Bitcoin has been on a rollercoaster experience ever because it reached its all-time excessive (ATH) of $73,737 again in March. Nevertheless, no matter that, a number of analysts and merchants within the crypto neighborhood stay persistent of their bullish outlook for the asset. An instance is Willy Woo, a well known determine within the crypto sector. Earlier right now, Woo shared his optimistic view on Bitcoin and insights on how excessive BTC’s value might probably climb to hit this anticipated excessive mark.

Bitcoin Highway To $700,000: Robust Or Clean?

In line with Woo in his newest publish on Elon Musk’s social media platform, X, Bitcoin’s value projection can vary dramatically based mostly on the proportion of international wealth belongings allotted to Bitcoin. In his rationalization, Woo outlined two potential future situations for Bitcoin’s valuation: a extra possible decrease band and a extremely unlikely higher restrict.

Associated Studying: Bitwise CIO On Bitcoin: ‘We’re Not Bullish Sufficient’ – Right here’s Why

He pegs the “conservative” estimate for Bitcoin at roughly $700,000, assuming modest adoption and funding ranges. This determine arises from a hypothetical allocation of a small share of worldwide wealth into Bitcoin, reflecting a rising however cautious integration of Bitcoin into the broader monetary sector

Woo’s evaluation additional delves into how institutional buyers would possibly affect Bitcoin’s worth over time. Drawing from trade behaviors and proposals, comparable to Constancy’s suggestion that portfolios embody 1-3% in BTC, Woo interprets these actions as indicators of rising, though conservative, confidence in Bitcoin as a viable asset class.

He contrasts these figures with BlackRock’s 85% funding, highlighting a stark divergence in institutional methods in the direction of Bitcoin. The theoretical higher restrict of Bitcoin reaching $24 million per unit, in response to Woo, would require an unrealistically full conversion of the world’s $500 trillion in wealth belongings into Bitcoin.

He dismisses this state of affairs as unbelievable, focusing as a substitute on the extra grounded predictions supported by present funding developments and financial behaviors.

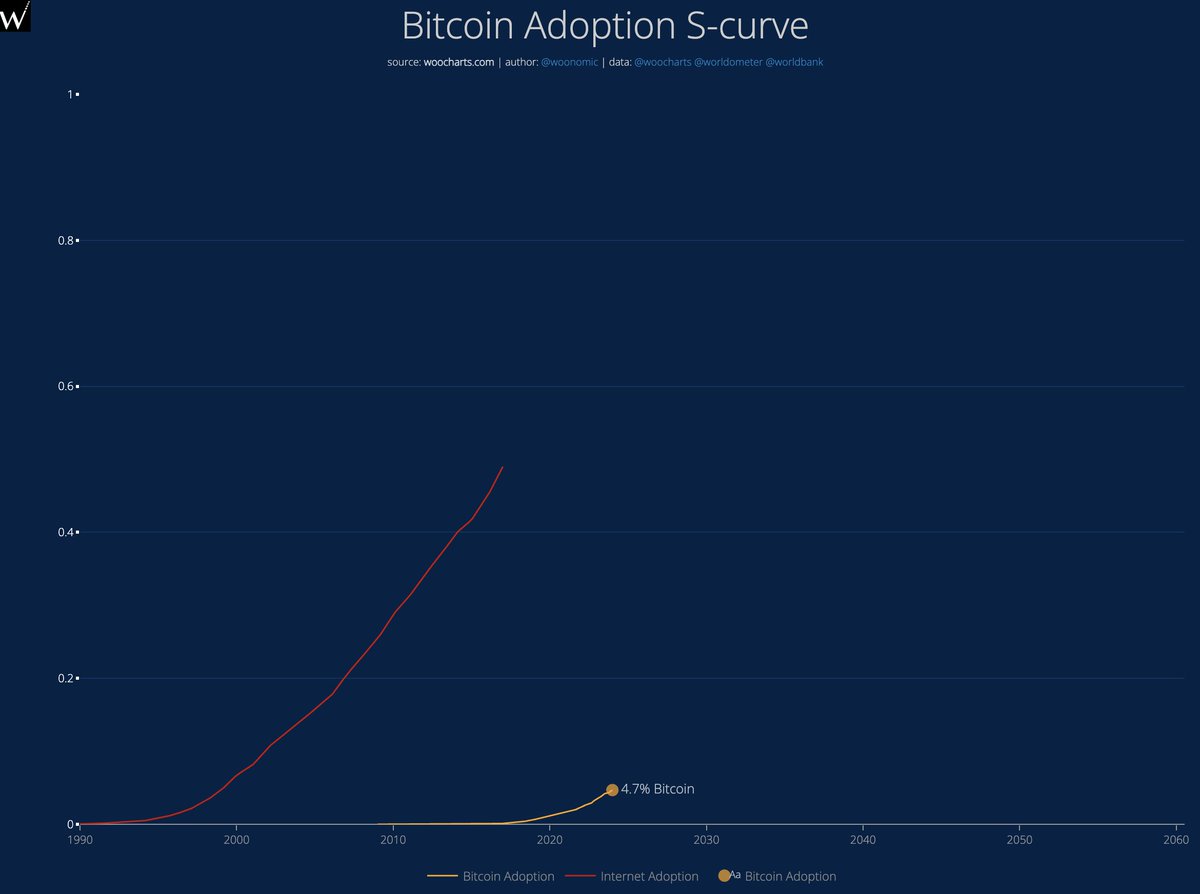

Woo explains that as Bitcoin’s adoption curve follows the basic S-curve of technological adoption, which presently sits at 4.7%, the potential for important value will increase stays viable as adoption grows in the direction of the 16% to 50% vary.

What The Future Holds

In his concluding ideas, Woo speculates a few future the place Bitcoin’s market capitalization might surpass all international fiat currencies.

This paradigm shift would remodel investor priorities, shifting away from fiat-based valuations in the direction of a brand new financial mannequin the place main company belongings might be measured towards their BTC holdings, reasonably than conventional fiat metrics.

This shift, he argues, would mark a profound change in monetary pondering, specializing in belongings that may leverage Bitcoin’s stability and development reasonably than merely surpassing its worth.

As soon as the worth produces a marketcap exceeding all of the fiat on the earth you received’t be desirous about final value. That’s a fiat mindset based mostly on present realities.

After this inflection level, you’ll solely be searching for investments that may beat BTC. For starters these are…

— Willy Woo (@woonomic) August 1, 2024

Featured picture created with DALL-E, Chart from TradingView