vital upheavals in crypto historical past, casted a protracted shadow over the business.

Nonetheless, as Hougan famous, the resilience of Bitcoin and the broader crypto market has been exceptional. “That is loopy. Lower than two years in the past, FTX was collapsing in a historic fraud, bitcoin was buying and selling at $17,000, and skeptics have been dancing on crypto’s grave. Now politicians are overtly speaking about constructing a ‘Bitcoin Fort Knox,’ Hougan writes.

Associated Studying

He additional factors out that lower than a 12 months after the SEC’s aggressive motion in opposition to Coinbase, the US Division of Justice is now cooperating with the identical platform to safe its crypto operations, reflecting a broader recalibration of governmental attitudes in the direction of Bitcoin and cryptocurrencies.

Hougan means that these developments should not merely opportunistic however replicate a deeper recognition of cryptocurrencies’ rising affect in American society. “If you say ‘opportunism,’ I say, ‘That’s how politics works,’” Hougan said, acknowledging the strategic shifts throughout the US political sphere.

The implications for traders, in keeping with Hougan, are profound. Buyers have to reassess the potential scale of Bitcoin’s progress. Hougan highlighted the asymmetry in danger perceptions, the place the main target has historically been on draw back potentialities. “We spend numerous time targeted on draw back danger […] Nonetheless, there’s now an equal danger to the upside,” he said.

The sentiment on Wall Avenue can also be seeing a notable shift. In a dialog reported from the convention, Goldman Sachs CEO David Solomon referred to Bitcoin as a possible retailer of worth, indicating rising curiosity from main monetary establishments.

The Bitwise CIO mused, “May we get up tomorrow and discover out {that a} G20 nation has added bitcoin to its steadiness sheet, trying to front-run the US? May complete crypto laws get handed extra rapidly than anticipated within the US as bipartisan help strengthens? May Wall Avenue massively embrace crypto, at a scale a lot bigger than most count on? “

Total, the 2024 Bitcoin Convention has evidently served as a catalyst for rethinking Bitcoin’s function on each nationwide and world levels. “These concepts would have been the stuff of daydreams a 12 months in the past. However after what I witnessed final week, they appear extra seemingly than not,” Hougan concluded.

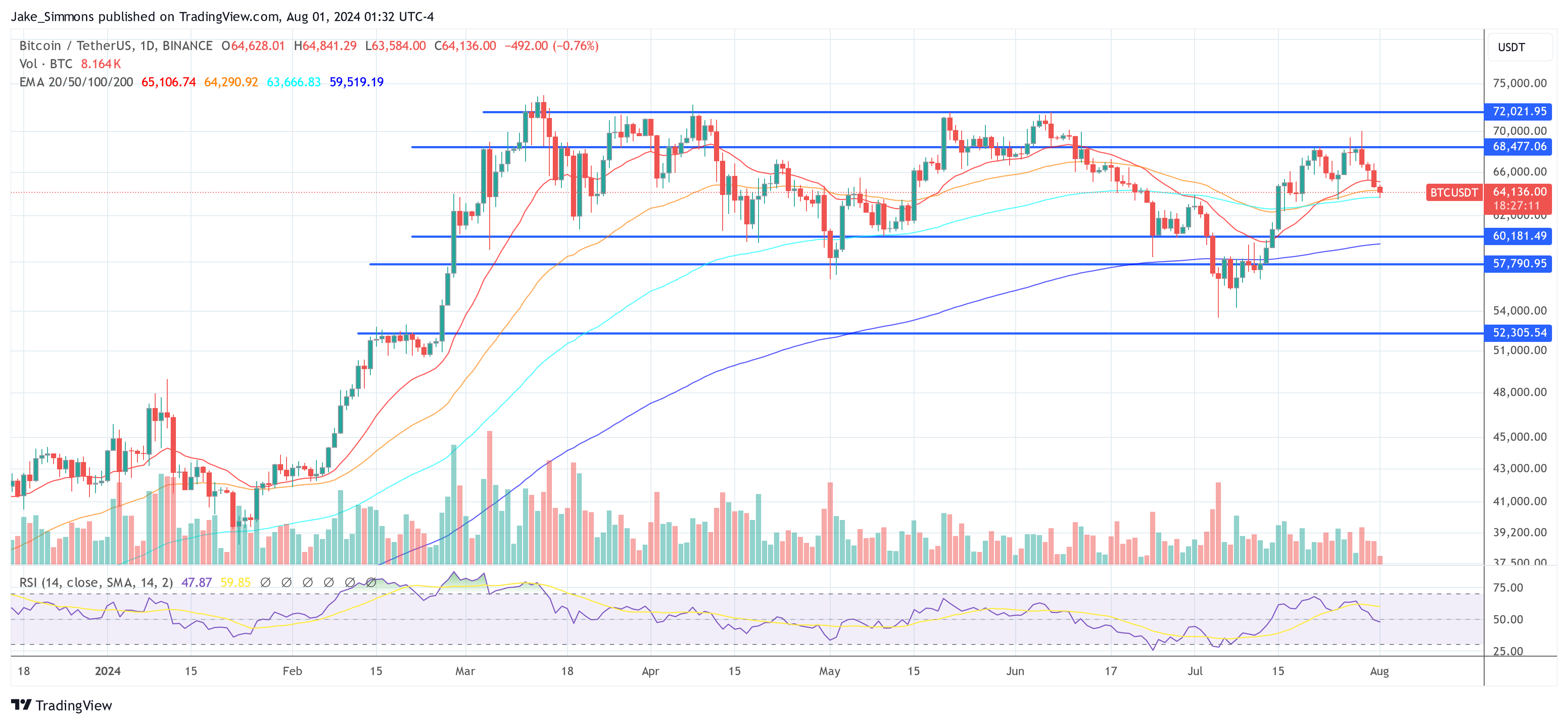

At press time, BTC traded at $64,136.

Featured picture from YouTube / Mr. M Podcast, chart from TradingView.com