Onchain Highlights

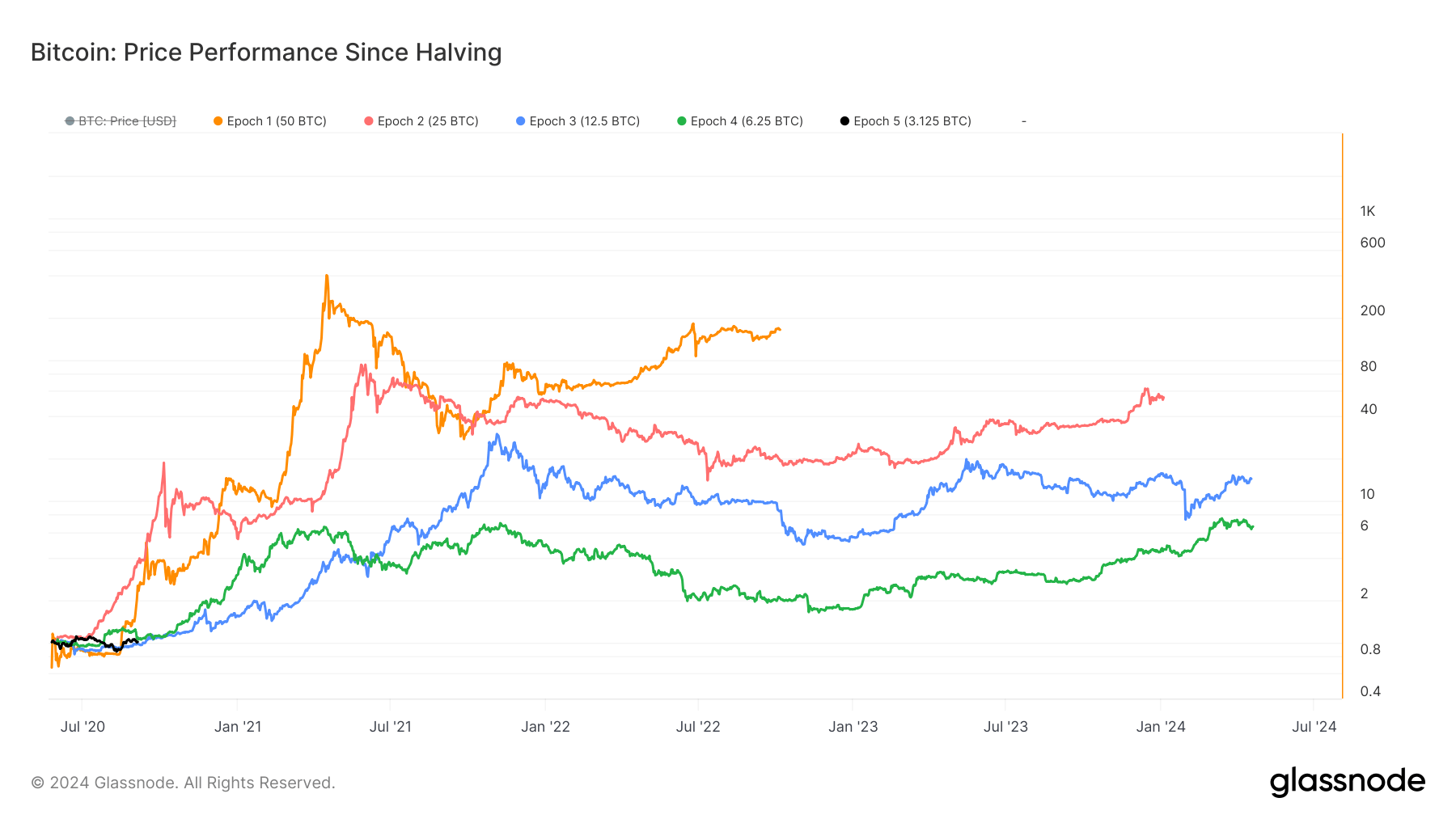

DEFINITION: Bitcoin worth efficiency because the halving in opposition to earlier cycles.

Bitcoin’s worth efficiency since the latest halving in April has adopted a definite trajectory in comparison with earlier halving occasions. Observing the historic worth patterns, every halving epoch demonstrates distinctive worth actions, reflecting various market dynamics and investor sentiments.

The primary halving epoch (50 BTC reward) exhibits a pointy and sustained worth enhance, peaking at a unprecedented degree, suggesting excessive early adoption and enthusiasm. The second epoch (25 BTC reward) reveals a equally robust upward development, albeit with extra pronounced volatility, reflecting growing market maturity and speculative exercise.

In distinction, the third epoch (12.5 BTC reward) presents a extra tempered rise, indicating a shift towards a extra stabilized development sample because the market adjusted to diminished mining rewards and broader participation. The fourth epoch (6.25 BTC reward) reveals comparatively decrease volatility and a extra regular worth enhance, highlighting a extra mature market with numerous institutional and retail participation.

The present fifth epoch (3.125 BTC reward) displays these cumulative results, displaying average development and stability. This implies that Bitcoin’s market dynamics have developed with elevated regulatory scrutiny, institutional adoption, and macroeconomic components influencing its worth trajectory.

The present Epoch 5 is tied with Epoch 3 because the worst-performing cycle at this stage because the halving. If Epoch 5 follows the identical sample as Epoch 3, the height of this cycle would possible happen across the fourth quarter of 2025.