Because the extremely anticipated launch date of spot Ethereum ETFs approaches, Matt Hougan, Chief Funding Officer of crypto asset supervisor Bitwise, has harassed the potential for these ETF inflows to drive the Ethereum value to file highs.

In a latest consumer be aware, Hougan highlighted the numerous affect that ETF flows may have on the Ethereum value, surpassing even the results witnessed within the spot Bitcoin ETF market within the US.

Ethereum ETFs Poised To Surpass Bitcoin’s Impression?

Hougan confidently predicts that introducing spot Ethereum ETFs will result in a surge in ETH’s worth, probably reaching all-time highs above $5,000. Nonetheless, he cautions that the primary few weeks after the ETF launch might be risky, as funds may circulation out of the prevailing $11 billion Grayscale Ethereum Belief (ETHE) after it’s transformed to an ETF.

This might be just like the case of the Grayscale Bitcoin Belief (GBTC), which noticed important outflows of over $17 billion after the Bitcoin ETF market was authorised in January, with the primary inflows recorded 5 months afterward Could 3.

Nonetheless, Hougan expects the market to stabilize in the long run, pushing Ethereum to file costs by the top of the yr after the preliminary outflows subside, drawing a comparability with Bitcoin in key metrics to grasp this thesis.

Associated Studying

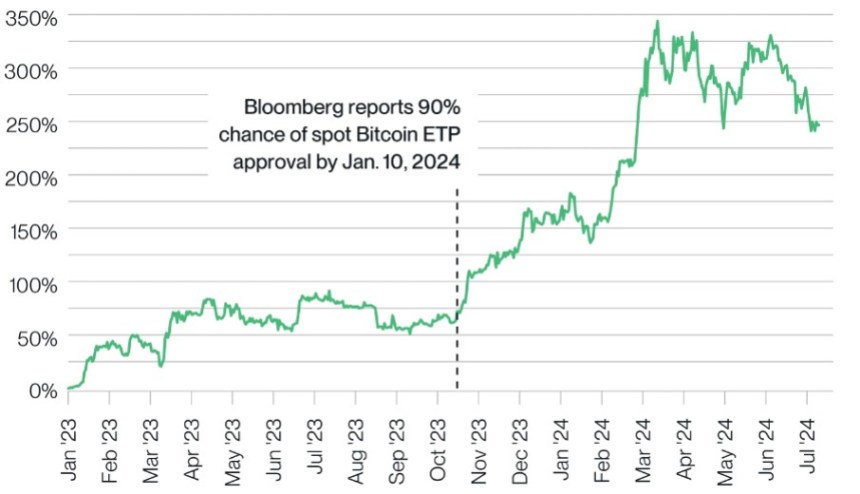

For instance, Bitcoin ETFs have bought greater than twice the quantity of Bitcoin in comparison with what miners have produced over the identical interval, contributing to a 25% improve in Bitcoin’s value because the ETF launch and a 110% improve because the market started pricing within the launch in October 2023.

That stated, Hougan believes the affect on Ethereum might be much more important, and identifies three structural the explanation why Ethereum’s ETF inflows may have a larger affect than Bitcoin’s.

Decrease Inflation, Staking Benefit, And Shortage

The primary cause Bitwise’s CIO highlights is Ethereum’s decrease short-term inflation price. Whereas Bitcoin’s inflation price was 1.7% when Bitcoin ETFs launched, Ethereum’s inflation price over the previous yr has been 0%.

The second cause lies within the distinction between Bitcoin miners and Ethereum stakers. Because of the bills related to mining, Bitcoin miners usually promote a lot of the Bitcoin they purchase to cowl operational prices.

In distinction, Ethereum depends on a proof-of-stake (PoS) system, the place customers stake ETH as collateral to course of transactions precisely. ETH stakers, not burdened with excessive direct prices, should not compelled to promote the ETH they earn. Consequently, Hougan means that Ethereum’s every day pressured promoting stress is decrease than that of Bitcoin.

Associated Studying

The third cause stems from the truth that a considerable portion of ETH is staked and, subsequently, unavailable on the market. At the moment, 28% of all ETH is staked, whereas 13% is locked in sensible contracts, successfully eradicating it from the market.

This leads to roughly 40% of all ETH being unavailable for instant sale, creating a substantial shortage and finally favoring a possible improve in value for the second largest cryptocurrency in the marketplace, relying on the outflows and inflows recorded. Hougan concluded:

As I discussed above, I anticipate the brand new Ethereum ETPs to be a hit, gathering $15 billion in new property over their first 18 months in the marketplace… If the ETPs are as profitable as I anticipate—and given the dynamics above—it’s onerous to think about ETH not difficult its outdated file.

ETH was buying and selling at $3,460, up 1.5% up to now 24 hours and practically 12% up to now seven days.

Featured picture from DALL-E, chart from TradingView.com